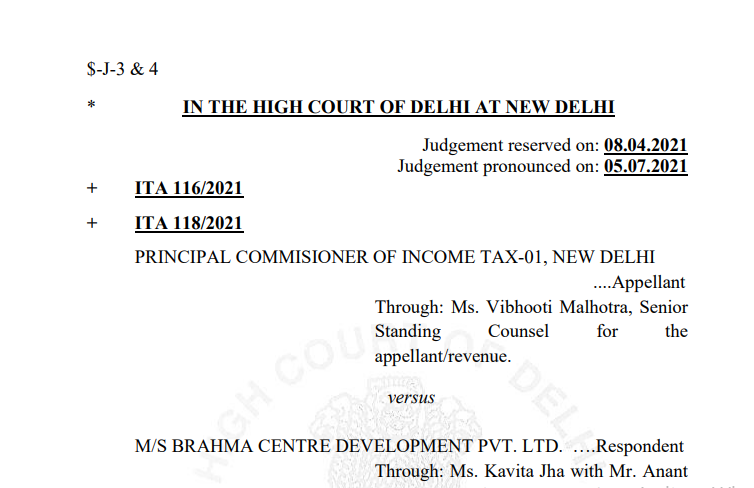

Delhi HC order in the case of PCIT V/s M/s Brahma Centre Development Pvt. Ltd.

Case covered:

Principal Commissioner of Income Tax

Versus

M/s Brahma Centre Development Pvt. Ltd.

Facts of the case:

The above-captioned appeals are directed against the common order dated 18.12.2019, passed by the Income Tax Appellate Tribunal [in short “Tribunal”] in ITA Nos. 4341/Del/2019 and 4342/Del/2019, concerning assessment years [in short AYs] 2012-2013 and 2013-2014, respectively.

The Tribunal, via the impugned order, has in turn set aside two separate but similar orders dated 28.03.2019, passed by the Principal Commissioner of Income Tax [in short “PCIT”] in the exercise of his powers under Section 263 of the Income Tax Act, 1961 [in short “Act”]

The PCIT has, via his orders dated 28.03.2019, interfered with the assessment orders dated 31.01.2017 and 27.09.2017 passed by the assessing officer [in short “AO”] concerning the respondent/assessee [hereafter referred to as “assessee”] pertaining to AYs 2012-2013 and 2013-2014 respectively. The assessment orders were passed under Section 143(3) read with Section 144C of the Act, although, in the opening sheet of the assessment order concerning AY 2013-2014, there is only a reference to Section 143(3) of the Act. The record also shows that, after the PCIT had passed the order dated 28.03.2019, insofar as AY 2013-2014 is concerned, the AO as directed, passed a fresh order dated 12.11.2019 under Section 143(3) of the Act by conducting “proper enquiries”.

Related Topic:

Delhi HC in the case of M/s Eternity Entertainment & Hospitality Pvt. Ltd

Observations of the Hon’ble Court:

According to us, the AO, having received a response to his query about the adjustment of interest, in the concerned AYs, against inventory, concluded that, there was a nexus between the receipt of funds from investors located abroad and the real estate project, which upon being invested generated interest. Thus, it cannot be said that the conclusion arrived by the AO, that such

adjustment was permissible in law, was erroneous.

Related Topic:

Delhi HC in the case of Insitel Services Pvt. Ltd. Versus Union of India

The Decision of the Court:

In the instant cases, it was not as if the funds were surplus and therefore invested in a fixed deposit. The funds were received for the real estate project and while awaiting their deployment, they were invested in a fixed deposit which generated interest. This fits in with the dicta of the Supreme Court in

Bokaro Steels Case and of this Court in Indian Oil Panipat Power Case, NTPC Sail Power Case, and Jaypee DSC Ventures Case.

Related Topic:

Delhi HC in the case of Lupita Saluja Versus DGGI

Furthermore, in our view, we need not detain ourselves and examine as to whether Clause (a) and (b) of Explanation 2 appended to Section 263 of the Act could have been applied to the AYs in issue, since on facts, it has been found by the Tribunal that an enquiry was, indeed, conducted by the AO.

Thus, for the foregoing reasons, the above-captioned appeals are dismissed as, according to us, no substantial question of law arises for our consideration.

Related Topic:

Delhi HC in the case of Arise India Limited Versus Commissioner of Trade & Taxes

There shall, however, be no order as to costs.

Read & Download the full decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.