Finance Act 2020 provisions effective from 01-01-2021

1. Composition Taxable person barred from following transactions in services in wake of composition scheme applicable to services also to a limited extent […]

1. Before 23-03-2020, physical verification of place of business could be done only post-registration. It means physical verification of the place of business was not a pre-condition for registration.

Observations of Telangana High Court MSR, J, and TA, J pronounced on 06-11- 2020 in a case where both revenue and assessee made counter-allegations of physical assault on each other

a) Whether midnight summons […]

The claim of ITC under wrong head in GSTR 3B due to wrong filing of GSTR-1 by the supplier

The issue considered by Madras High Court in Sun Dye Chem on 06-10-2020 in WP 29676 of 2019

Refund of Unutilized ITC whether to be allowed to the supplier only?

Gujrat High Court in Britania Industries Limited discusses this issue on 11-03-2020 in the context of section 54(3), which says that a […]

Whether refund claim is vested right or statutory right?

The issue was considered by Delhi Cestat in BHEL Ltd while deciding upon the refund of education, SHE, Krishi Kalyan Cess. The appellant could not utilize […]

Situs of Goods or accretion of goods in works contract whether relevant to determine the nature of Supply in case of Works Contract

Introduction

Though GST is destination-based tax but In a works contract, it […]

GST on Stage and Contract Carriage

Exordium

In GST law the taxation in the business of passenger transportation can be divided under following categories:

a) Where entire vehicle is not used

b) Where […]

Components of the definition of Plant and Machinery examined by AAR Madhya Pradesh in Atriwal Amusement Park case on 09-06-2020 for allowability of ITC to an amusement park

Section 17(5)(d) of CGST law restricts […]

Refund of Inverted Duty Structure to be allowed on Input services also

Gujrat High Court in VKC Footsteps India Private Limited on 24-07-2020 has pronounced as under:

1. Section 54(3) allows refund of any […]

Due Date for Composition Taxable Person

The dilemma about Due Dates for Compliances by Composition Taxable Persons [CMP-02, CMP-03, CMP-08, GSTR-4, and ITC-03]

Whether Transfer of Development Rights is “Sale of Land”

Introduction

As per Paragraph 5 of Schedule III ‘sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building’ shall be tre […]

The relevant date for computation of time limit for the refund to be calculated from the last date of last month of the quarter

Karnataka High Court in Suretex Prophylactics India (P.) Ltd. [2020] 116 taxmann.com […]

Important Observations from Delhi High Court Judgment in Brand Equity

Important Observations from Delhi High Court Judgment in Brand Equity rendered on 05-05-2020 while directing the Union of India to accept the […]

Issues arising from Refund related Circular No. 135/05/2020 dated 31-03-2020

1. Bunching of Financial years has been allowed for the purpose of claiming refunds. Now, this may result in assessee having applied […]

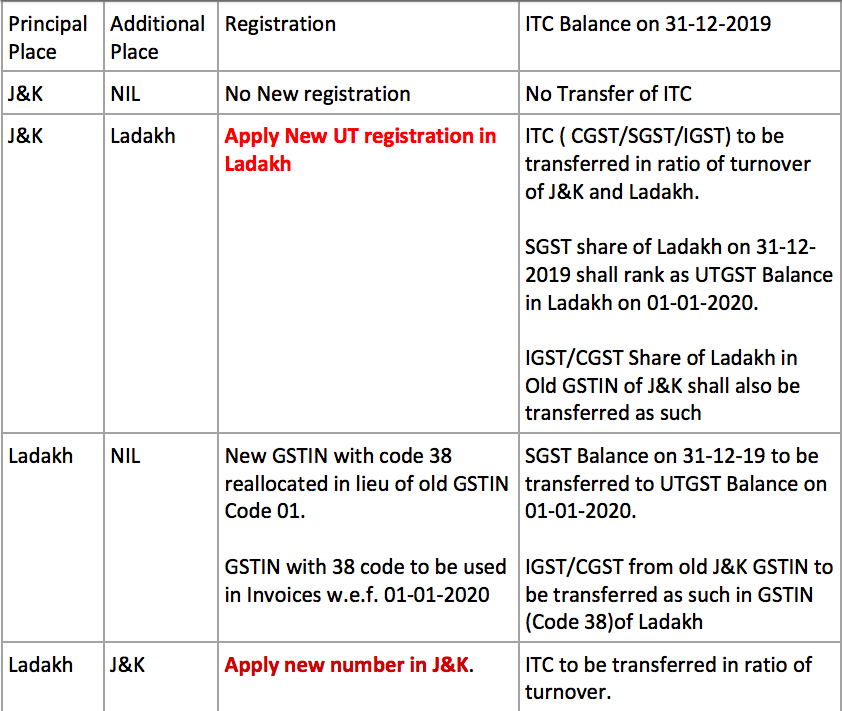

Impact of Changes on 01-01-2020 on GST in J&K and Ladakh:

Note: 1. Jurisdictional tax officer of transferor and transferee state should should be informed about transfer of ITC along with copy of ITC and the […]

Implications of Notification 01/2020 dated 01-01-2020 on the various GST related provisions of Finance No. 2 Act 2019

Finance No.2 Act 2019 was enacted on 01-08-2019. GST related amendments are […]

CA Vinamar Gupta

@caskumargupta

active 3 years, 12 months agoCA Vinamar Gupta

Location

Amritsar, India

OOPS!

No Packages Added by CA Vinamar Gupta. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Vinamar Gupta wrote a new post, Refund of IGST paid on goods exported on consignment basis 1 week, 4 days ago

Paradox of Refund of IGST paid on goods exported on consignment basis

In case of export on consignment basis, it has been clarified by Circular No. 108/27/2019-GST dated 18-07-2019 read with Customs […]

CA Vinamar Gupta wrote a new post, How to tackle Show Cause Notices and related Judgments 2 years, 10 months ago

Introduction

In Pre GST era section 11A of the Central Excise Act, section 28 of the Customs Act and Section 73 of Finance Act 1994 dealt with SCNs

• In GST law following sections deal with SCN:

a) S […]

CA Vinamar Gupta wrote a new post, Finance Act 2020 provisions effective from 01-01-2021 3 years, 4 months ago

Finance Act 2020 provisions effective from 01-01-2021

1. Composition Taxable person barred from following transactions in services in wake of composition scheme applicable to services also to a limited extent […]

CA Vinamar Gupta wrote a new post, Unbridled powers for physical verification for gst registration 3 years, 4 months ago

1. Before 23-03-2020, physical verification of place of business could be done only post-registration. It means physical verification of the place of business was not a pre-condition for registration.

2. W.e.f. […]

CA Vinamar Gupta wrote a new post, Observations of Telangana High Court MSR, J, and TA, J pronounced on 06-11- 2020 in a case where both revenue and assessee made counter-allegations of physical assault on each other 3 years, 5 months ago

Observations of Telangana High Court MSR, J, and TA, J pronounced on 06-11- 2020 in a case where both revenue and assessee made counter-allegations of physical assault on each other

a) Whether midnight summons […]

CA Vinamar Gupta wrote a new post, Claim of ITC under wrong head in GSTR 3B due to wrong filing of GSTR-1 by the supplier 3 years, 5 months ago

The claim of ITC under wrong head in GSTR 3B due to wrong filing of GSTR-1 by the supplier

The issue considered by Madras High Court in Sun Dye Chem on 06-10-2020 in WP 29676 of 2019

In GSTR-1 for 2017-18, […]

CA Vinamar Gupta wrote a new post, Refund of Unutilized ITC whether to be allowed to the supplier only? 3 years, 7 months ago

Refund of Unutilized ITC whether to be allowed to the supplier only?

Gujrat High Court in Britania Industries Limited discusses this issue on 11-03-2020 in the context of section 54(3), which says that a […]

CA Vinamar Gupta wrote a new post, Whether refund claim is vested right or statutory right? 3 years, 7 months ago

Whether refund claim is vested right or statutory right?

The issue was considered by Delhi Cestat in BHEL Ltd while deciding upon the refund of education, SHE, Krishi Kalyan Cess. The appellant could not utilize […]

CA Vinamar Gupta wrote a new post, Situs of Goods or accretion of goods in works contract whether relevant to determine the nature of Supply in case of Works Contract 3 years, 8 months ago

Situs of Goods or accretion of goods in works contract whether relevant to determine the nature of Supply in case of Works Contract

Introduction

Though GST is destination-based tax but In a works contract, it […]

CA Vinamar Gupta wrote a new post, GST on Stage and Contract Carriage 3 years, 8 months ago

GST on Stage and Contract Carriage

Exordium

In GST law the taxation in the business of passenger transportation can be divided under following categories:

a) Where entire vehicle is not used

b) Where […]

CA Vinamar Gupta wrote a new post, Components of the definition of Plant and Machinery examined by AAR Madhya Pradesh 3 years, 8 months ago

Components of the definition of Plant and Machinery examined by AAR Madhya Pradesh in Atriwal Amusement Park case on 09-06-2020 for allowability of ITC to an amusement park

Section 17(5)(d) of CGST law restricts […]

CA Vinamar Gupta wrote a new post, Refund of Inverted Duty Structure to be allowed on Input Services also 3 years, 9 months ago

Refund of Inverted Duty Structure to be allowed on Input services also

Gujrat High Court in VKC Footsteps India Private Limited on 24-07-2020 has pronounced as under:

1. Section 54(3) allows refund of any […]

CA Vinamar Gupta wrote a new post, Due Date for Composition Taxable Person 3 years, 9 months ago

Due Date for Composition Taxable Person

The dilemma about Due Dates for Compliances by Composition Taxable Persons [CMP-02, CMP-03, CMP-08, GSTR-4, and ITC-03]

Notification 34/2020-CT dated 03-04-2019, […]

CA Vinamar Gupta wrote a new post, Time Limits for certain actions (other than GSTR-1 and GSTR 3B) extended/not Extended 3 years, 9 months ago

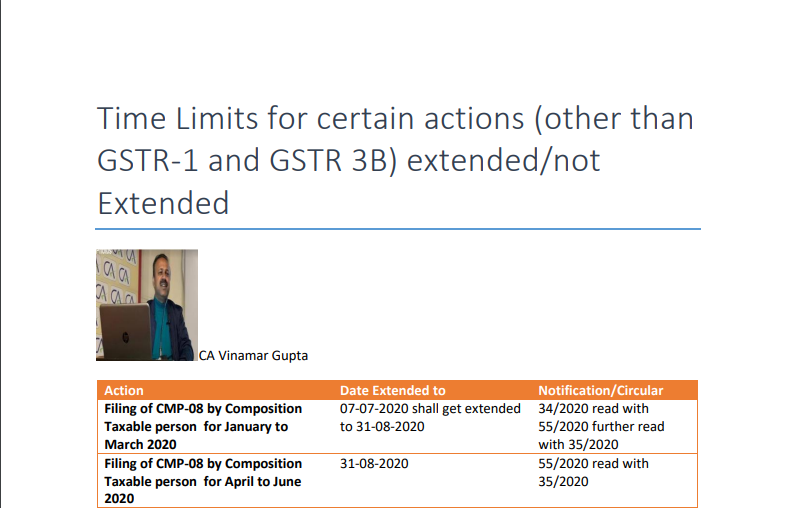

Time Limits for certain actions (other than GSTR-1 and GSTR 3B) extended/not Extended

Action

Date Extended to

Notification/Circular

Filing of CMP-08 by Composition Taxable person for January to […]

CA Vinamar Gupta wrote a new post, Whether Transfer of Development Rights is “Sale of Land” 3 years, 11 months ago

Whether Transfer of Development Rights is “Sale of Land”

Introduction

As per Paragraph 5 of Schedule III ‘sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building’ shall be tre […]

CA Vinamar Gupta wrote a new post, The relevant date for computation of time limit for the refund to be calculated from the last date of last month of the quarter 3 years, 11 months ago

The relevant date for computation of time limit for the refund to be calculated from the last date of last month of the quarter

Karnataka High Court in Suretex Prophylactics India (P.) Ltd. [2020] 116 taxmann.com […]

CA Vinamar Gupta wrote a new post, Important Observations from Delhi High Court Judgment in Brand Equity 3 years, 11 months ago

Important Observations from Delhi High Court Judgment in Brand Equity

Important Observations from Delhi High Court Judgment in Brand Equity rendered on 05-05-2020 while directing the Union of India to accept the […]

CA Vinamar Gupta wrote a new post, Issues arising from Refund related Circular No. 135/05/2020 dated 31-03-2020 4 years ago

Issues arising from Refund related Circular No. 135/05/2020 dated 31-03-2020

1. Bunching of Financial years has been allowed for the purpose of claiming refunds. Now, this may result in assessee having applied […]

CA Vinamar Gupta wrote a new post, Impact of Changes on 01-01-2020 on GST in J&K and Ladakh 4 years, 3 months ago

Impact of Changes on 01-01-2020 on GST in J&K and Ladakh:

Note: 1. Jurisdictional tax officer of transferor and transferee state should should be informed about transfer of ITC along with copy of ITC and the […]

CA Vinamar Gupta wrote a new post, Implications of Notification 01/2020 dated 01-01-2020 4 years, 3 months ago

Implications of Notification 01/2020 dated 01-01-2020 on the various GST related provisions of Finance No. 2 Act 2019

Finance No.2 Act 2019 was enacted on 01-08-2019. GST related amendments are […]