Time Limits for certain actions (other than GSTR-1 and GSTR 3B) extended/not Extended

Table of Contents

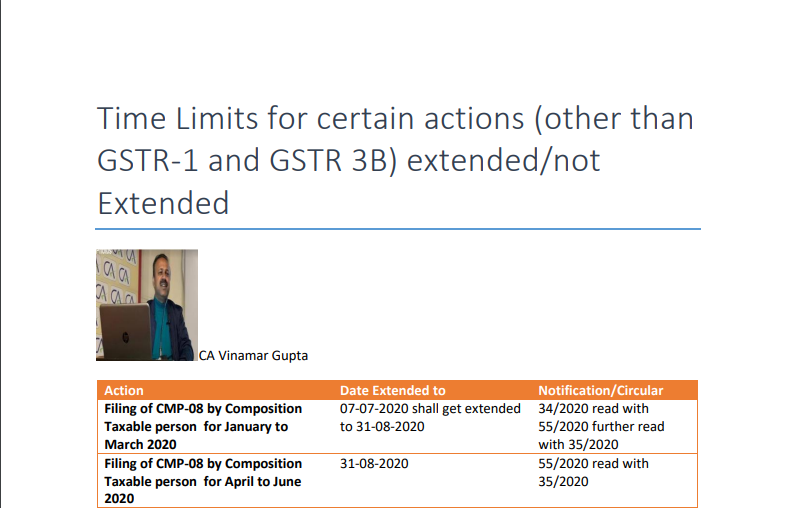

Time Limits for certain actions (other than GSTR-1 and GSTR 3B) extended/not Extended

|

Action |

Date Extended to | Notification/Circular |

| Filing of CMP-08 by Composition Taxable person for January to March 2020 | 07-07-2020 shall get extended to 31-08-2020 | 34/2020 read with 55/2020 further read with 35/2020 |

| Filing of CMP-08 by Composition Taxable person for April to June 2020 | 31-08-2020 | 55/2020 read with 35/2020 |

| GSTR-4 for the financial year 2019- 20 | 15-07-2020 shall get extended to 31-08-2020 | 34/2020 read with 55/2020 further read with 35/2020 |

| Opting for Composition Scheme for 2020-21 | 30-06-2020 shall get extended to 31-08-2020 | 30/2020 read with 55/2020 further read with 35/2020 |

| Filing of ITC-03 for reversal of ITC by persons opting for Composition Scheme | 31-07-2020 shall get extended to 31-08-2020 | Rule 3(3) amended vide 30/2020 read with 55/2020 further read with 35/2020 |

| Cumulative Adjustment of provisional ITC not exceeding 10% of invoices uploaded by suppliers | August 2020 | Rule 36(4) amended by NN 30/2020 |

| E way Bills generated on or before 24-03-2020 and period of validity expiring between 20-03-2020 to 15- 04-2020 | 30-06-2020 | 47/2020 |

| GSTR-6 for Input service distributor for March to July 2020 | 31-08-2020 | 55/2020 read with 35/2020 and Circular 136/06/2020 |

| Due date of Deposit of TDS by tax deductor falling between 20-03- 2020 to 30-08-2020 | 31-08-020 | 55/2020 read with 35/2020 and Circular 137/07/2020 |

| GSTR-7 for tax deductor for March 2020 to July 2020 | 31-08-2020 | 55/2020 read with 35/2020 and Circular 136/06/2020 |

| GSTR-8 for E-Commerce Operator for March 2020 to July 2020 | 31-08-2020 | 55/2020 read with 35/2020 and Circular 136/06/2020 |

| GSTR-9 and 9C, annual return and reconciliation statement for 2018- 19 | 30-09-2020 | 41/2020 |

| GSTR-10 required to be filed within 3 months from cancellations falling due between 20-03-2020 to 30-08- 2020 | 31-08-2020 | 55/2020 read with 35/2020 |

| Furnishing of LUT for 2020-21 | 31-08-2020 | 55/2020 read with 35/2020 further read with 37/2017 and Circular 137/07/2020 |

| Filing of Refund Application expiring between 20-03-2020 to 30-08-2020 | 31-08-2020 | 55/2020 read with 35/2020 further read with 37/2017 and Circular 137/07/2020 |

|

Due Dates falling between 20-03- 2020 to 29-09-2020 under Customs, Excise or Service Tax for: 1. Issue of any adjudication order/appeal order/other order 2. Issue of notice including SCN 3. Intimation 4. Notification 5. Sanction 6. Approval 7. Filing of Appeal 8. Filing of Reply to notice 9. Filing of Application 10. Furnishing any return 11. Furnishing any document 12. Furnishing any return or statement |

30-09-2020 | Section 6 of TAXATION AND OTHER LAWS (RELAXATION OF CERTAIN PROVISIONS) ORDINANCE, 2020 read with NN 47/2020 |

|

Due Dates falling between 20-03- 2020 to 30-08-2020 under CGST and IGST for: 1. Issue of any adjudication order/appeal order/other order 2. Issue of notice including SCN 3. Intimation 4. Notification 5. Sanction 6. Approval 7. Filing of Appeal 8. Filing of Reply to notice 9. Filing of Application 10. Furnishing any return 11. Furnishing any document 12. Furnishing any return or statement 13. Furnishing of such other record |

31-08-2020 | 55/2020 read with 35/2020 and Circular 136/06/2020 |

There is no extension of time limit for following actions:

1. Time for Liability to pay the tax arising from the issue of Invoice for goods required to be issued before or at the time of removal of goods.

2. Time for Liability to pay the tax arising from the issue of invoice for services within 30 days from the date of provision of service in cases of supplier other than banking company or insurer

3. Time for Liability to pay the tax arising from the issue of invoice for services within 45 days from the date of provision of service in case of a banking company and insurance company

4. Time of liability to pay tax on RCM on receipt of goods or date of payment or 31st day immediately following the date of issue of invoice, whichever is earliest

5. Time of liability to pay tax on RCM on services on the date of payment or 61st day immediately following the date of issue of the invoice.

6. Time of seeking registration within 30 days from the date becoming liable to be registered

7. Time of seeking registration by casual taxable person 5 days prior to commencement of business

8. Time of validity of registration for the casual taxable person beyond 90 days.

9. Time for making an arrest

10. Time for invoking liability of partners

11. Time for levy of penalty.

12. Time for issue of a summary report in EWB-03

13. Time for the final report in Part B of EWB-03

14. 15 days period for the validity of Part A of EWB-01

15. 14 days time to make payment for the release of detained goods, documents, and conveyance

Read the copy:

CA Vinamar Gupta

CA Vinamar Gupta

Amritsar, India