Delhi HC Order in the case of M/s Omaxe New Chandigarh Developers Pvt. Ltd V/s. UOI.

Case Covered:

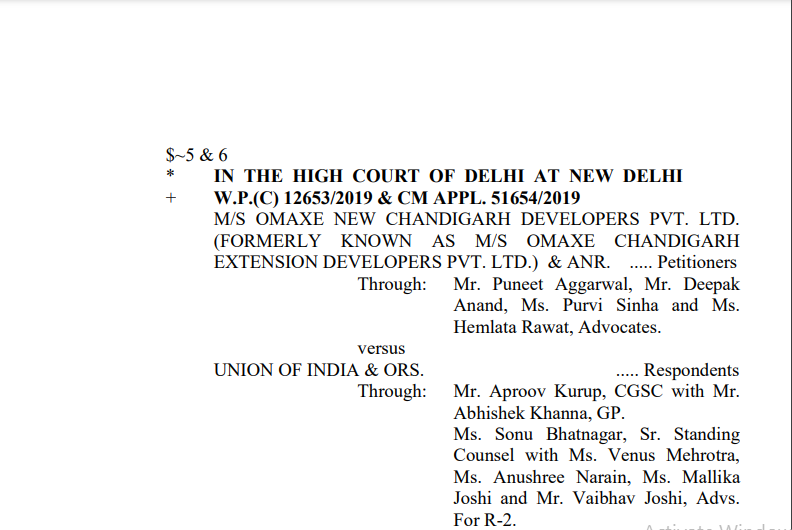

M/s Omaxe New Chandigarh Developers Pvt. Ltd

Versus

Union of India

Facts of the Case:

The limited issue which arises for consideration in the captioned writ petitions concerns the applicability of the instruction dated 21.12.2015 bearing F. No. 1080/09/DLA/MISC/15/757 [in short “2015 instruction”] and the Master Circular dated 10.03.2017 [in short “2017 Master Circular”], issued by Central Board of Excise & Customs, Department of Revenue, Ministry of Finance, Government of India [presently, known as “Central Board of Indirect Taxes & Customs”]. In this context, in particular, the petitioners rely upon paragraph 5 of the 2017 Master Circular.

It is the submission of the petitioners that as per paragraph 5 of the 2017 Master Circular, the contesting respondents, i.e., respondents nos. 2 to 5, who are represented by Mr. Satish Aggarwala in W.P.(C) 12653/2019 and Mr. Harpreet Singh in W.P.(C) 7842/2020, were mandatorily required to hold pre-show cause notice consultation with the petitioners prior to initiation of the proceedings under the Finance Act, 1994.

Related Topic:

Delhi HC in the case of Three C Homes Pvt. Ltd.

Observations:

We are of the view that “voluntary statements” recorded before the Senior Intelligence Officer cannot constitute pre-show cause notice consultation as envisaged in paragraph 5 of the 2017 Master Circular. Consultation entails discussion and deliberation. There is back and forth between parties concerned with the consultative process, leading to, metaphorically speaking, often, separation of wheat from the chaff.

A voluntary statement is at best a one-way dialogue made before an authority that does not make a decision as to whether or not the next steps in the matter are required to be taken. It is not in dispute that the show cause notices impugned in the captioned writ petitions dated 11.04.2018 (W.P.(C) 12653/2019) & 24.04.2018 (W.P.(C) 7842/2020) were issued by an officer of the rank of Additional Director General. Therefore, it cannot be said that voluntary statements made by the officials of the petitioners before the Senior Intelligence Officer would constitute a pre-show cause notice consultation, as stipulated under paragraph 5 of the 2017 Master Circular.

The Decision of the Court:

Given this position, we are inclined to dispose of the captioned writ petitions, by issuing the directions similar to the ones which were issued in W.P.(C) 5766/2019:

(i) The contesting respondents will serve an appropriate communication on the petitioner indicating therein the date, time, and venue at which they intend to convene a meeting for holding pre-show cause notice consultation.

(ii) The concerned officer will accord a personal hearing to the authorized representative of the petitioner.

(iii) The concerned officer would allow the petitioner to make submissions with regard to the merits of the matter including the aspect pertaining to the jurisdiction. The concerned officer will, after hearing the authorized representative of the petitioner, pass an order as to whether or not it is a fit case for continuing with the proceedings in accordance with the mandate of the law including the Finance Act, 1994.

(iv) If the concerned officer concludes that it is a fit case in which proceedings should continue against the petitioner, then, he would take a decision with regard to whether or not the impugned show cause notice should be revived or a fresh show-cause notice should be issued in consonance with the decision that would be rendered by the Supreme Court in SLP (Civil) Diary No. 35886/2019 [arising out of the judgment rendered in Amadeus India Pvt. Ltd. (supra)].

The captioned writ petitions are disposed of in the aforesaid terms. Pending applications shall also stand closed.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.