CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.

Legal Background:

The Bombay High Court case, M/s. Aggarwal Coal Corporation Pvt Ltd vs. The Assistant Commissioner of State Tax, addresses the issue of reverse charge mechanism (RCM) on ocean freight for imports […]

The Kerala High Court emphasized that under Article 226 of the Constitution, the writ jurisdiction cannot be utilized to re-evaluate the evidence presented in a domestic inquiry conducted by disciplinary […]

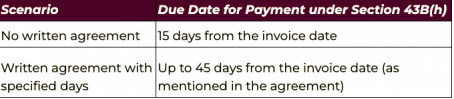

Q-1 What is 43B(h)

Ans- 43B(h) refers to a section of the Indian Income Tax Act, introduced in the Finance Act of 2023. It aims to ensure timely payments to Micro and Small Enterprises (MSMEs).

Refund of tax recovered from the recipient-

In a recent judgment the court has allowed the refund of amount recovered from the buyer. In this case the supplier defaulted in payment of tax. the deptt recovered the […]

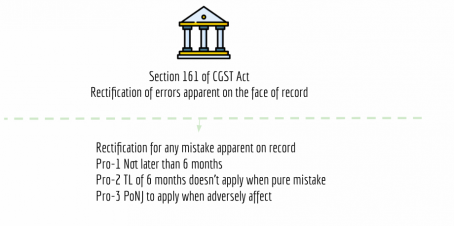

Rectification may be misjudged with the rectification of returns. So first thing I would like to clarify is that here we are going to discuss about the rectification of orders already passed by the GST […]

Issue in jurisdiction in GST

Since the starting of GST the issue of proceedings by the authorities not assigned the TP is disputed. In many cases the courts are observing the relevant facts. In GST the cross […]

In this case rectification was allowed by the court. We have very strong jurisprudence related to the rectification in bona fide cases.

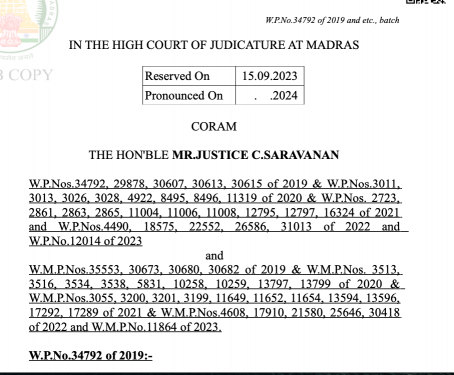

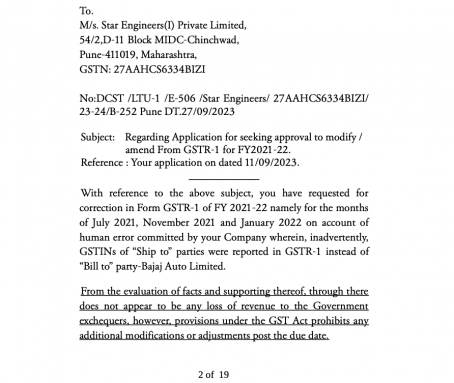

Case Details-

Start Engineers Pvt Ltd

When the courts allowed the rectification-

The scheme of GST always allowed the rectification in return. But in many cases the portal restricted it. But initial hiccups of GSTIN made it difficult. In many cases […]

No ITC reversal-

In a recent judgment the court has observed that the ITC shouldn’t be denied merely on fact that the registration of supplier is cancelled.

The contentions of the petitioner were rejected […]

When registrations are cancelled by the departments-

In many cases the department is cancelling the registrations of suppliers. There can be various stances when a registration can be cancelled.-

1- Why an SCN is issued ?

The Show cause notice gets its power from the principles of natural justice. Although most of the statutes provide for its issuance. But even if it is not written in any statute, SCN is […]

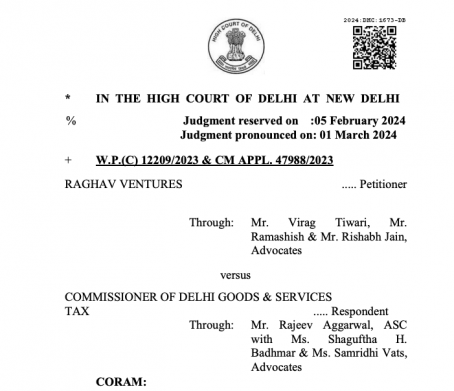

In a recent decision the Delhi high court has held that the TP is eligible for interest on refund. In GST the rate of interest on refund is 6%. It is mandatory even if the TP has not asked for it specifically for […]

Comment

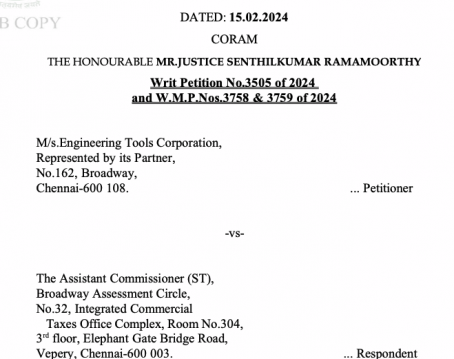

This case involves a writ petition filed by NRB Bearings Ltd. against various respondents, including the Commissioner of State Tax, Deputy Commissioner of SGST, State of Maharashtra, and Bajaj Auto Ltd., […]

Comment

The court is considering a civil writ jurisdiction case filed by Saurav Kumar against the Union of India and others regarding the cancellation of his registration under the Bihar Goods and Services Tax […]

Comment

The Court observed that the petitioner had fulfilled their obligations under the GST Act by generating digital documents and providing physical copies during inspection. The imposition of penalty was […]

Comment

The Court supported the petitioner’s argument, affirming that the Act establishes a distinct limitation period, thereby exempting the relevance of Section 5 of the Limitation Act.

Pleading

The […]

Comment

The assessing officer’s role is pivotal in determining the classification of goods and subsequent tax implications. It is imperative for the assessing officer to objectively consider all materials and […]

Comment

The court directs the lower court to promptly address the stay application and issue a reasoned order within two weeks. The judgment underscores the importance of timely resolution and procedural fairness […]

Comment

The court allows the present writ petition, setting aside the order dated 25.11.2022, and remits the matter to the Assistant Commissioner, State Tax, Sector-6, Aligarh, to issue a fresh notice with a […]

CA Shafaly Girdharwal

CA

Paid User

@shaifalygirdharwal

active 4 years, 8 months agoCA Shafaly Girdharwal

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.

5.0Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by CA Shafaly Girdharwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, No RCM on Ocean freight on FOB basis- Bombay High court 6 days, 22 hours ago

Legal Background:

The Bombay High Court case, M/s. Aggarwal Coal Corporation Pvt Ltd vs. The Assistant Commissioner of State Tax, addresses the issue of reverse charge mechanism (RCM) on ocean freight for imports […]

CA Shafaly Girdharwal wrote a new post, GST return mismatch cases grouped by High Courts where ITC was allowed 1 week, 4 days ago

Here are the GST return mismatch cases grouped by High CourtsFor any error or feedback pls write back at shaifaly.ca@gmail.com, 9953077844.

Initial period of GST was filled with a lot of issues. Here We have […]

CA Shafaly Girdharwal wrote a new post, Kerala HC: Writs Not for Questioning Sufficiency of Evidence in Disciplinary Proceedings 3 weeks, 4 days ago

The Kerala High Court emphasized that under Article 226 of the Constitution, the writ jurisdiction cannot be utilized to re-evaluate the evidence presented in a domestic inquiry conducted by disciplinary […]

CA Shafaly Girdharwal wrote a new post, 16 FAQ’s on 43B(h) applicable from 1.04.2024 4 weeks, 1 day ago

Q-1 What is 43B(h)

Ans- 43B(h) refers to a section of the Indian Income Tax Act, introduced in the Finance Act of 2023. It aims to ensure timely payments to Micro and Small Enterprises (MSMEs).

In this […]

CA Shafaly Girdharwal wrote a new post, Court allowed refund when the tax was lateron paid by the Supplier 1 month ago

Refund of tax recovered from the recipient-

In a recent judgment the court has allowed the refund of amount recovered from the buyer. In this case the supplier defaulted in payment of tax. the deptt recovered the […]

CA Shafaly Girdharwal wrote a new post, FAQ’s on rectification of orders in GST 1 month ago

Rectification may be misjudged with the rectification of returns. So first thing I would like to clarify is that here we are going to discuss about the rectification of orders already passed by the GST […]

CA Shafaly Girdharwal wrote a new post, landmark judgment on jurisdiction of GST authorities – TVL Vardhan Infrastructure 1 month ago

Issue in jurisdiction in GST

Since the starting of GST the issue of proceedings by the authorities not assigned the TP is disputed. In many cases the courts are observing the relevant facts. In GST the cross […]

CA Shafaly Girdharwal wrote a new post, Rectification of return allowed by Bombay high court 1 month ago

In this case rectification was allowed by the court. We have very strong jurisprudence related to the rectification in bona fide cases.

Case Details-

Start Engineers Pvt Ltd

Versus

Union of […]

CA Shafaly Girdharwal wrote a new post, 10 times when court allowed to rectify GST returns to claim ITC 1 month ago

When the courts allowed the rectification-

The scheme of GST always allowed the rectification in return. But in many cases the portal restricted it. But initial hiccups of GSTIN made it difficult. In many cases […]

CA Shafaly Girdharwal wrote a new post, ITC shall not be rejected for cancellation of registration of supplier- HC 1 month, 1 week ago

No ITC reversal-

In a recent judgment the court has observed that the ITC shouldn’t be denied merely on fact that the registration of supplier is cancelled.

The contentions of the petitioner were rejected […]

CA Shafaly Girdharwal wrote a new post, Judgments on ITC reversal for retro cancellation of regitration of supplier 1 month, 1 week ago

When registrations are cancelled by the departments-

In many cases the department is cancelling the registrations of suppliers. There can be various stances when a registration can be cancelled.-

When the […]

CA Shafaly Girdharwal wrote a new post, Judgments on Cryptic Notices which are invalid 1 month, 1 week ago

1- Why an SCN is issued ?

The Show cause notice gets its power from the principles of natural justice. Although most of the statutes provide for its issuance. But even if it is not written in any statute, SCN is […]

CA Shafaly Girdharwal wrote a new post, Interest is payable even if not asked by TP-HC 1 month, 2 weeks ago

In a recent decision the Delhi high court has held that the TP is eligible for interest on refund. In GST the rate of interest on refund is 6%. It is mandatory even if the TP has not asked for it specifically for […]

CA Shafaly Girdharwal wrote a new post, NRB Bearings Ltd. v. Commissioner of State Tax: GST Return Rectification 1 month, 2 weeks ago

Comment

This case involves a writ petition filed by NRB Bearings Ltd. against various respondents, including the Commissioner of State Tax, Deputy Commissioner of SGST, State of Maharashtra, and Bajaj Auto Ltd., […]

CA Shafaly Girdharwal wrote a new post, Dispute Over GST Registration: Saurav Kumar v. Union of India 1 month, 2 weeks ago

Comment

The court is considering a civil writ jurisdiction case filed by Saurav Kumar against the Union of India and others regarding the cancellation of his registration under the Bihar Goods and Services Tax […]

CA Shafaly Girdharwal wrote a new post, Fair Enforcement: Quashing Unjust Penalties in GST Compliance 1 month, 2 weeks ago

Comment

The Court observed that the petitioner had fulfilled their obligations under the GST Act by generating digital documents and providing physical copies during inspection. The imposition of penalty was […]

CA Shafaly Girdharwal wrote a new post, Enhancing Time Constraints: M/S Garg Enterprises vs. CGST Appellate Authority 1 month, 2 weeks ago

Comment

The Court supported the petitioner’s argument, affirming that the Act establishes a distinct limitation period, thereby exempting the relevance of Section 5 of the Limitation Act.

Pleading

The […]

CA Shafaly Girdharwal wrote a new post, Challenging Unfair Tax Assessment: M/s.SL Lumax Limited’s Plea for Justice” 1 month, 2 weeks ago

Comment

The assessing officer’s role is pivotal in determining the classification of goods and subsequent tax implications. It is imperative for the assessing officer to objectively consider all materials and […]

CA Shafaly Girdharwal wrote a new post, Timely Justice: Urgency in Resolving Gurdeep Singh’s Appeal 1 month, 2 weeks ago

Comment

The court directs the lower court to promptly address the stay application and issue a reasoned order within two weeks. The judgment underscores the importance of timely resolution and procedural fairness […]

CA Shafaly Girdharwal wrote a new post, Fair Hearing: M/S Gaurav Enterprises vs. State of U.P. 1 month, 2 weeks ago

Comment

The court allows the present writ petition, setting aside the order dated 25.11.2022, and remits the matter to the Assistant Commissioner, State Tax, Sector-6, Aligarh, to issue a fresh notice with a […]