Delhi High Court Rules on Customs Act Appeal Period Calculation

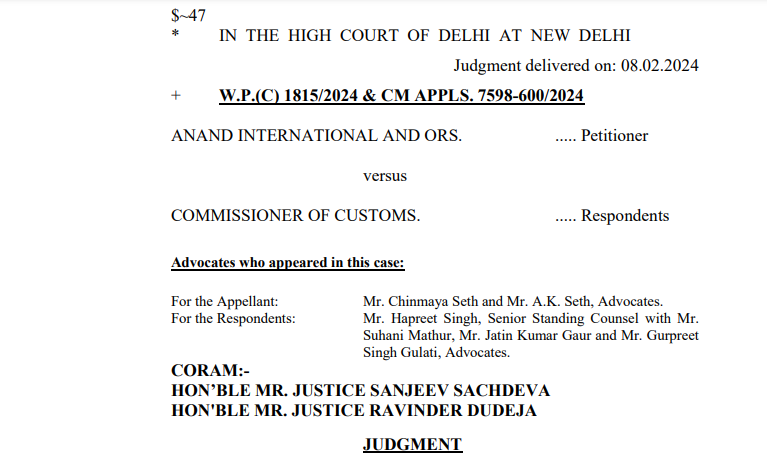

In a recent ruling, the Delhi High Court has clarified an important aspect regarding the calculation of time periods under Section 28(9) of the Customs Act. The bench comprising Justice Sanjeev Sachdeva and Justice Ravinder Dudeja held that the period spent in the disposal of an appeal before the Customs Excise and Service Tax Appellate Tribunal (CESTAT) shall not be counted towards the stipulated period mentioned in the aforementioned section. The case in question involved a petitioner who had filed an interim reply to a Show Cause Notice on August 26, 2023. Additionally, the petitioner had sought an opportunity to cross-examine certain witnesses, which was denied, leading the petitioner to appeal to the CESTAT. The court noted that the appeal had been heard, and judgment was reserved for January 30, 2024. However, on the same day the arguments were reserved, the petitioner was called upon to file a final reply and appear for a hearing on February 9, 2024, regarding the Show Cause Notice. The petitioner argued that concluding the hearing on the Show Cause Notice while the appeal was pending would cause grave prejudice. The department contended that the Show Cause Notice must be adjudicated within a statutory period of one year, as per Section 28(9) of the Customs Act. Considering the circumstances, the court directed that the hearing on the Show Cause Notice be deferred until the order was pronounced by the CESTAT. Following the pronouncement of the order, the petitioner would be granted a period of two weeks to file a final reply to the Show Cause Notice. The adjudicating authority could then proceed with concluding the Show Cause Notice after providing the petitioner with an opportunity for a personal hearing. This ruling by the Delhi High Court provides clarity on the computation of time periods in cases involving appeals before the CESTAT under the Customs Act. It ensures that parties have adequate opportunity to present their cases without undue haste or prejudice.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.