Guidelines for Manual selection of returns for Complete Scrutiny

Guidelines for Manual selection of returns for Complete Scrutiny

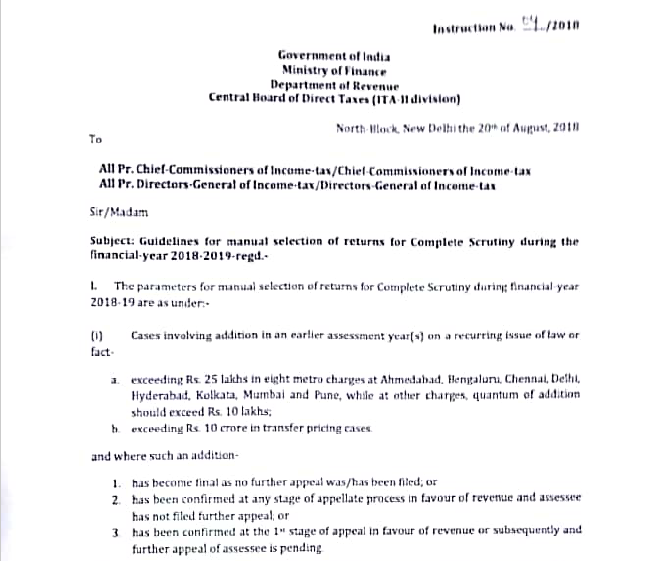

The Central Board of Direct Taxes has issued the instruction regarding the Complete Scrutiny. The Subject of the instruction is “Guidelines for Manual selection of returns for Complete Scrutiny”. The instruction (Instruction No. 04/2018) was issued on 20th August 2018.

The parameters for manual selection of returns for Complete Scrutiny during the financial year 2018-19 are as under.-

(i) Cases involving addition In an earlier assessment year(s) on a recurring issue of law or fact-

a. exceeding Rs. 25 lakhs in eight metro charges at Ahmedabad. Hengaluni, Chennai, Delhi. Hyderabad. Kolkata. Mumbai and Pune, while at other charges, the quantum of add none should exceed Rs. 10 lakhs;

b. It exceeding Rs. 10 crores In transfer pricing cases

and where such an addition-

1. has become final as no further appeal was/has been filed; or

2. has been confirmed at any stage of the appellate process In favor of revenue and assessee has not filed the further appeal, or

3. has born confirmed at the 1st stage of appeal in favor of revenue or subsequently and further appeal of the assessee is pending

Download the Guidelines for Manual selection of returns for Complete Scrutiny by Clicking the below Image:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.