CBDT guidelines for manual selection of returns for detailed scrutiny

CBDT guidelines for manual selection of returns for detailed scrutiny

CBDT issued a circular for guidance on manual selection of returns for detailed scrutiny. There are 5 parametres to for selection of returns for scrutiny.

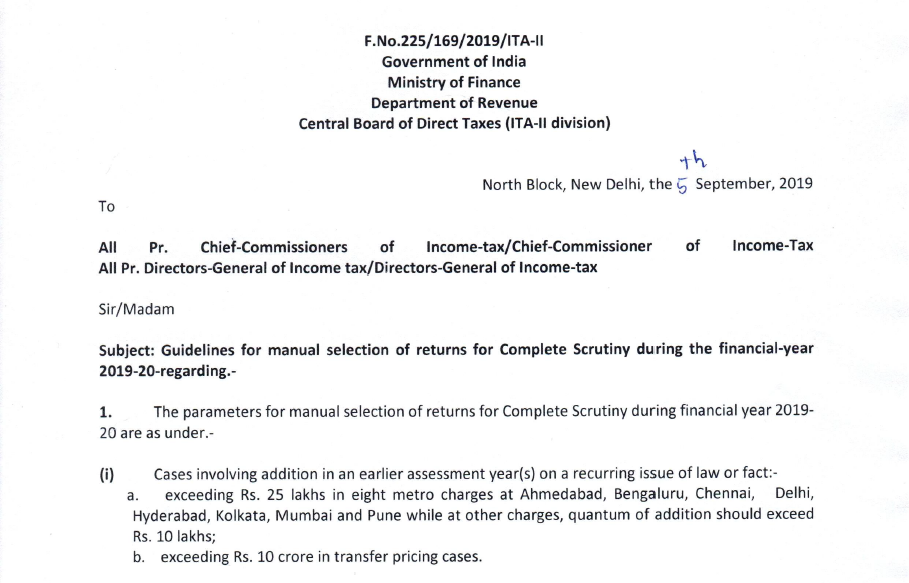

F.No.225/169/2019/ITA-II Government of India Ministry of Finance Department of Revenue Central Board of Direct Taxes (ITA-II division)

4h North Block, New Delhi, the & September, 2019 To All Pr. Chief-Commissioners of Income-tax/Chief-Commissioner of Income-Tax

All Pr. Directors-General of Income tax/Directors-General of Income-tax Sir/Madam

Subject: Guidelines for manual selection of returns for Complete Scrutiny during the financial-year 2019-20-regarding.-

- The parameters for manual selection of returns for Complete Scrutiny during financial year 2019- 20 are as under.-

Cases involving addition in an earlier assessment year(s) on a recurring issue of law or fact.

- exceeding Rs. 25 lakhs in eight metro charges at Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkata, Mumbai and Pune while at other charges, quantum of addition should exceed Rs. 10 lakhs;

- exceeding Rs. 10 crore in transfer pricing cases.

and where such an addition:-

- has become final as no further appeal has been filed against the assessment order; or

- has been confirmed at any stage of appellate process in favor of revenue and assessee has not filed further appeal; or

- has been confirmed at the 1* stage of appeal in favor of revenue or subsequently; even if further appeal of assessee is pending, against such order.

2 Cases pertaining to survey under section 133A of Income-tax Act

| Cases pertaining to Survey under section 133A of the Income-tax Act, 1961 (‘Act’) excluding those cases where books of accounts, documents, etc. were not impounded and returned income (excluding any disclosure made during the Survey) is not less than returned income of preceding assessment year. However, where assessee has retracted from disclosure made during the Survey, such cases will be considered for scrutiny.

3. Assessment in search and seizure cases under section(s) 153A,153C, 158BA, 158BC & 158BD read with section 143(3)

Assessments in search and seizure cases to be made under section(s) 153A, 153C, 158BA, 158BC & 158BD read with section 143(3) of the Act and also for return filed for assessment year relevant to previous year in which authorization for search and seizure was executed under section 132 or 132A of the Act.

4. Cases where the registration/approval under various sections of the Act such as 12A, 35(1)(ii)/(iia) & (iii) ,10(23C) etc.have not been granted or have been cancelled.

Cases where registration/approval under various sections ofthe Actsuchas12A, 35(1)(ii)/(iia)/(iii), 10(23C), etc. have not been granted or have been cancelled/withdrawn by the Competent Authority, yet the assessee has been found to be claiming tax-exemption/deduction in the return. However, where such orders of withdrawal of registration/approval have been reversed/set-aside in appellate proceedings, those cases will not be selected under this clause.

5. Cases in respect of which specific information pointing out the tax evasion for the relevant year is given by any law enforcement/intelligence/regulatory authority or agency.

Cases in respect of which specific information pointing out tax-evasion for the relevant year is given by any law-enforcement/intelligence/regulatory authority or agency. However, before selecting a return for scrutiny under this criterion, Assessing Officer shall take prior administrative approval from jurisdictional Pr. CIT/Pr.DIT/CIT/DIT concerned.

Procedure for selection:

- Through Computer Aided Scrutiny Selection (CASS), cases are being selected in two categories viz. Limited Scrutiny & Complete Scrutiny in a centralized manner under CASS-2019. CASS is a system-based method for scrutiny selection which identifies the cases through data-analytics and three-hundred sixty- degree data profiling of taxpayers and in a non-discretionary manner. The list of these cases is being/has been separately intimated by the Principal DGIT(Systems) to the Jurisdictional authorities concerned for further necessary action. In respect of cases selected under CASS cycle 2019, the following guidelines are specified.

- Cases where returns are selected for scrutiny through CASS but are not verified by the assessee within the specified period of e-filing and such returns remain unverified before the due date for issue of notice u/s 143(2), should be reopened by issue of notice under section 148 of the Act.

- Cases selected for ‘Limited Scrutiny’ but credible specific information has been/is received from any law-enforcement/intelligence/regulatory authority or agency regarding tax-evasion in such cases, then only issue(s) arising from such information can be examined during the course of conduct of assessment proceedings in such ‘Limited Scrutiny’ cases, with prior administrative approval of the Pr. CIT/CIT concerned as per the procedure laid down in Board’s letter dated 28.11.2018 issued vide F.No.225/402/2018/ITA-II. In such ‘limited Scrutiny’ cases, Assessing Officer shall not expand the scope of enquiry/investigation beyond the issue(s) on which the case was flagged for ‘Limited Scrutiny’ and the issue(s) arising from the information received from the above referred agency or authority.

- This may be brought to the notice of all concerned for necessary compliance.

- Hindi version to follow. ~Sob _ (Rajarajeswari R.) Under Secretary-ITA.II, CBDT Copy to:

- PS to FM/OSD to FM/PS to MoS (R)/OSD to MoS(R)

- PS to Secretary (Finance)/(Revenue)

- Chairman, CBDT & All Members, CBDT

- All Joint Secretaries/CsIT, CBDT

- O/o Pr. DGIT(Systems) with request to upload on the departmental website

- CIT, Data-Base Cell for uploading on irsofficer’s website Pha orem 4

Download the pdf on full CBDT guidelines for manual selection of returns for detailed scrutiny, below:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.