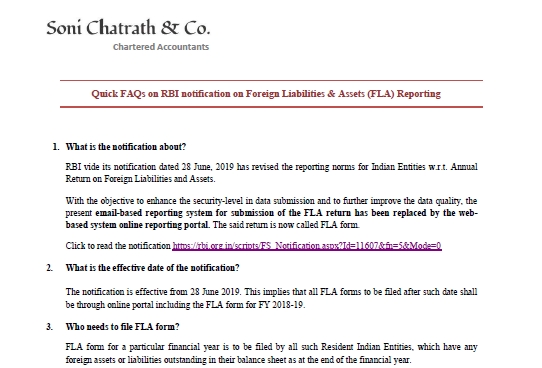

FAQs on RBI notification on Foreign Liabilities & Assets Reporting

- 1. What is the notification about?

- 2. What is the effective date of the notification?

- 3. Who needs to file FLA form?

- 4. What is the definition of ‘Entity’ for the purposes of filing FLA form?

- 5. What constitutes foreign assets and liabilities?

- 6. What is the due date for filing FLA form?

- 7. How and where to file FLA form?

- 8. How to file FLA form on FLAIR portal for FY 2018-19?

- 9. What are the pre-requisites for filing FLA User Registration Form?

- 10. How to file FLA form if financial statements are not finalized for a particular FY?

- 11. What are the consequences in case FLA form is not filed by 15 July?

1. What is the notification about?

RBI vide its notification dated 28 June 2019 has revised the reporting norms for Indian Entities w.r.t. Annual Return on Foreign Liabilities and Assets.

With the objective to enhance the security-level in data submission and to further improve the data quality, the present email-based reporting system for submission of the FLA return has been replaced by the web-based system online reporting portal. The said return is now called FLA form.

Click to read the notification https://rbi.org.in/scripts/FS_Notification.aspx?Id=11607&fn=5&Mode=0

2. What is the effective date of the notification?

The notification is effective from 28 June 2019. This implies that all FLA forms to be filed after such date shall be through online portal including the FLA form for FY 2018-19.

3. Who needs to file FLA form?

FLA form for a particular financial year is to be filed by all such Resident Indian Entities, which have any foreign assets or liabilities outstanding in their balance sheet as at the end of the financial year.

4. What is the definition of ‘Entity’ for the purposes of filing FLA form?

- A Company within the meaning of section 1(4) of the Companies Act, 2013;

- A Limited Liability Partnership (LLP) registered under the Limited Liability Partnership Act, 2008;

- SEBI registered Alternative Investment Funds (AIFs); &

- Others, which includes Partnership Firms, Public-Private Partnerships (PPPs), etc.

5. What constitutes foreign assets and liabilities?

- Any equity investment under Foreign Direct Investment (FDI) scheme received by a resident Indian entity;

- Any portfolio investment held by a foreign entity in eligible equity or debt securities of a resident Indian entity;

- Any other outstanding loans, trade credits, etc. from unrelated foreign parties for a resident Indian entity;

- Any equity investment abroad under Overseas Direct Investment (ODI) scheme made by a resident Indian entity;

- Any portfolio investments held by a resident Indian entity in eligible equity or debt securities abroad; &

- Any other outstanding claims including loans, trade credits, etc. from unrelated foreign entities for a resident Indian entity.

6. What is the due date for filing FLA form?

The FLA form is to be filed every year on or before 15 July from the end of the relevant financial year.

7. How and where to file FLA form?

Upto 27 June 2019, excel based FLA form was filed and emailed directly to fla@rbi.org.in. However, with the release of aforesaid notification, FLA form will now be filed on a web-portal interface called Foreign Liabilities and Assets Information Reporting (FLAIR) System with immediate effect.

8. How to file FLA form on FLAIR portal for FY 2018-19?

Every eligible Indian entity needs to first obtain registration at the FLAIR portal https://flair.rbi.org.in by filling the online FLA User Registration Form. There are two mandatory attachments to the said form:

- Authority letter from the entity

- Verification letter The format of the verification & authority letter (doc) are available on FLAIR portal

9. What are the pre-requisites for filing FLA User Registration Form?

- Verification & authority letter: Name, PAN, designation & address of the authorized representative & CIN & PAN of the Indian entity

- FLA User Registration Form: Email & contact number of the authorized representative & the Indian entity

10. How to file FLA form if financial statements are not finalized for a particular FY?

In such a case the FLA form will be filed based on the unaudited accounts, following which a revised form based on the audited accounts can be filed in case of any revisions before 30 September from the end of the relevant financial year.

11. What are the consequences in case FLA form is not filed by 15 July?

Non-filing of FLA form before the due date will be treated as a violation of FEMA and penalty thereon can go up to thrice the sum involved in the contravention. In case it is not quantifiable, then a penalty of INR 2 Lac will have to be paid by the company. If the contravention is continuing, a penalty of INR 5,000 per day will have to be paid by the company.

If you already have a premium membership, Sign In.