Capital Gain Exemption: House Property acquired in Foreign Countries

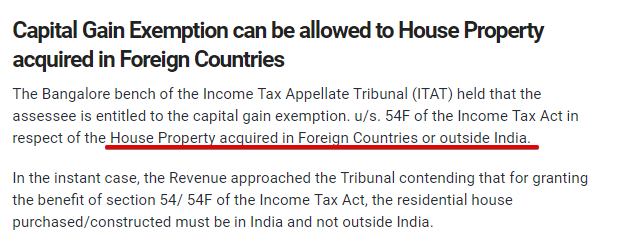

Capital Gain Exemption can be allowed to House Property acquired in Foreign Countries

The Bangalore bench of the Income Tax Appellate Tribunal (ITAT) held that the assessee is entitled to the capital gain exemption. u/s. 54F of the Income Tax Act in respect of the House Property acquired in Foreign Countries or outside India.

In the instant case, the Revenue approached the Tribunal contending that for granting the benefit of section 54/ 54F of the Income Tax Act, the residential house purchased/constructed must be in India and not outside India.

The Tribunal cited a few decisions of ITAT wherein it was held that the words “in India” cannot be inserted in section 54F of the Act and as per plain of section 54F of the Act, the sale proceeds of the capital asset shall be invested in the residential house or outside India.

“This issue was examined by the Tribunal in the case of ACIT Vs. Iqbal Jafar which was authored by one of the members of this Bench and it was held by the Tribunal that before the amendments, the benefit can also be given to the residential house acquired in abroad,” the bench said.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.