Clarification on the immunity provided u/s 270AA of the Income-tax Act, 1961

Clarification on the immunity provided u/s 270AA of the Income-tax Act, 1961

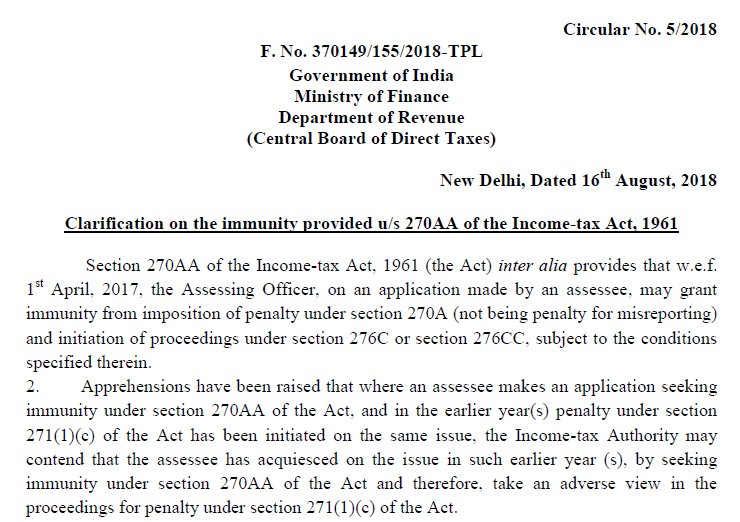

A circular is issued for Clarification on the immunity provided u/s 270AA of the Income-tax Act, 1961. The circular was issued on the 16th August, Circular no. 5/2018.

Section 270AA of the Income-tax Act, 1961 (the Act) inter alia provides that w.e.f. 1st April 2017, the Assessing Officer, on an application made by an assessee, may grant immunity from imposition of penalty under section 270A (not being the penalty for misreporting) and initiation of proceedings under section 276C or section 276CC, subject to the conditions specified therein.

Apprehensions have been raised that where an assessee makes an application seeking immunity under section 270AA of the Act, and in the earlier year(s) penalty under section 271(1)(c) of the Act has been initiated on the same issue, the Income-tax Authority may contend that the assessee has acquiesced on the issue in such earlier year (s), by seeking immunity under section 270AA of the Act and therefore, take an adverse view in the proceedings for penalty under section 271(1)(c) of the Act.

In this matter, it is hereby clarified that where an assessee makes an application seeking immunity under section 270AA of the Act, it shall not preclude such assessee from contesting the same issue in any earlier assessment year. Further, the Income-tax Authority, shall not take an adverse view in the proceedings for penalty under section 271(1)(c) of the Act in earlier assessment years merely on the ground that the assessee has acquiesced on the issue in any later assessment year by preferring an immunity on such issue under section 270AA of the Act.

Download the full notification for Clarification on the immunity provided u/s 270AA of the Income-tax Act, 1961:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.