How to file ITR 1without help of any expert or software in 15 minutes

What you will learn here

- How to file ITR-1

- File ITR using utility available free at Income tax department of India’s website

- File ITR -1 without the help of any expert.

We all need to file ITR to fulfil our statutory need. Many of us has experienced that in spite of taking the help of an expert you find it hand and time consuming to file ITR. Even after that you come to know about mistakes in ITR when you receive a notice from the department. Here we will guide you how to file your ITR without the help of any expert or software by using the utility available on website of Income tax department.

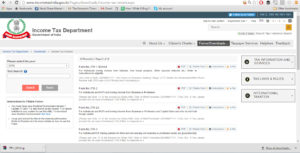

http://www.incometaxindia.gov.in/Pages/downloads/income-tax-return.aspx this is the link you need to visit. Please copy and paste in your browser. Here you will get the following window.

Now click on fillable form and a zip file will be downloaded. Save it and extract to get the excel utility for ITR-1

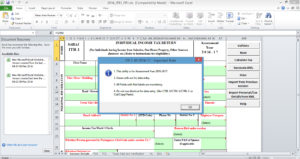

When you will try to open it there will be a checkbox you need to click on okay.

Now your utility is ready to use. Start filing the information. Here a brief list of information you will need. Compile these before you start filing this utility.

- Name, Address

- PAN

- DoB (as per PAN card)

- Bank account number

- Bank IFSC and MICR codes

- Bank branch and address

- Details of TDS deducted(including TAN of deducted, Use a copy of 26 AS to fill this information)

- Bank statement for last one year and mark all interest income apart from salary.

- Details of all bank accounts including dormant accounts.

- Details of advance tax paid, if any

- Details of any donation made under section 80 G to avail exemption.

- Details of investments to avail deduction of sec 80C

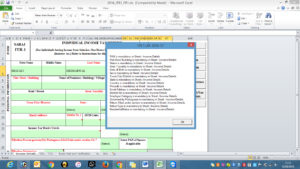

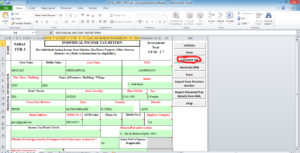

After filing this information click on validate button and it will populate a list of discrepancy as shown in image below.

Fill in the required details and click again. When all requirements will be fulfilled it will show you the banner which says sheet is okay. Now you can proceed to next sheet.

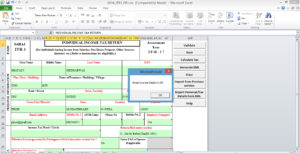

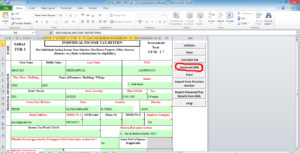

After filing all sheets and validation them you can now click on “Calculate tax” as shown in image below.

It will take a sec and will calculate the amount of Tax/refund taking into consideration all information you have provided. You can reconcile this amount with your own calculation.

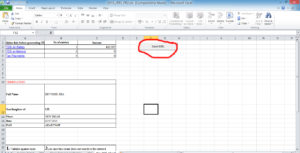

Now it is a matter on one minute only. Click on generate XML

If there is still any error it will show you and will ask you to correct. If it is all correct it will save an XML file in the same folder where you save this excel utility.

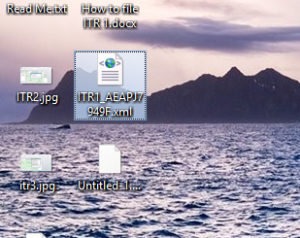

The XML file will look like this (see below)

Now go to the website of income tax department and enter your login details.Don’t worry, here is the link. Just copy and paste it into your browser.

https://incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html

Login here and click on upload return

Select ITR-1, Assessment Year and upload the Xml we generated few minutes back

Now click on submit and here you are.

Your return is filed.It will ask you to verify. You can verify it online by login into your bank account or by generation verification link with your Aadhar number.

If you don’t want to verify it online you can simply take a print out of ITR V generated and sign it and send it to bangalore address mentioned on ITR V itself. (it is password protected.Enter PAN followed by Dob to open it).

You are done.

It will hardly take you 10-15 minutes once you collected all the information.

Hope it was fun and you find it helpful.

For any other requirement you can simply send me an email at shaifaly.ca@gmail.com or whats app me at 9953077844

Thanks for reading

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.