How To Compute 5% Cash Transactions

This writes up explains how to compute the limit of five percent of the aggregate of transactions for the purpose of tax audit u/s 44AB. As we are all aware that this is an […]

All about House Rent Allowance (HRA)

House Rent Allowance (HRA) is one of the most relevant claimed allowances by the salaried class employees. The write-up deals with some of the commonly asked questions.

Can […]

Is it possible for a taxpayer to file an Income Tax Return (ITR) without Form 16?

There are possible scenarios where a taxpayer may not be able to obtain Form 16 from his/her employer. Since the due date for […]

Introduction

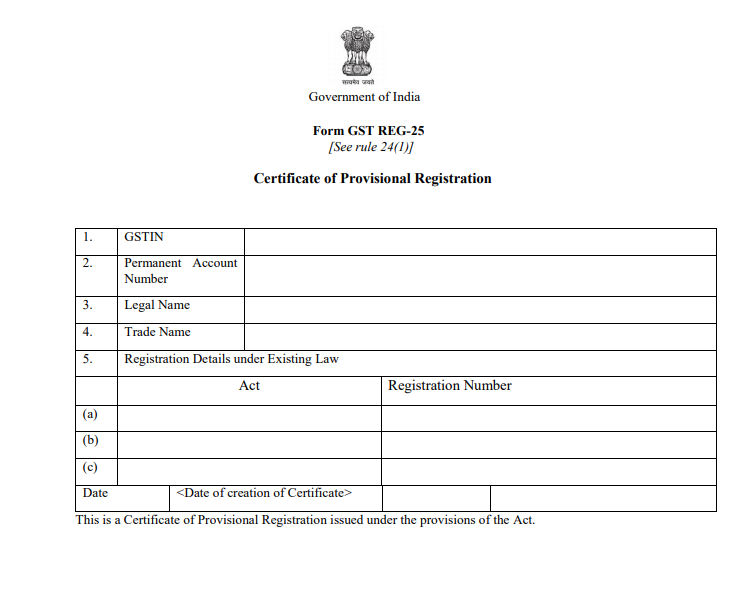

REG 25 is a certificate of provisional registration under GST. Every taxpayer registered under excise/VAT/service tax enrolls on a common portal. He provides his email ID and mobile number for […]

Introduction

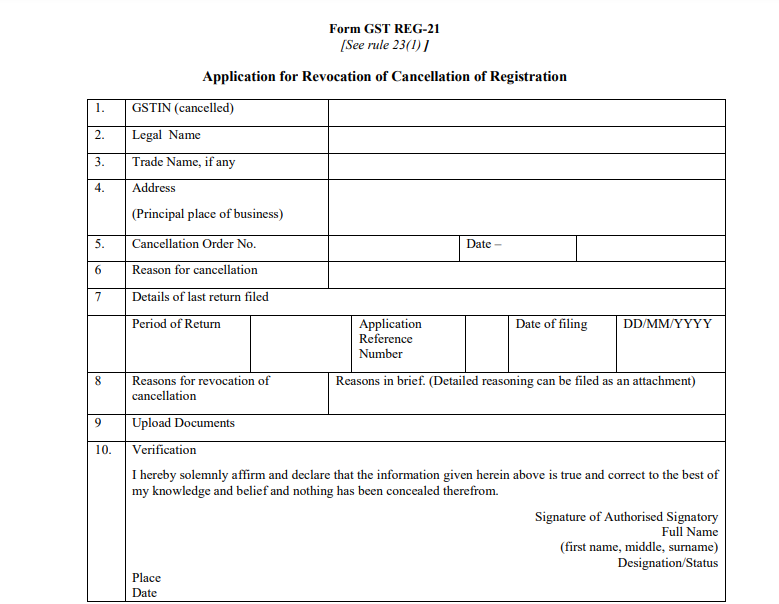

Form REG 21 is application for revocation of cancellation of registration under GST. What does revocation mean? Revocation means official cancellation. So revocation of cancellation of registration […]

Introduction

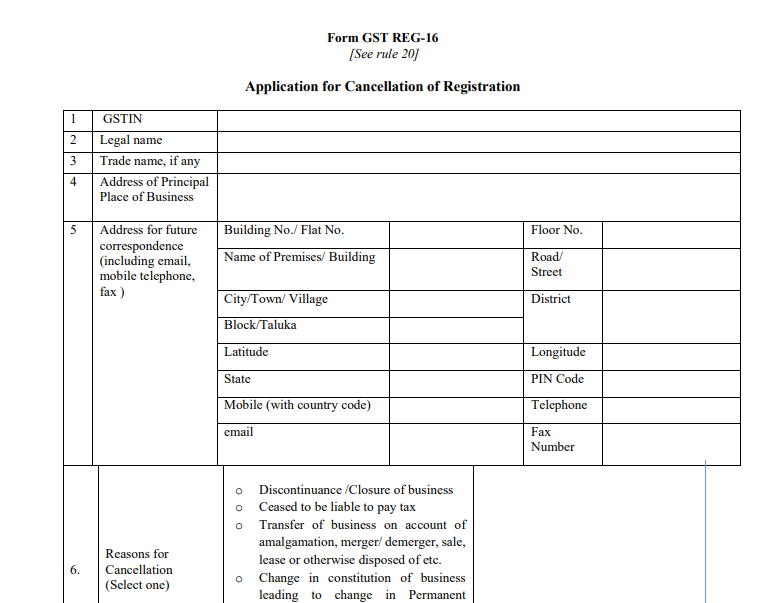

Cancellation of GST registration means a taxpayer is not registered anymore. He need not to collect or pay tax anymore. But why does the taxpayer wish to cancel his registration? Reasons can […]

Introduction

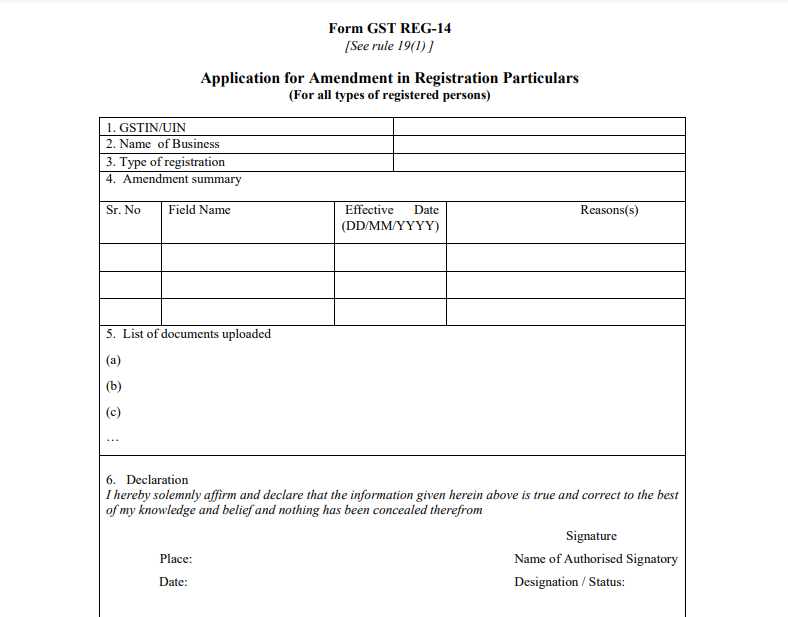

Many times applicants commit mistakes at the time of filing an application for registration. Such mistakes can be updated or corrected at the time application is being processed. If business is […]

Introduction

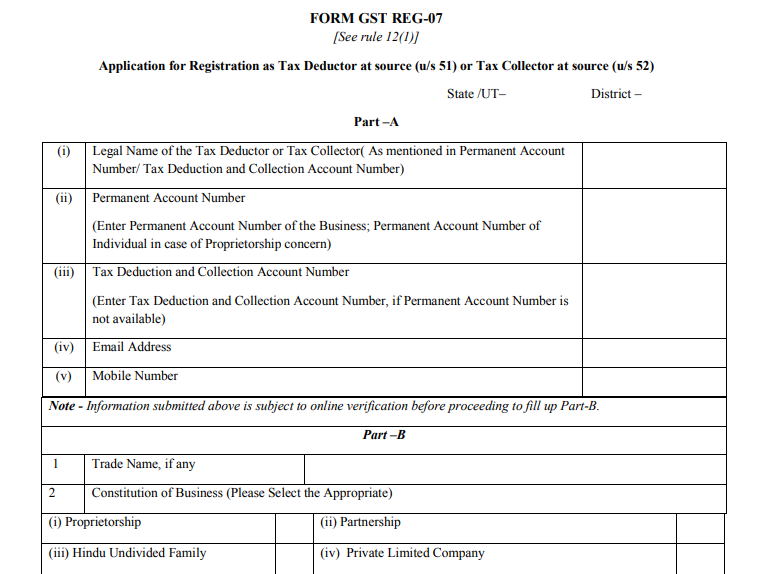

REG 07 is the form for TDS & TCS deductors. TDS requirement is on government departments whereas TCS is deducted by E-commerce operators.

They need to deposit it into the account of government and […]

Introduction

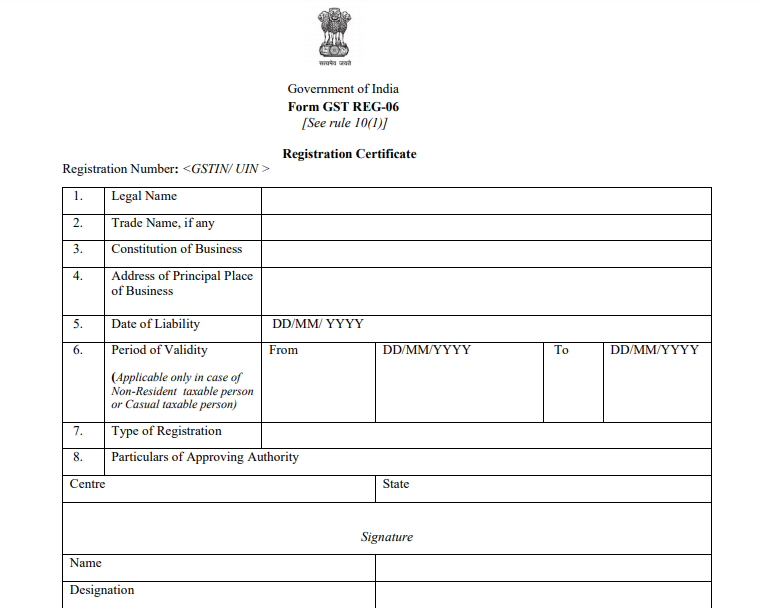

Turnover is the basic criteria for registration requirement in GST. The general threshold is Rs. 20 lac. In case of sales of goods it is Rs 40 lac. But the limit of Rs. 40 lac is only for specified […]

Introduction

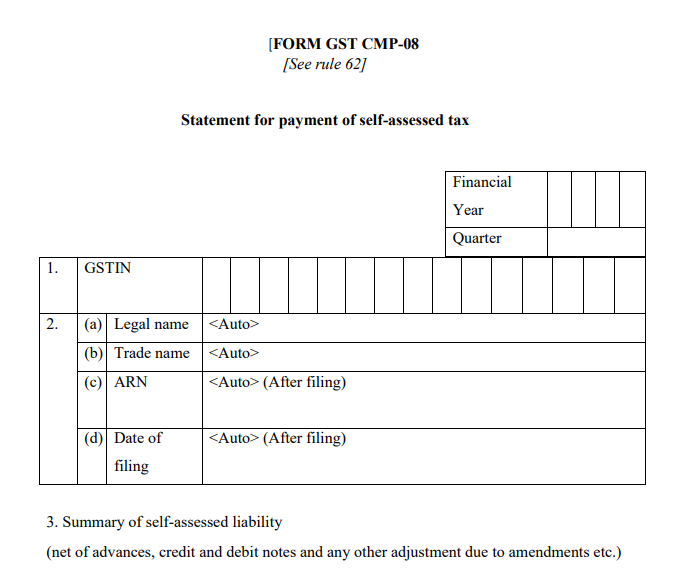

A composition dealer is required to file CMP 08. Earlier they were required to file GSTR 4 on quarterly basis. Thereafter, rule 62 was amended in which CMP 08 is required to be filed as a quarterly […]

Introduction

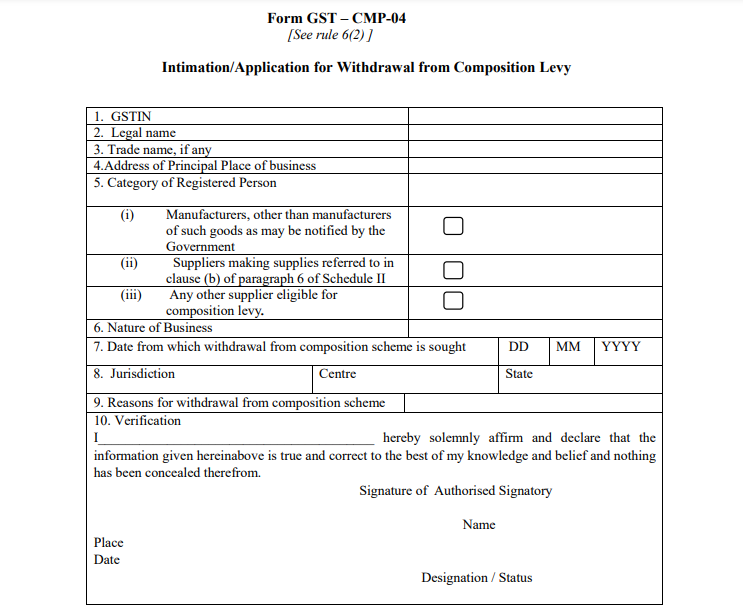

GST has a long list of compliances. It is easy for big corporations but small taxpayers find it hard. A composition levy is introduced to reduce the number of compliance on small taxpayers. It covers […]

Background

The CBDT has the power under section 138 of the Income-tax Act, 1961 to provide information received or obtained by income tax authorities to any officer, authority or body performing any functions […]

This writeup deals with all the aspects related to supply of old and used business assets under GST. Being a business person there are various assets that are required for furtherance of business and after a span […]

Appellant: M/s Siemens Power Engineering Pvt. Ltd. (SPEPL) [now merged with M/s Siemens Ltd.]

Respondent: Assistant Commissioner of Income Tax.

FACTS:

The assessee raised many grounds of appeal, among which […]

APPELLANT: DCIT Central Circle 2 (2), Bengaluru

RESPONDENT : M/s Cornerstone Property Investment (P) Ltd.

FACTS OF THE CASE:

Appeal has been filed by the revenue against the order to CIT(A) for the f […]

In this article we will discuss about Aadhaar Authentication Procedure while applying for New Registration on GST Common Portal. Aadhaar authentication has been mandated w.e.f 21/08/2020, at the time of taking new […]

1. What is E invoicing?

Rule 48(4) has been inserted vide N/N 68/2019- CT dt 13.12.2019 which amends the rules w.r.t E invoicing.

‘E-invoicing’ or ‘electronic invoicing’ is a system in which B2B invoices […]

Sakshi Virmani

@sakshiconsultease-com

active 3 years, 2 months agoSakshi Virmani

OOPS!

No Packages Added by Sakshi Virmani. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewSakshi Virmani wrote a new post, How to Compute 5% Cash Transactions Limit For Tax Audit U/s 44AB 2 years, 9 months ago

How To Compute 5% Cash Transactions

This writes up explains how to compute the limit of five percent of the aggregate of transactions for the purpose of tax audit u/s 44AB. As we are all aware that this is an […]

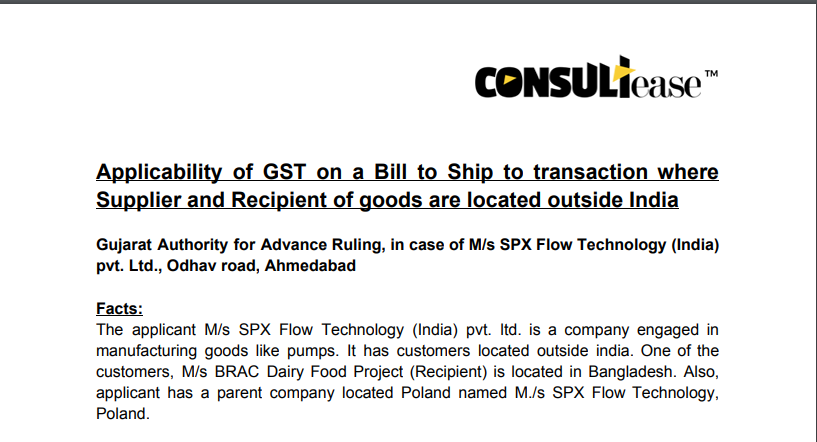

Sakshi Virmani wrote a new post, Applicability of GST on a Bill to Ship to transaction where Supplier and Recipient of goods are located outside India. 3 years, 3 months ago

Applicability of GST on a Bill to Ship to transaction where Supplier and Recipient of goods are located outside India.

Gujarat Authority for Advance Ruling, in case of M/s SPX Flow Technology (India) Pvt. Ltd., […]

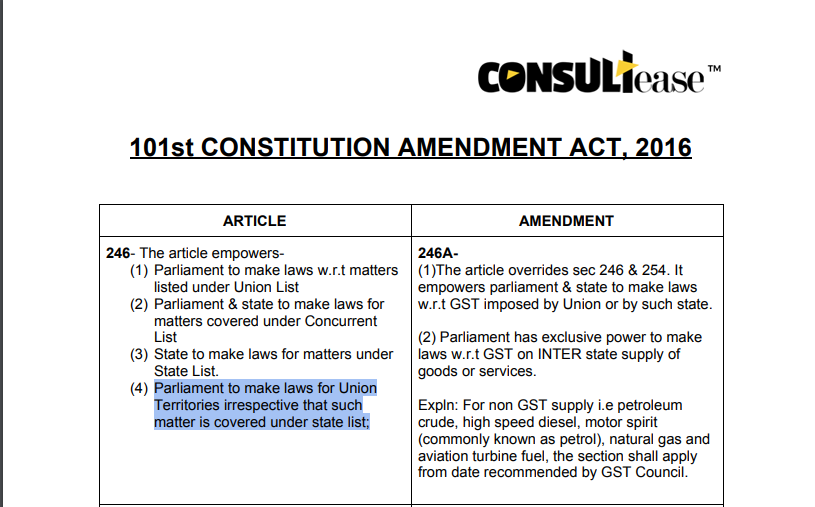

Sakshi Virmani wrote a new post, 101st Constitution Amendment Act, 2016 3 years, 3 months ago

101st Constitution Amendment Act, 2016

ARTICLE

AMENDMENT

246- The article empowers-

Parliament to make laws w.r.t matters listed under Union List

Parliament & state to make laws for matters c […]

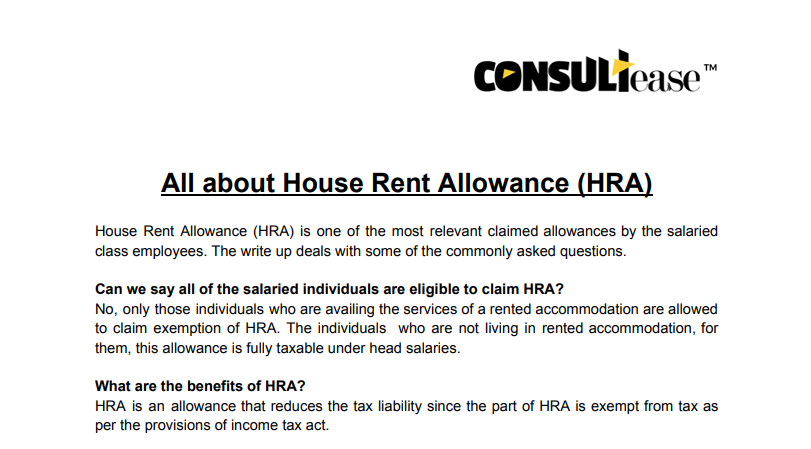

Sakshi Virmani wrote a new post, All about House Rent Allowance (HRA) 3 years, 3 months ago

All about House Rent Allowance (HRA)

House Rent Allowance (HRA) is one of the most relevant claimed allowances by the salaried class employees. The write-up deals with some of the commonly asked questions.

Can […]

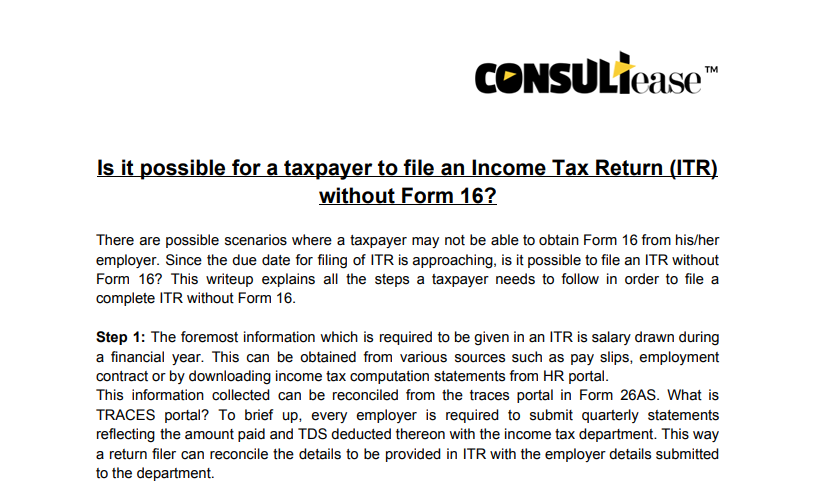

Sakshi Virmani wrote a new post, Is it possible for a taxpayer to file an Income Tax Return (ITR) without Form 16? 3 years, 3 months ago

Is it possible for a taxpayer to file an Income Tax Return (ITR) without Form 16?

There are possible scenarios where a taxpayer may not be able to obtain Form 16 from his/her employer. Since the due date for […]

Sakshi Virmani wrote a new post, Format of “Form” – REG 25 3 years, 7 months ago

Introduction

REG 25 is a certificate of provisional registration under GST. Every taxpayer registered under excise/VAT/service tax enrolls on a common portal. He provides his email ID and mobile number for […]

Sakshi Virmani wrote a new post, Format of “Form” – REG 21 3 years, 7 months ago

Introduction

Form REG 21 is application for revocation of cancellation of registration under GST. What does revocation mean? Revocation means official cancellation. So revocation of cancellation of registration […]

Sakshi Virmani wrote a new post, Format of “Form” – REG 16 3 years, 7 months ago

Introduction

Cancellation of GST registration means a taxpayer is not registered anymore. He need not to collect or pay tax anymore. But why does the taxpayer wish to cancel his registration? Reasons can […]

Sakshi Virmani wrote a new post, Format of “Form” – REG 14 3 years, 7 months ago

Introduction

Many times applicants commit mistakes at the time of filing an application for registration. Such mistakes can be updated or corrected at the time application is being processed. If business is […]

Sakshi Virmani wrote a new post, Format of “Form”- REG 07 3 years, 7 months ago

Introduction

REG 07 is the form for TDS & TCS deductors. TDS requirement is on government departments whereas TCS is deducted by E-commerce operators.

They need to deposit it into the account of government and […]

Sakshi Virmani wrote a new post, Format of “Form”- REG 06 3 years, 7 months ago

Introduction

Turnover is the basic criteria for registration requirement in GST. The general threshold is Rs. 20 lac. In case of sales of goods it is Rs 40 lac. But the limit of Rs. 40 lac is only for specified […]

Sakshi Virmani wrote a new post, Format of “Form”- CMP 08 3 years, 7 months ago

Introduction

A composition dealer is required to file CMP 08. Earlier they were required to file GSTR 4 on quarterly basis. Thereafter, rule 62 was amended in which CMP 08 is required to be filed as a quarterly […]

Sakshi Virmani wrote a new post, Format of “Form”- CMP 04 3 years, 7 months ago

Introduction

GST has a long list of compliances. It is easy for big corporations but small taxpayers find it hard. A composition levy is introduced to reduce the number of compliance on small taxpayers. It covers […]

Sakshi Virmani wrote a new post, Sharing of Data between Income Tax and GST Authorities 3 years, 8 months ago

Background

The CBDT has the power under section 138 of the Income-tax Act, 1961 to provide information received or obtained by income tax authorities to any officer, authority or body performing any functions […]

Sakshi Virmani wrote a new post, Supply of Used Business Assets under GST 3 years, 8 months ago

This writeup deals with all the aspects related to supply of old and used business assets under GST. Being a business person there are various assets that are required for furtherance of business and after a span […]

Sakshi Virmani wrote a new post, ITAT: Validity of a Notice issued to an amalgamating company which is no more existent. 3 years, 8 months ago

Appellant: M/s Siemens Power Engineering Pvt. Ltd. (SPEPL) [now merged with M/s Siemens Ltd.]

Respondent: Assistant Commissioner of Income Tax.

FACTS:

The assessee raised many grounds of appeal, among which […]

Sakshi Virmani wrote a new post, In case of conflict, can the Provisions of Income Tax Act prevail over Accounting Standards ? 3 years, 8 months ago

APPELLANT: DCIT Central Circle 2 (2), Bengaluru

RESPONDENT : M/s Cornerstone Property Investment (P) Ltd.

FACTS OF THE CASE:

Appeal has been filed by the revenue against the order to CIT(A) for the f […]

Sakshi Virmani wrote a new post, Process of Aadhaar Authentication while applying for New Registration on GST Common Portal 3 years, 8 months ago

In this article we will discuss about Aadhaar Authentication Procedure while applying for New Registration on GST Common Portal. Aadhaar authentication has been mandated w.e.f 21/08/2020, at the time of taking new […]

Sakshi Virmani wrote a new post, FAQs on Income under head House Property – all you need to know. 3 years, 8 months ago

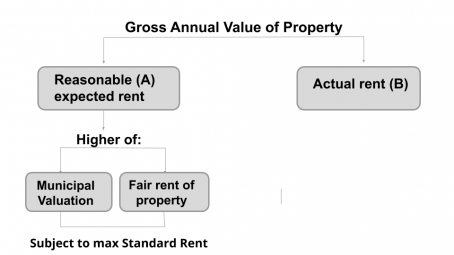

What is income from House Property?

The total income is divided into five heads for taxability.

Income from Salary

Income from house property

Income from business & profession

Income from Capital […]

Sakshi Virmani wrote a new post, FAQs on E Invoice under GST 3 years, 8 months ago

1. What is E invoicing?

Rule 48(4) has been inserted vide N/N 68/2019- CT dt 13.12.2019 which amends the rules w.r.t E invoicing.

‘E-invoicing’ or ‘electronic invoicing’ is a system in which B2B invoices […]