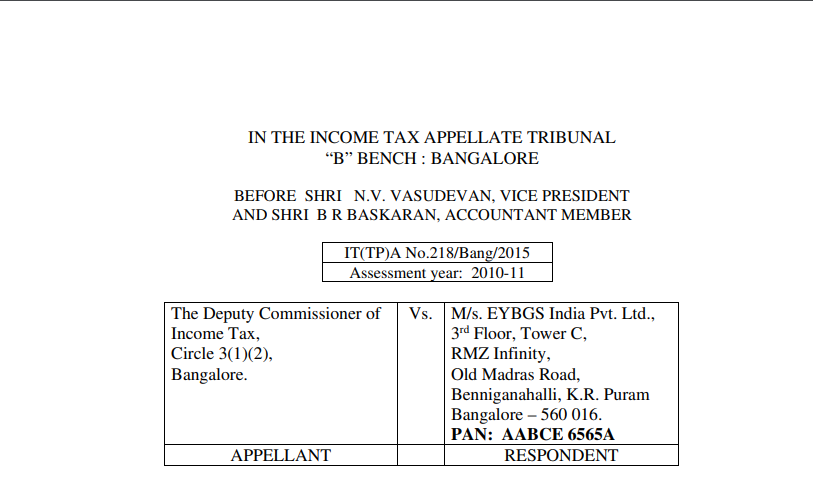

ITAT in the case of The Deputy Commissioner of Income Tax Versus M/s. EYBGS India Pvt. Ltd.

Case Covered:

The Deputy Commissioner of Income Tax

Versus

M/s. EYBGS India Pvt. Ltd.

Facts of the case:

The facts relating to the case are discussed in brief. The assessee is a 100% subsidiary of EYGI B.V., Netherlands. It is engaged in the business of providing back-office support services, which are in the nature of ‘Information Technology Enabled Services’ (ITES). The nature of services provided by the assessee to its Associated Enterprises (AEs) includes financial analysis and reporting functions such as standard reporting/analysis, work-in-progress details, timesheet details, etc., accounting center processing activities/functions such as accounts receivable, accounts payable functions, billing analysis, and invoice preparation, etc and financial assistance/administration functions such as time and expenses review, helpdesk providing assistance on employee queries, etc. The assessee is remunerated at the “cost-plus” basis for the services provided to its AEs.

The assessee adopted the TNMM method to benchmark its international transactions and adopted Operating Profit/Operating Cost (OP/OC) as Profit Level Indicator (PLI). The assessee made a Transfer pricing adjustment of Rs.8,11,70,000/- voluntarily to its financial results. It also included foreign exchange gains as part of its operating income. Accordingly, it worked out the PLI at 28.86%. The arithmetic mean of PLI of comparable companies selected by the assessee worked out to 18.53%. Accordingly, the assessee claimed that its international transactions with the AEs are at arm’s length. The Transfer Pricing Officer (TPO), however, rejected the Transfer pricing study of the assessee.

Observations:

We have noticed earlier that the assessee had made a transfer pricing adjustment of Rs.8,11,70,000/- voluntarily and added the same to the total income while filing return of income. The assessee also claimed deduction u/s 10AA of the Act on the profits of the business arrived at after the inclusion of the above-said amounts. The Ld DRP took the view that the assessee did not furnish the details as to how the above-said figure was arrived at by the assessee. It further took the view that the assessee will not be bringing the above-said amount in foreign exchange within the period prescribed in sec.10AA of the Act, which is one of the mandatory conditions for allowing deduction under that section. The Ld DRP also noticed that the eligible unit has actually incurred loss and hence the assessee is not eligible to claim deduction u/s 10AA of the Act. However, the assessee, by making voluntary Transfer pricing adjustment, is attempting to avail deduction u/s 10AA of the Act and the same should not be permitted. The Ld DRP also held that the Transfer pricing adjustment determined by the TPO is added to the total income for tax purposes, irrespective of the profits/loss of 10A/10AA units and whether they are eligible for deduction under those sections or not. Further, the Ld DRP also proceeded on the ground that the assessee did not determine the voluntary T.P adjustment in its Transfer Pricing Study. Accordingly, the Ld DRP held that the decision rendered by the co-ordinate Bench in the case of I-Gate Global Solutions Ltd (2007)(112 TTJ 1002) is distinguishable. Accordingly, the Ld DRP directed the AO to disallow the deduction claimed u/s 10AA in respect of Voluntary Transfer pricing adjustment.

We heard the parties on this issue and perused the record. The Ld A.R submitted that the Ld DRP was factually not correct in observing that the assessee did not furnish details of voluntary Transfer pricing adjustment. It has added the amount of voluntary TP adjustment while computing the revised margin of the assessee, which is placed at page 680 of the paper book. He further submitted that the assessee has arrived at the amount of voluntary T.P adjustment in a scientific manner by comparing the margins of comparable companies selected by the assessee. Accordingly, he submitted that the Ld DRP was not justified in observing that the same is an Adhoc amount. He further submitted that the coordinate bench has held in the case of I-Gate Global Solutions Ltd (supra) has held that the assessee is eligible for deduction u/s 10AA on the amount of voluntary TP adjustment. He submitted that the decision of the Tribunal in the above-said case has since been upheld by the Hon’ble High Court of Karnataka. He further submitted that the Pune bench of Tribunal has rendered a decision in favour of the assessee in the case of Apoorva Systems (P) Ltd (2018)(92 taxmann.com 82) by considering the decision rendered in the case of I-Gate Global Solutions Ltd. On the contrary, the Ld D.R supported the order passed by Ld DRP on this issue.

The decision of the Tribunal:

The identical view has been expressed by the Delhi bench of Tribunal in the case of AT Kearney India P Ltd (ITA No.2623/Del/2015 dated 21.06.2019). Accordingly, we hold that the assessee is eligible for deduction u/s 10AA of the Act in respect of voluntary Transfer Pricing adjustment made by it. We direct accordingly.

In the result, the appeal of the revenue is dismissed and the appeal of the assessee is partly allowed.

Read & Download the full decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.