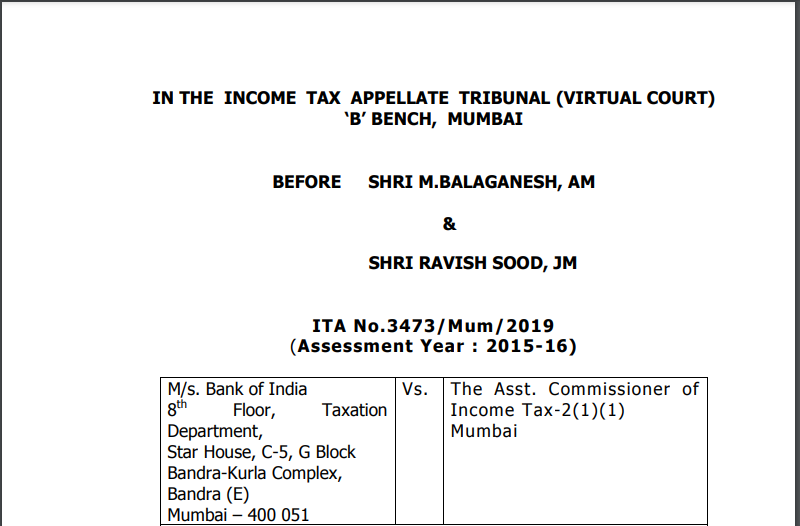

ITAT in the case of M/s. Bank of India Versus The Asst. Commissioner of Income Tax

Case Covered:

M/s. Bank of India

Versus

The Asst. Commissioner of Income Tax

Facts of the Case:

This appeal in ITA No.3473/Mum/2019 for A.Y.2015-16 preferred by the order against the revision order of the ld. Pr. Commissioner of Income Tax (Appeals)-2, Mumbai u/s.263 of the Act dated 15/03/2019 for A.Y.2015-16.

The only issue to be decided in this appeal is as to whether the ld. Pr. Commissioner of Income Tax (PCIT) was justified in invoking his revisionary jurisdiction u/s.263 of the Act in the facts and circumstances of the instant case with regard to provision for bad and doubtful debts u/s. 36(1)(viia) of the Act.

Observations:

We find that the impugned issue in dispute is squarely covered by the order of this Tribunal in the assessee’s own case for A.Y.2014-15 in ITA No.3699/Mum/2018 dated 05/10/2020 which is also an appeal filed by the assessee against the order passed by the PCIT u/s.263 of the Act. In A.Y.2014-15, PCIT had sought to revise the order passed by the ld. Assessing Officer on several issues which include the issue before us for A.Y.2015-16. We find that this Tribunal in A.Y.2014-15 had held the action of the ld. PCIT in invoking revisionary jurisdiction in respect of the impugned issue before us as incorrect and decided the same in favour of the assessee. The relevant operative portion of the said order of this Tribunal for A.Y.2014-15 dated 05/10/2020 are as under:-

“D) The next issue relates to the allowance of bad debts under clause (vii) of Sub-section (1) of Section 36 of the Act. As per the applicable provisions of law for the assessment year under consideration, the proviso to Section 36(1)(vii) requires maintenance of Provision for Bad and Doubtful Debts (in short ‘PBDD’) account under Section 36(1)(viia) of the Act. The deduction in respect of PBDD allowed under Section 36(1)(viia) of the Act is required to be credited to this account. Section 36(1)(vii) of the Act requires bad debts written off to be debited to this account. The proviso to Section 36(1)(vii) of the Act states that opening credit balance in this account as on 1st day of the previous year should be reduced from the amount of bad debts written off during the previous year and excess of bad debts written off, if any, shall be allowed as a deduction under Section 36(1)(vii) of the Act. The ld. PCIT observed that the assessee has claimed that the opening balance of PBDD is negative and has given the computation of the opening balance as on 31.03.2013, which is the opening balance for the assessment year under consideration. It is further observed that the computation given by the assessee is not correct. In the assessment year 2013-14, the PBDD is required to be debited to opening balance only and the remaining PBDD is allowed under Section 36(1)(vii) of the Act. He observed that the amount of PBDD claimed under Section 36(1)(viia) of the Act will remain as closing balance even when the whole opening balance is reduced to Nil on account of a debit of PBDD during the assessment year 2013-14 and the unadjusted or excess PBDD will be allowed under Section 36(1)(vii) of the Act. Thus, for the assessment year under consideration, i.e. the assessment year 2014- 15, the minimum opening balance shall be Rs.2039.28 crores which have been Bank of India claimed as deduction under Section 36(1)(viia) of the Act during the preceding assessment year, i.e. 2013-14. Thus, excess claim of PBDD to the extent of Rs.2039.28 crores has been allowed. This has rendered the assessment order erroneous insofar as it is prejudicial to the interests of the Revenue.

8. Further, he observed that the contention of the assessee is that the Assessing Officer passed the assessment order after examining the details of the aforesaid issues and such order cannot be revised. In this regard, the ld. PCIT observed that the assessment order is found to be erroneous insofar as it is prejudicial to the interests of the Revenue on the law as well as on facts as discussed in the above paragraphs. Accordingly, he invoked the provisions of Section 263 of the Act and held that the order passed by the Assessing Officer is erroneous and prejudicial to the interests of the Revenue.

18. With regard to the issue of deduction under Section 36(1)(vii) of the Act, he submitted that the issue was examined by the Assessing Officer at the time of original assessment under Section 143(3) of the Act. He brought to our notice, pages 48 to 50 of the paper book as per which it is evident that full details of the claim were furnished by the assessee in the note forming part of the return of income and that during the assessment proceedings, the Assessing Officer asked the assessee to file a detailed note justifying the above claim and assessee has submitted the same taking into consideration that there was no opening credit balance in PBDD under Section 36(1)(vii) of the Act. The Assessing Officer after examining the details submitted before him satisfied himself to allow the claim of bad debts written off by the assessee. Further, he submitted that the decision of the Assessing Officer to allow the claim cannot be held to be erroneous or prejudicial to the interests of the Revenue just because in his order he does not make any elaborate discussion in respect of the claim. He submitted that merely because the Commissioner has a different opinion in the matter, it cannot render the order of Assessing Officer erroneous and prejudicial to the interests of the Revenue. In this regard, he relied on the following case laws:-

A) CIT vs Gabriel India Ltd., 203 ITR 108(Bom.)

B) Anil Shah vs ACIT, (2007) 162 taxman 39 (Mum.)

C) Reliance Money Inf Ltd. vs PCIT, [2017] 88 taxman 871 (Mumbai Trib.)

19. With regard to the third issue of disallowance under Section 14A of the Act in computing book profits, he submitted that the ld. PCIT in his order under Section 263 of the Act had not directed any revision in respect of this issue, therefore, the order of Assessing Officer is neither erroneous and prejudicial to the interests of the Revenue. Further, he submitted that even on merits, the directions of ld. PCIT to make reference/additions in order under Section 263 of the Act is not valid for the above reasons. He submitted that subsequently during the revision proceedings, ld. PCIT issued a show-cause notice on the issue of reference to the TPO. He submitted that an issue that does not form part of show cause notice under Section 263 of the Act cannot be a matter which can be decided in order under Section 263 of the Act. For this purpose, he relied on the decision of Hon’ble Bombay High Court in the case of Maharashtra Hybrid Seeds Co. Ltd.,[2019] 102 taxman 48 (Bombay).

20. With regard to disallowance of deduction under Section 36(1)(vii) of the Act, he submitted that ld. PCIT erred in concluding that deduction allowed under Section 36(1)(viia) of the Act for the preceding assessment year has to be considered as opening credit balance in provision for bad and doubtful debts opened under Section 36(1)(viia) of the Act. Ld. PCIT failed to appreciate that there is no such provision in the Income Tax Act which deems the deduction allowed under Section 36(1)(viia) of the Act for the preceding assessment year as opening credit balance. He submitted that assessee has computed the opening credit balance by considering the deduction allowed under Section 36(1)(viia) of the Act and bad debts written off in each of the assessment years in which the said section became applicable to it and accordingly arrived at the balance in the provision account. Since the bad debts written off was in excess of the deduction allowed under Section 36(1)(viia) of the Act, there was a debit balance of Rs.2388.11 crores. Since there was no opening credit balance, but only a debit balance of Rs.2388.11 crores, the opening credit balance was considered as Nil and the entire amount was written off correctly and allowed in the order under Section 143(3) of the Act.

21. He further submitted that without prejudice to the above submissions, even considering the credit balance of Rs.123.12 crores as per the assessment order for the assessment year 2013-14, the opening credit balance for the assessment year 2014-15 was only a debit balance of Rs.2388.11 crores as stated in page 5 of ld. PCIT order and hence there is no opening credit balance to be set off against the bad debts written off during the year. Accordingly, the entire bad debts written off has been correctly allowed in the order under Section 143(3) of the Act. In this regard, he relied on the decision of ITAT Mumbai Benches in the case of SIDBI in ITA No. 743/Mum/2008 dated 15.02.2012 in which it was held that when there is no opening credit balance in provision for bad and doubtful debts account under Section 36(1)(viia) of the Act, the entire bad debts are written off has to be allowed as deduction.

24. Considered the rival submissions and material placed on record, we notice that ld. PCIT initiated the proceedings under Section 263 of the Act by issuing show cause notice and the reasons mentioned in the show cause notice was that in computing the book profits under Section 115JB of the Act, the profits of foreign branches were wrongly excluded and certain provisions were omitted to be added back, deduction under Section 36(1)(vii) of the Act in respect of bad debts written off was incorrectly allowed and disallowance made as per Rule 8D was not considered in computing the book profits. After careful consideration of the submissions of both the parties, we observe that the issue of applicability of book profits to the nationalised banks was agitated by the assessee before the ld. CIT(A) and ld. CIT(A) has already passed an order on 21.06.2017 in favour of the assessee that the provisions of Section 115JB of the Act do not apply to the assessee. Now, in the show cause notice, a similar issue was raised by ld. PCIT and passed an order on 27.03.2018, therefore, in our considered view, ld. PCIT cannot invoke the provisions of Section 263 of the Act in this matter. With regard to the issue of deduction claimed under Section 36(1)(vii) and 36(1)(viia) of the Act, the assessee has filed detailed submissions before the Assessing Officer and the Assessing Officer has considered the submissions even though he has not discussed it in his order under Section 143(3) of the Act. The material submitted before us clearly indicates that the assessee has made elaborate submissions on this issue and the Assessing Officer has satisfied himself that the assessee is eligible to claim deduction under Section 36(1)(vii) and 36(1)(viia) of the Act and, therefore, in our considered view, ld. PCIT cannot form another view on the same issue in which the Assessing Officer has already satisfied himself and passed an order which clearly indicates that the Assessing Officer has verified and investigated the matter in detail. Therefore, even in this issue, the provisions of Section 263 of the Act cannot be invoked. (emphasis supplied by us herein). With regard to the third issue raised in the show cause notice, i.e. disallowance under Rule 8D which was not considered in computing the book profits, we notice that the ld. PCIT himself dropped this issue and has not directed any revision to the Assessing Officer. From the above discussion, it is clear that the issues raised in the show cause notice issued under Section 263 of the Act do not survive. Therefore, in our considered view, the order passed under Section 263 of the Act deserves to be quashed.

The Decision of the Tribunal:

Respectfully following the aforesaid decision, in view of the identical facts and circumstances except with variance in figures, we hold that ld. PCIT had erred in invoking revisionary jurisdiction in the facts and circumstances of the instant case and accordingly, the order passed by the ld. PCIT u/s.263 stands hereby quashed. Accordingly, the grounds raised by the assessee are allowed.

As a result, the appeal of the assessee is allowed.

Order pronounced on 08/12/2020 by way of proper mentioning in the notice board.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.