HUF can’t be taxed after partition

Case Covered:

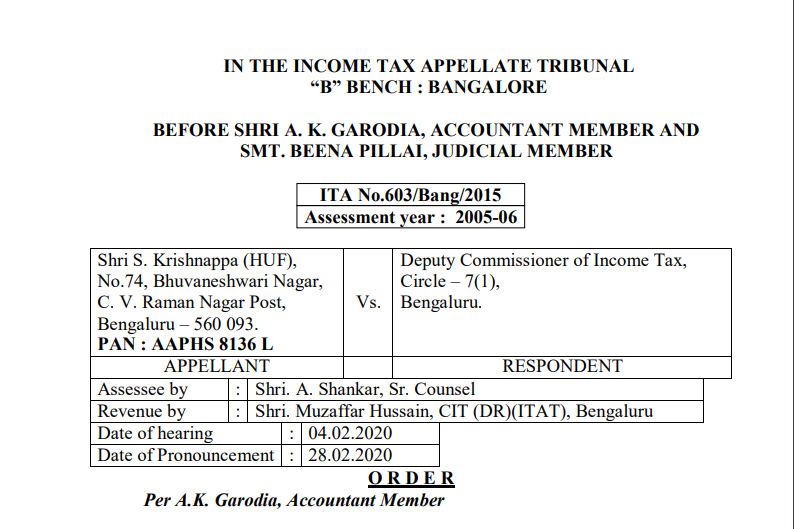

Shri S. Krishnappa (HUF)

Versus

Deputy Commissioner of Income Tax

Facts of the case:

This appeal is filed by the assessee and the same is directed against the order of learned CIT(A)-4, Bengaluru, dated 20.01.2011 for the Assessment Year 2005-06.

In the course of hearing, learned AR of the assessee submitted list of dates and synopsis of 24 pages and in particular, our attention was drawn to page 10 of the said synopsis para 26 and it was submitted that as per ground Nos.3 and 4 raised by the assessee before the Tribunal, this is the issue raised by the assessee that the HUF was not in existence when the assessment proceedings have been conducted and the Assessment Order has been passed on HUF and therefore, the entire proceedings are rendered null and void and it should be held that the Assessment Order is bad in law on the facts and circumstances of the present case. Reliance was placed by learned AR of the assessee on the judgment of Hon’ble Karnataka High Court rendered in the case of CIT Vs. Puttaranga Naika (HUF) in ITA No.2980-2985/2005 dated 13.09.2011, copy available on pages 311 to 338 of case law paper book. He pointed out that paras 11 to 13 of the judgment relevant wherein it was held that no assessment can be made on HUF if, at the time of assessment, it has been divided because, at that point of time, there was no undivided family in existence which could be taxed, even if it is found that when the income was received, the family was joint. Regarding the facts of present case, he pointed out that in para 9 on page 6 of his order, it is noted by learned CIT(A) that the assessee is HUF is divided by partition on 22.08.2009 but he survey action and notice under section 148 was initiated after the date of partition and hence, this was the claim of the assessee before learned CIT(A) that since HUF was not existing on these dates after partition, it cannot be assessed to tax. He submitted that this claim of the assessee was rejected by CIT(A) on this basis that the assessment year in question is Assessment Year 2005-06 being the year in which the HUF existed. He submitted that even in the facts of the present case, the judgment of the Hon’ble Karnataka High Court is squarely applicable and hence, the issue should be decided in favor of the assessee and it should be held that assessment order is bad in law.

Observations of the court:

From para 13 of this judgment as reproduced above, it comes out that it was held by Hon’ble Karnataka High Court that no assessment can be made on a HUF if, at the time of assessment, it has become divided because, at that point of time, there was no undivided family in existence which could be taxed though when the income was received in the year of accounts, the family was joint. In the present case also, the Assessment Order is dated 31.012.2010 and as per the Assessment Order, survey under section 133A of the Income Tax Act, 1961 was carried out on 10.09.2009 and notice under section 148 of the IT Act, 1961 was issued and served on the assessee on 22.09.2009. As per para 9 reproduced from the order of CIT(A), it is noted by learned CIT(A) that HUF was disrupted by a partition on 22.08.2009. Hence, it is seen from the facts of the present case that on 10.09.2009, when the survey action was conducted under section 133A of the IT Act and also on 22.09.2009 when notice under section 148 of the IT Act, 1961 was issued by the AO and on dated 31.12.2010 when the Assessment Order was passed by AO under section 143 r.w.s. 147 of the IT Act, 1961 for Assessment Year 2005-06, the HUF was not in existence because the same was already partitioned on 22.08.2009. This is the basis of the order of the learned CIT(A) that the Assessment Year involved is 2005-06 and at that point in time, HUF was in existence but as per the judgment of Hon’ble Karnataka High Court rendered in the case of CIT Vs. CIT Vs. Puttaranga Naika (HUF) (supra), this situation is also considered and it is held that if on the date of assessment, the HUF is not in existence, then such HUF cannot be taxed even for an earlier year when the income was received and the HUF was in existence. Respectfully following this judgment of Hon’ble Karnataka High Court, we hold that the present Assessment Order is bad in law and the same is accordingly quashed.

In view of this decision, no other ground requires any adjudication.

In the result, assessee’s appeal is allowed.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.