HC Upholds constitutional validity of Sec 234E imposing a late fine on TDS TCS statement

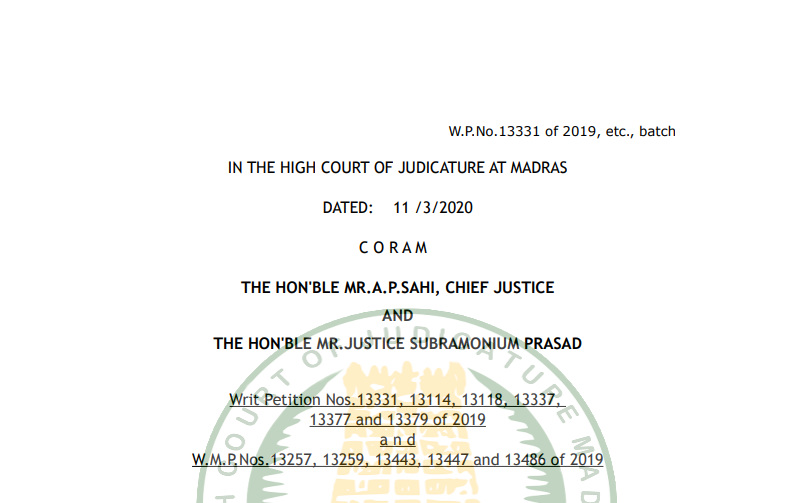

Case Covered:

Qatalys Software Technologies Private Limited

Versus

Union of India

Read the full text of the case here.

Facts of the case:

W.P.Nos.13331, 13118 and 13377 of 2019 have been filed by Qatalys Software Technologies Private Limited, QSource Global Consulting Private Limited and Jeans Park (India) Private Limited, challenging the vires of Section 234 E of the Income Tax Act, 1961.

W.P.Nos.13114, 13337 and 13379 of 2019 have been filed by QSource Global Consulting Private Limited, Qatalys Software Technologies Private Limited and Jeans Park (India) Private Limited, challenging the demand notices raised by the fifth respondent against them under Section 234 E along with Section 220 (2) and 201 (1) (A) of the Income Tax Act, 1961.

Text of Section 243E:

234E of the Income Tax Act reads thus:-

Fee for default in furnishing statements – (1) Without prejudice to the provisions of the Act, where a person fails to deliver or cause to be delivered a statement within the time prescribed in sub-section (3) of Section 200 or the proviso to subSection (3) of Section 206 C,he shall be liable to pay, by way of fee, a sum of two hundred rupees for every day during which the failure continues.

(2). The amount of fee referred to in sub-section (1) shall not exceed the amount of tax deductible or collectible, as the case may be.

(3). The amount of fee referred to in sub-Section 91) shall be paid before delivering or causing to be delivered a statement in accordance with sub-Section (3) of Section 200 or the proviso to sub-Section (3) of Section 206 C.

(4). The provisions of this Section shall apply to a statement referred to in sub-Section (3) of Section 200 or the proviso to sub-Section (3) of Section 206 C which is to be delivered or caused to be delivered for tax deducted at source or tax collected at source, as the case may be, on or after the 1st day of July 2012.

Observations of the court:

Revenue is right in contending that Section 234 (E) of the Act is not a penalty. Penalty is levied under Section 271 (H) and is not automatic. Penalty is levied only when tax is deducted at source along with interest fee is not deposited and statement is not filed within one year. If the above two conditions are satisfied, then penalty is not leviable. On the other hand, Section 234 (E) of the Act is only a late fee at the rate of Rs.200/- per day. As held in the judgments relied above, Section 234 (E) of the Act is purely compensatory and is a special benefit to the advantage of the assessee as well for belatedly filing the TDS statement. The revenue is right in contending that Section 234 (E) of the Act is meant to ensure that assessee files the statement in time, so that the Department can clear the returns of the persons connected with the assessee, i.e., from whom tax has been deducted at source without any delay and accurately with increasing or overloading the burden of the department.

The Parliament is competent to pass legislation on Taxes in Income under Entry 82 of the List I to the Seventh Schedule. Section 234 F is not violative of any of the other provisions of Income Tax Act or the Constitution of India. Nothing has been shown as to how the Section is manifestly arbitrary for it to be struck down.

In view of the above, W.P.Nos.13331, 13118 and 13377 of 2019 fail and are hereby dismissed. Since the levy is constitutional, the challenge to the demand notices also fail.

Accordingly, W.P.Nos.13114, 13337 and 13379 of 2019 are also dismissed. No costs. Consequently, the connected Miscellaneous Petitions are closed.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.