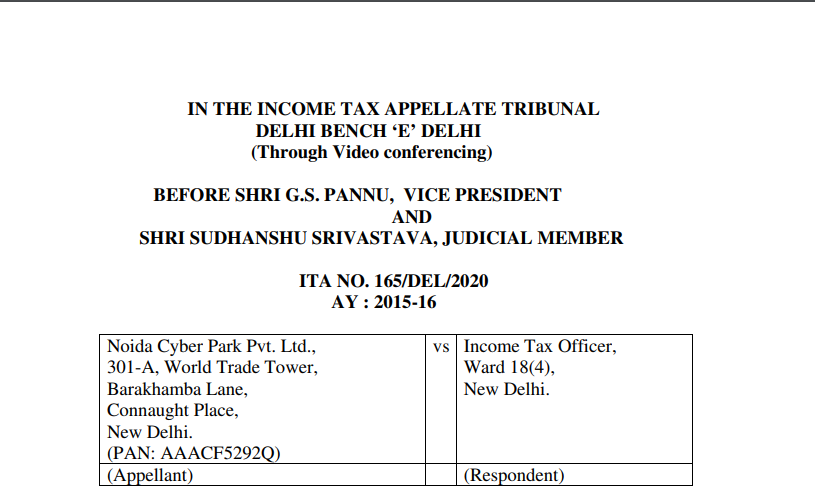

ITAT Order in the case of Noida Cyber Park Pvt. Ltd

Case Covered:

Noida Cyber Park Pvt. Ltd

Versus

Income Tax Officer

Facts of the Case:

This appeal has been preferred by the assessee against the order of the learned Commissioner of Income Tax(A) dated 14.11.2019, which in turn, has arisen from an order passed by the Assessing Officer under Section 143(3) of the Income Tax Act, 1961 (in short ‘the Act’) dated 29.12.2017 pertaining to the assessment year 2015-16.

2. The following Grounds have been raised by the assessee in the appeal:-

“1. Under the facts and circumstances of the case learned Commissioner of Income Tax has grossly erred on facts as well as in law in confirming the assessment order which is ex-facie arbitrary, illegal and without jurisdiction being against the provisions of Income Tax Act 1961 and principles of natural justice.

2. The Ld. CIT(A) has grossly erred on facts as well as in law in confirming the addition made by the learned assessing officer under section 50C in spite of the fact that the impugned properties are leasehold properties.

3. The Ld.CIT(A) has grossly erred on facts as well as in law in confirming the addition of Rs. 240,77,29,683/- under section 50C in spite of the fact that the learned AO himself has already completed the assessment at the returned income in the first part of the assessment order on page 2 thereof.

4. The Ld.CIT(A) has grossly erred on facts as well as in law in confirming the assessment order which is passed without waiting for the report from the DVO on the reference made under section 50C(2) in complete violation of the provisions of Income Tax Act 1961, hence leading to the assessment order being ex-facie illegal, arbitrary and without jurisdiction.

5. The learned CIT(A) has grossly erred on facts as well as in law in confirming the addition of Rs. 240,77,29,683/- under section 50C of the Income Tax Act 1961.

6. The learned CIT(A) has grossly erred on facts as well as in law in considering valuation at Rs. 399,97,79,799/- under section 50C in spite of the fact that DVO has determined the valuation under section 50C at Rs. 193,56,67,000/-.

7. The Learned CIT(A) has grossly erred on facts as well as in law in rejecting the DVO report on the basis of recommendations of the learned assessing officer.

8. The learned CIT(A) has grossly erred on facts as well as in law in rejecting the valuation of approved valuer without assigning any reason.

9. The Ld. CIT(A) has grossly erred on facts as well as in law in confirming the addition without considering the submissions made by the assessee.

10. The Ld.CIT(A) has grossly erred on facts as well as in law in holding that objections are similar to those raised before they learned assessing officer.

11. The Ld. CIT(A) has grossly erred on facts as well as in law in holding that procedure laid down under section 142 A is not applicable to section 50.”

Observations:

We have carefully considered the rival submissions. As our discussion in the earlier paragraphs show, the sum and substance of the preliminary controversy revolve around the applicability or otherwise of section 50C of the Act to the facts and circumstances of the instant case. Shorn of other details, Section 50C(1) of the Act, in so far as it is relevant for our purpose, prescribes that where the sale consideration received or accruing as a result of the transfer by an assessee of a capital asset, being “land or building or both”, is less than the value adopted by the Stamp Valuation Authority for the purposes of payment of stamp duty, then the value so adopted by the Stamp Valuation Authority be deemed to be the full value of the consideration received or accruing as a result of the transfer for the purposes of computing Capital Gains in the hands of the seller u/s 48 of the Act. Before us, the case sought to be made out by the assessee is that Section 50C, being a deeming provision, has to be strictly interpreted, a proposition which is quite acceptable; and, according to the assessee, Section 50C(1) covers a capital asset being “land or building or both” whereas in the instant case, what is transacted is merely leasehold rights in land and building, which is a distinct ‘Capital Asset’. The distinction sought to be made by the assessee is well-founded, and such distinction can be gauged from the Act itself. In this context, we may refer to section 54D(1) of the Act, whose relevant portion reads as under:-

“Subject to the provisions of sub-section (2), where the capital gain arises from the transfer by way of compulsory acquisition under any law of a capital asset, being land or building or any right in land or building, forming part of an industrial undertaking….”

Decision:

In view of the aforesaid factual position and in law, we find that the present transaction of six properties in question does not warrant invoking of section 50C(1) of the Act as the property in question is not of the nature covered by section 50C(1) of the Act. Therefore, on this point itself, we set aside the order of the ld. Commissioner of Income Tax(A) and direct the Assessing Officer to delete the addition.

Since the assessee has succeeded on the above preliminary plea, all other aspects of the dispute manifested in the Grounds of Appeal are rendered academic, and are not being adjudicated for the present.

As the result, the appeal of the assessee is allowed as above.

Order pronounced on 12th October 2020.

Read & Download the full Decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.