GST refund can be filed even after cancellation of registration(Pdf Attach)

Cases Covered:

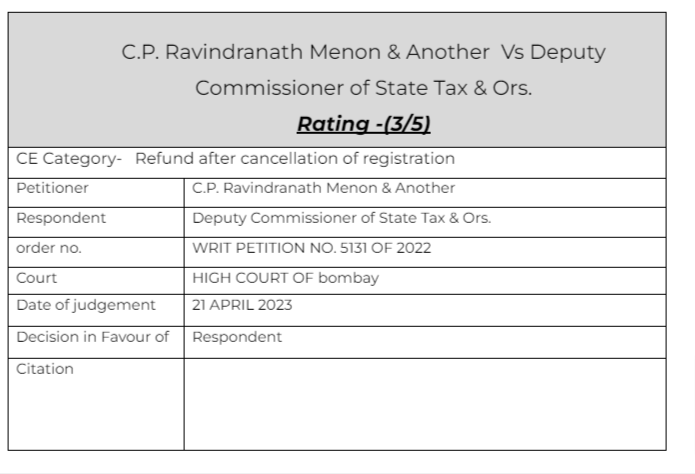

C.P. Ravindranath Menon & Another Vs Deputy Commissioner of State Tax & Ors.

Facts of the Cases:

The brief facts of the case are that the Petitioners had entered into an agreement for sale of a residential flat with Respondent No. 6. According to the Petitioners, pursuant to further proceedings that took place under the said agreement, the Petitioners became entitled to claim refund of the Goods and Services Tax (GST). Accordingly, the Petitioners applied for refund to Respondent No.1 under the provisions of section 54 of the Goods and Services Tax (GST) Act, 2017. By the impugned order, Respondent No.1 rejected the prayer of the Petitioners stating that persons such as the Petitioners are not entitled for refund of the GST in respect of such transactions

Observations & Judgement of the supreme court:

The respondents said-

Considering the fact that the Petitioners are flat purchasers and unregistered persons and that the policy now has been evolved governing the application for refund by unregistered person subsequent to passing of the impugned order rejecting the refund, we are of the opinion that an opportunity needs to be given to the Petitioners for reconsideration of their claim for refund.

Accordingly, the impugned order dated 8 September 2022 is quashed and set aside. The application of the Petitioners dated 4 September 2020 is restored to the file of Respondent No.1- Deputy Commissioner of State Tax. Subject to earlier time bound commitment, the application be decided within twelve weeks from the date order is uploaded.

Comment:

The appellant was an unregistered person. He applied for a refund which was rejected. But later on, the policies changed and the government allowed refunds to unregistered people also. Thus the respondents themselves accepted the fact and thus the petition was allowed by the honorable court.

Read & Download the Full C.P. Ravindranath Menon & Another Vs Deputy Commissioner of State Tax & Ors.

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.