Intention to evade tax is mandatory for penalty u/s 129 (Pdf Attach)

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

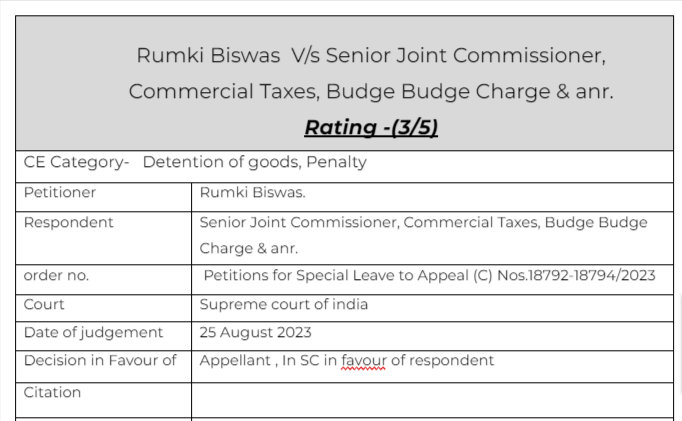

Rumki Biswas V/s Senior Joint Commissioner, Commercial Taxes, Budge Budge Charge & anr.

Facts of the cases:

The case of the appellant is that they had generated part A of the e-way bill on 22nd March, 2022 and part – B was generated on 24th March, 2022. However, since the goods could not be loaded into the vehicle, the appellant appears to have cancelled part A e-way bill dated 22nd March, 2022 and generated new part A e-way bill on 24th March, 2022. When the vehicle was intercepted, the driver was carrying part B of e-way bill in respect of which part A has been cancelled.

The question would be whether this would tantamount to intention to evade payment of duty or with a view to clandestinely move certain goods. In our prima facie view, it does not appear so and could be considered to be a bona fide error.

Observation & Judgement of the Court:

However, in our consider view, such cumbersome exercise need not have been done by the appellate authority as the short issue, which falls for consideration is whether there was any intention on the part of the appellant to evade payment of duty. If the appellant is able to give a satisfactory explanation that there was no intention to evade payment of duty, nothing more is required to be done and the proceedings could be dropped

Comment:

The respondent approached the SC in this case and the honorable SC also rejected the appeal and asked the deptt to remand back the case to appeal

Read & Download the Full Rumki Biswas V/s Senior Joint Commissioner, Commercial Taxes, Budge Budge Charge & anr.

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.