ITC shall not be rejected for cancellation of registration of supplier- HC

No ITC reversal-

In a recent judgment the court has observed that the ITC shouldn’t be denied merely on fact that the registration of supplier is cancelled.

The contentions of the petitioner were rejected entirely on the ground that the petitioner should have proved the existence of M/s.Shikhar Technologies. The petitioner purchased goods in 2017-2018 and, at the highest, the petitioner may be called upon to produce evidence of the existence of the supplier at the relevant point of time.

How to draft a reply in case of notice received for reversal of ITC?

The court said-

“The ITC claim shall not be rejected upon such reconsideration solely on the ground that the supplier’s GST registration was cancelled with retrospective effect and a fresh assessment order shall be issued upon reconsideration, after providing a reasonable opportunity to the petitioner”

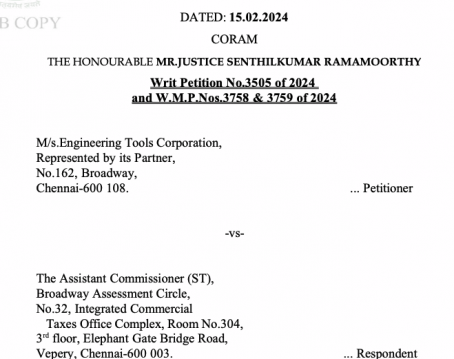

Read the judgment here-

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.