ITC cant be denied for a technical error in return (pdf Attach)

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

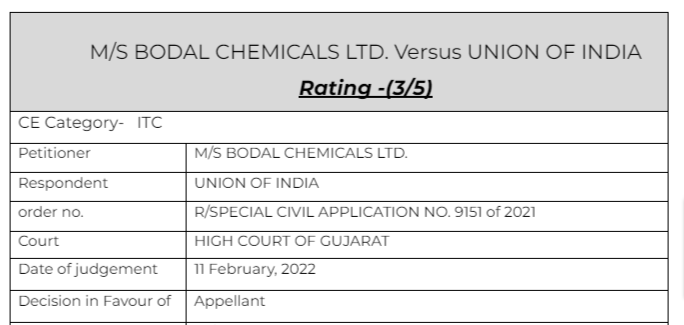

M/S BODAL CHEMICALS LTD. Versus UNION OF INDIA

Citation:

M/s. Vishnu Aroma Pouching Pvt. Ltd. Vs. The Union of India

Facts of the cases:

“(A) That Your Lordships may be pleased to issue a Writ of Mandamus or any other appropriate writ, direction or order, thereby directing the Respondents to allow the Petitioner to furnish, if necessary manually, GSTR-6 Return with details of ISD credit of Rs.20,52,989/-;

(B) That Your Lordships may be pleased to issue a Writ of Mandamus or any other appropriate writ, direction or order, thereby directing the Respondents herein, to allow the Petitioner to take ISD credit of Rs.20,52,989/- in the ISD Register and to distribute such credit of Rs.20,52,989/- to the Petitioner’s Constituents;

(C) Pending hearing and final disposal of the present petition, Your Lordships may be pleased to direct the Respondents to allow the Petitioner to distribute ISD credit of Rs.20,52,989/- for being utilized in respect of payment of GST liability of the Petitioner;

(D) Pending hearing and final disposal of the present petition,Your Lordships may be pleased to direct the Respondents to permit the Petitioner to file all the GSTR – 6 Returns for the previous period without charging and recovering any penalty or late fee;

(E) An ex-parte ad-interim relief in terms of para 17(C) above may kindly be granted;

(F) Any other further relief that may be deemed fit in the facts and circumstances of the case may also please be granted.”

Observation & Judgement of the Court:

Mr. Tripathi is right in his submission that the credit is a tax paid by the registered person on input transactions and therefore, the credit of such tax already paid to the credit of the Central Government is a vested right of the person. Such vested right cannot be defeated on account of any irregularity in the system evolved by the Government.

For all the aforegoing reasons, this petition succeeds and is hereby allowed. The respondents are directed to allow the writ applicant to furnish manually the GSTR – 6 return with details of the ISD credit of Rs.20,52,989/- and also permit distribution of such credit to the constituents of the writ applicant. Let this entire exercise be undertaken within a period of six weeks from the date of the receipt of writ of this order

Comment:

ITC is a tax paid by the taxpayer and it i the vested right of the assessee.

Read & Download the Full M/S BODAL CHEMICALS LTD. Versus UNION OF INDIA

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.