[Breaking] SC issued notice in SLP filed against judgment upheld section16(4)

Section 16(4) is pain for all taxpayers since the GST was introduced. A long litigation is in place. But there is a good news.

The provision putting a time limit on taking credit after the November of the year end. Its validity was in challenge. In a recent judgement by Patna high court the validity of this provision was upheld.

Author can be reached at shaifaly.ca@gmail.com

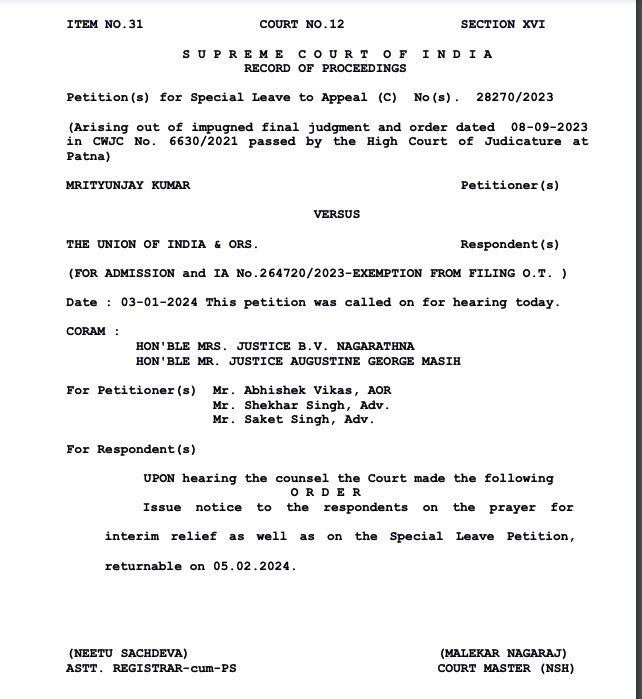

But the Supreme court has issued a notice against that order in an SLP filed in case of Mritunjay kumar Vs Union of India.

Read (download) judgement

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.