6 important questions about section 16(4) answered by the Court in case of Gobinda Construction

Case Covered:

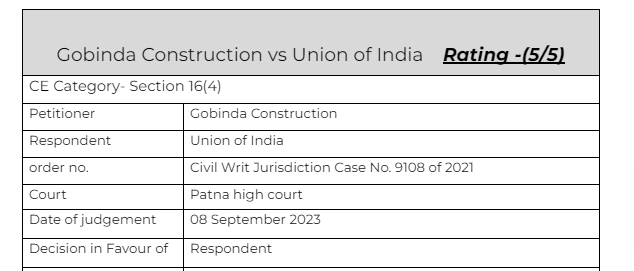

Gobinda Construction vs Union of India

Citation:

1. Vinoy Viswam vs. Union of India & Ors

2. Modern Dental College and Research Centre & Ors. vs. State of Madhya Pradesh & Ors

3. K.T. Moopil Nair vs. State of Kerala

4. Adfert Technologies Pvt. Ltd. vs. Union of India and others

5. ALD Automotive Private Limited vs. Commercial Tax Officer & Ors.

6. ilubhai Nanbhai Khachar & Ors. vs. State of Gujarat & Anr

7. Vemareddy Kumaraswamy Reddi vs. State of A.P

8. BTC vs. Mazdoor Congress reported in 1991

9. Godrej & Boyce Mfg. Co. Pvt. Ltd. & Ors. vs. Commissioner of Sales Tax & Ors

10. Jayam and Company vs. Assistant Commissioner & Anr

Facts of the case

A batch of writ petitions for the constitutional validity of section 16(4) and other related issues was taken up by the Patna High court. Some important questions answered in the judgment are-

Whether section 16(2) overrides section 16(4)?

Whether we need to read down section 16(4)?

The ITC is a vested right?

Section 16(4) is violative of Article 300-A of constitution of India

Section 16 is violative of article 19(1)(g) of Constitution of India

Condition of section 16(4) is directory and not Mandatory.

Observations & Judgement of the court

All these questions are answered as follows by the honorable court.

Whether section 16(2) overrides section 16(4)?

The conditions of section 16(4) are not contradictory to section 16(2) but complimentary.

Whether we need to read down section 16(4)?

one of the elementary principles of interpreting or construing a statute to gather the intention of the Legislature. The purpose of statutory interpretation is to ascertain the intention of the Legislature enacting it. Further, the legislative intent is to be gathered from the language used in the enactment. It is also a fundamental rule of statutory interpretation that where the words are clear, there is no obscurity, there is no ambiguity and the intention of the Legislature is clearly conveyed, there is no scope for the Court to innovate or take upon itself the task of amending or altering the statutory provisions. The case of Vemareddy Kumaraswamy Reddi vs. State of A.P. reported in (2006) 2 SCC 670 was referred.

“We need also to remind ourselves that doctrine of reading down applies only when general words used in a statute or regulation should be construed in a particular manner so as to save its constitutionality”

Another case BTC vs. Mazdoor Congress reported in 1991 Supp (1) SCC 600, was referred by the honorable court.

The language of Section 16 of the CGST/BGST Act suffers from no ambiguity and clearly stipulates grant of ITC subject to the conditions and restrictions put thereunder.

The ITC is a vested right?

As already made clear by the honorable supreme court in case of ALD automotives, The ITC is not a vested right but a mere benefit by the government.

All these questions are answered as follows by the honorable court.

- Whether section 16(2) overrides section 16(4)?

The conditions of section 16(4) are not contradictory to section 16(2) but complimentary.

- Whether we need to read down section 16(4)?

one of the elementary principles of interpreting or construing a statute to gather the intention of the Legislature. The purpose of statutory interpretation is to ascertain the intention of the Legislature enacting it. Further, the legislative intent is to be gathered from the language used in the enactment. It is also a fundamental rule of statutory interpretation that where the words are clear, there is no obscurity, there is no ambiguity and the intention of the Legislature is clearly conveyed, there is no scope for the Court to innovate or take upon itself the task of amending or altering the statutory provisions. The case of Vemareddy Kumaraswamy Reddi vs. State of A.P. reported in (2006) 2 SCC 670 was referred.

“We need also to remind ourselves that doctrine of reading down applies only when general words used in a statute or regulation should be construed in a particular manner so as to save its constitutionality”

Another case BTC vs. Mazdoor Congress reported in 1991 Supp (1) SCC 600, was referred by the honorable court.

The language of Section 16 of the CGST/BGST Act suffers from no ambiguity and clearly stipulates grant of ITC subject to the conditions and restrictions put thereunder.

- The ITC is a vested right?

As already made clear by the honorable supreme court in case of ALD automotive, The ITC is not a vested right but a mere benefit by the government.

- Section 16(4) is violative of Article 300-A of constitution of India

In order to invoke Article 300-A of the Constitution by a person, two circumstances must jointly exist :- (i) Deprivation of property of a person

(ii) Without sanction of law

Case of Jilubhai Nanbhai Khachar was referred

“28. Upon close reading of sub-section (1) of Section 16 of the CGST/ BGST Act, we are of the view that the provision under sub-section (4) of Section 16 is one of the conditions which makes a registered person entitled to take ITC and by no means sub-section (4) can be said to be violative of Article 300-A of the Constitution of India”

- Section 16 is violative of article 19(1)(g) of Constitution of India

Submissions have been advanced on behalf of the petitioners that sub-section (4) of Section 16 imposes unreasonable and disproportionate restriction on the right to freedom of trade and profession guaranteed under Article 19(1)(g) of the Constitution and is, therefore, violative of Article 302 of the Constitution and is in teeth of Article 13 of the Constitution. This argument is founded on the ground of absence of any rationale behind fixation of a cut-off-date for filing of return. We do not find any merit in the submissions so advanced, which deserves to be outrightly rejected.

- Condition of section 16(4) is directory and not Mandatory.

Submission has been made, though feebly, on behalf of the petitioners that this Court may declare the requirement of sub-section (4) of Section 16 as directory and not mandatory. The said submission is not at all tenable in view of the clear language used in Section 16 of the Act. The concession of ITC under sub-section (1) of Section 16 of the CGST/ BGST Act is dependent upon the fulfillment of requisite conditions laid down under various provisions including sub-section (4) thereof.

Read & Download the Full Gobinda Construction vs Union of India

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.