Department cant reject the transaction value if can’t prove that invoice value is incorrect

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

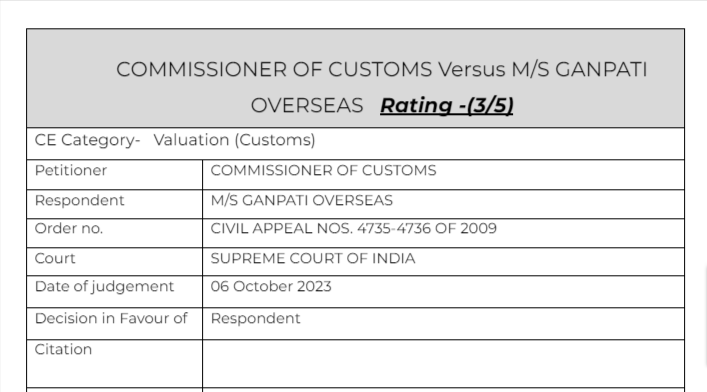

COMMISSIONER OF CUSTOMS Versus M/S GANPATI OVERSEAS

Facts of the cases:

The appeals have been filed by the Commissioner of Customs (Imports), Mumbai under Section 130-E of the Customs Act, 1962 against the common judgment and final order dated 27.06.2008 passed by the Customs, Excise and Service Tax Appellate Tribunal, West Zonal Bench at Mumbai (briefly the ‘CESTAT’ or ‘the Tribunal’ hereinafter) in Appeal Nos. C/1347 and 1374 of 2002. The issue that arises in the two appeals is whether the CESTAT was justified in holding that enhancement of the value of the imported goods and the penalties imposed by the Commissioner of Customs (Adjudication-1), Mumbai on the respondents could not be sustained and consequently in setting aside the same?

Observation & Judgement of the Court:

After adverting to the procedural aspects provided in the Customs Valuation Rules, more particularly in Rules 3 and 4 thereof, this court referred to its earlier decision in Eicher Tractors Limited (supra) and held that the price paid by the importer to the vendor in the ordinary course of commerce shall be deemed to be the value in the absence of any special circumstances indicated in Section 14(1) and particularised in Rule 4(2). However, when the transaction value under Rule 4 is rejected, the value shall be determined by proceeding sequentially through Rules 5 to 8 of the Customs Valuation Rules. This court held as follows:

“23. In Eicher Tractors this Court held that the value, according to Section 14, shall be deemed to be the price at which such or like goods are ordinarily sold or offered for sale, for delivery at the time and place of importation in the course of international trade. It was further held that by Rule 4(1), a mandate has been cast on the authorities to accept the price actually paid or payable for the goods in respect of the goods under assessment as the transaction value but this mandate is subject to certain exceptions specified in Rule 4(2). It was also held by this Court in Eicher Tractors [(2001) 1 SCC 315] that both Section 14(1) of the Act and Rule 4 provide that the price paid by the importer to the vendor in the ordinary course of commerce shall be deemed to be the value in the absence of any of the special circumstances indicated in Section 14(1) and particularised in Rule 4(2). However, when the transaction value under Rule 4 is rejected, the value shall be determined by proceeding sequentially through Rules 5 to 8 of the Rules.”

This court also referred to the decisions in Rabindra Chandra Paul (supra) and South India Television (P) Ltd. (supra) to reiterate the recognised legal position that transaction value can be rejected if the invoice price is not found to be correct but it is for the department to prove that the invoice price is incorrect.

Thus, on a cumulative analysis of the facts and the legal position as alluded to hereinabove, we have no hesitation in coming to the conclusion that both the department as well as the adjudicating authority were not justified in rejecting the import invoice price of the goods as not correct and enhancing the price by straightaway invoking Rule 8 of the Customs Valuation Rules when there was no evidence before them to do so. In these circumstances, CESTAT was justified in setting aside the order in original.

Read & Download the Full COMMISSIONER OF CUSTOMS Versus M/S GANPATI OVERSEAS

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.