Section 56 of CGST Act: interest on delayed refund (updated till on October 2023)

Section 56 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 56 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is depicted with a different color.

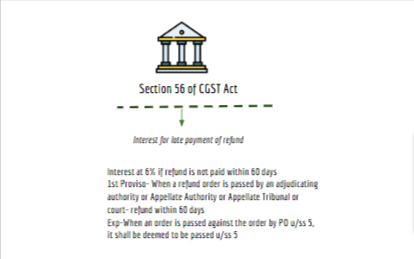

Section 56 of CGST Act provide for the refund on delayed payment of refund.

Text on the Section:

“If any tax ordered to be refunded under sub-section (5) of section 54 to any applicant is not refunded within sixty days from the date of receipt of application under subsection (1) of that section, interest at such rate not exceeding six per cent. as may be specified in the notification issued by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application under the said sub-section till the date of refund of such tax: [for the period of delay beyond sixty days from the date of receipt of such application

till the date of refund of such tax, to be computed in such manner and subject to such conditions

and restrictions as may be prescribed:]

Provided that where any claim of refund arises from an order passed by an adjudicating authority or Appellate Authority or Appellate Tribunal or court which has attained finality and the same is not refunded within sixty days from the date of receipt of application filed consequent to such order, interest at such rate not exceeding nine per cent. as may be notified by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application till the date of refund.

Explanation.––For the purposes of this section, where any order of refund is made by an Appellate Authority, Appellate Tribunal or any court against an order of the proper officer under sub-section (5) of section 54, the order passed by the Appellate Authority, Appellate Tribunal or by the court shall be deemed to be an order passed under the said sub-section (5).”

Related Topic:

Amount Paid During Investigation Whether Interest Payable On Refund

Chart of the section:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.