Extended meaning of governmental authority was adopted by the court

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

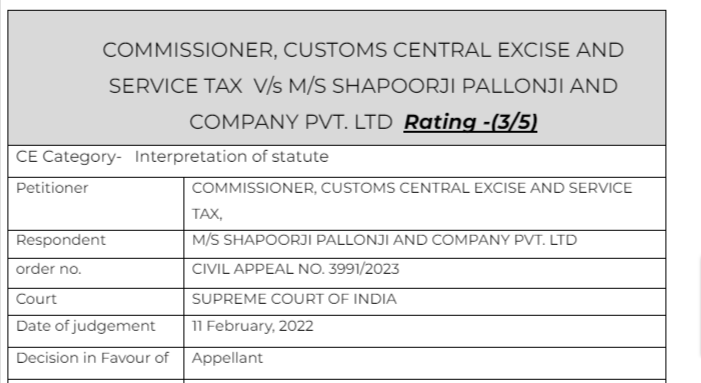

COMMISSIONER, CUSTOMS CENTRAL EXCISE AND SERVICE TAX V/s M/S SHAPOORJI PALLONJI AND COMPANY PVT. LTD

Citations:

Barun Kumar & Ors. vs. State of Jharkhand & Ors

Bihar State Electricity Board vs. Pulak Enterprises & Ors

ONGC Ltd vs. Afcons Gunanusa JV

Jindal Stainless Ltd. v. State of Haryana

Akshaibar Lal (Dr.) v. Vice-Chancellor, Banaras Hindu University

Commissioner of Customs (Import), Mumbai vs. Dilip Kumar and Company & Ors.

ITC Limited vs. Commissioner of Central Excise, Kolkata

Superintendent & Legal Remembrancer, State of West Bengal vs. Corporation of Calcutta

Union of India & Ors. vs. Ind-Swift Laboratories Ltd

Commissioner of Sales Tax, U.P. vs. Modi Sugar Mills Ltd

Utkal Contractors & Joinery (P) Ltd. vs State of Orissa

Green vs. Premier Glynrhonwy Slate Co.

Sri Jeyaram Educational Trust vs. A.G. Syed Mohideen

Kantaru Rajeevaru vs. Indian Young Lawyers Association & Ors

Girdhari Lal & Sons v. Balbir Nath Mathu

Facts of the cases:

We are tasked to decide two civil appeals that centre around a common question: whether the educational institutions in question, viz. (i) the Indian Institute of Technology, Patna (“IIT Patna”, hereafter) and (ii) the National Institute of Technology, Rourkela (“NIT Rourkela”, hereafter), are covered 2 by the definition of “governmental authority” in Mega Service Tax Exemption Notification1 (“Exemption Notification”, hereafter) inter alia exempting various services from the tax network rendered to government, governmental, or local authorities. If “governmental authority” as defined in the Exemption Notification takes within its embrace IIT Patna and NIT Rourkela, they would be eligible for an exemption from the service tax that otherwise applies to construction services provided by service providers or subcontractors within their premises.

The main question was for the meaning of governmental authority.

Observation & Judgement of the Court:

Ms. Bagchi had submitted that the impugned judgment broadens the scope of the exemption to include vast number of statutory bodies; therefore, unfairly burdening the exchequer. We observe that the authority having the competence to issue a notification completed its job by re-defining “governmental authority” and now it is a task entrusted to the courts to interpret the law. It is, at this juncture, important to notice the law laid down by this Court, speaking through Hon’ble O. Chinnappa Reddy, J. in Girdhari Lal & Sons v. Balbir Nath Mathur . The position of law was affirmed in the following terms:

“6. Where different interpretations are likely to be put on words and a question arises what an individual meant when he used certain words, he may be asked to explain himself and he may do so and say that he meant one thing and not the other. But if it is the legislature that has expressed itself by making the laws and difficulties arise in interpreting what the legislature has said, a legislature cannot be asked to sit to resolve those difficulties. The legislatures, unlike individuals, cannot come forward to explain themselves as often as difficulties of interpretation arise. So the task of interpreting the laws by finding out what the legislature meant is allotted to the courts. Of course, where words are clear and unambiguous no question of construction may arise. Such words ordinarily speak for themselves. Since the words must have spoken as clearly to legislators as to judges, it may be safely presumed that the legislature intended what the words plainly say. This is the real basis of the so-called golden rule of construction that where the words of statutes are plain and unambiguous effect must be given to them. A court should give effect to plain words, not because there is any charm or magic in the plainness of such words but because plain words may be expected to convey plainly the intention of the legislature to others as well as judges.”

32. Keeping the above-said ratio in mind, an interpretation of the relevant provision resulting in the expanded scope of its operation cannot in itself be sufficient to attribute ambiguity to the provision.

33. To make a statute workable by employing interpretative tools and to venture into a kind of judicial legislation are two different things. Merely because the statute does not yield intended or desired results, that cannot be reason for us to overstep and cross the Lakshman Rekha by employing tools of interpretation to interpret a provision keeping in mind its outcome. Interpretative tools should be employed to make a statute workable and not to reach to a particular outcome.

comment:

Just because an interpretation has widened the scope of a provision, its interpretation can’t be changed because its not giving the meaning desired by the department. Keeping the above-said ratio in mind, an interpretation of the relevant provision resulting in the expanded scope of its operation cannot in itself be sufficient to attribute ambiguity to the provision

Read & Download the Full COMMISSIONER, CUSTOMS CENTRAL EXCISE AND SERVICE TAX V/s M/S SHAPOORJI PALLONJI AND COMPANY PVT. LTD

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.