Authorization for search will be general and not the every item

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

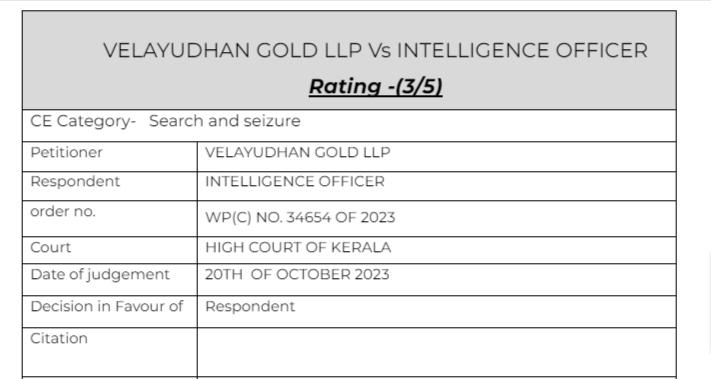

VELAYUDHAN GOLD LLP Vs INTELLIGENCE OFFICER

Facts of the cases:

Intelligence Officer, Intelligence Unit of the State Goods and Services Tax Department Kerala, Kottarakkara, conducted a search at the business premises of M/s Sobhana Jewellery, Main Road Ottappalam, Palakkad. The search took place on 26.05.2023 at 3.00 p.m. after the authorisation was given by the Joint Commissioner under Section 67(2) of the Kerala State Goods and Services Tax Act/Central Goods and Services Tax Act 2017 (for short, ‘SGST/CGST Act 2017’). After conducting the search operation, a Mahazar was prepared

Observation & Judgement of the Court:

There cannot be authorisation in respect of each and every person and each and every article, goods, books, and documents which may be discovered during the search operation. The authorisation has to be done in respect of the business premises of an assessee, and if things, items, books or documents are found that the authorised officer has reasons to believe that they would be relevant for the purpose of proceeding under the SGST/CGST Act 2017, they are liable to be seized. Therefore, I do not find any substance in the submission of the learned Counsel for the petitioner that there was no authorisation under Section 67(2) of the SGST/CGST Act 2017 for the seizure of the gold ornaments weighing 1647.970 grams.

In view thereof, I find no substance in this writ petition. However, if the petitioner is aggrieved by the impugned order, he may take recourse to the remedy as may be available to him under the provisions of the SGST/CGST Act and Rules 2017.

Comment:

The authorization was given by the commissioner. But the contention of the appellant was that authorization was not given. But the court said that the authorization cant be in respect of every item, it will be general only. Thus the case was disposed off in the favour of department.

Read & Download the Full VELAYUDHAN GOLD LLP Vs INTELLIGENCE OFFICER

optional file name

optional file name

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.