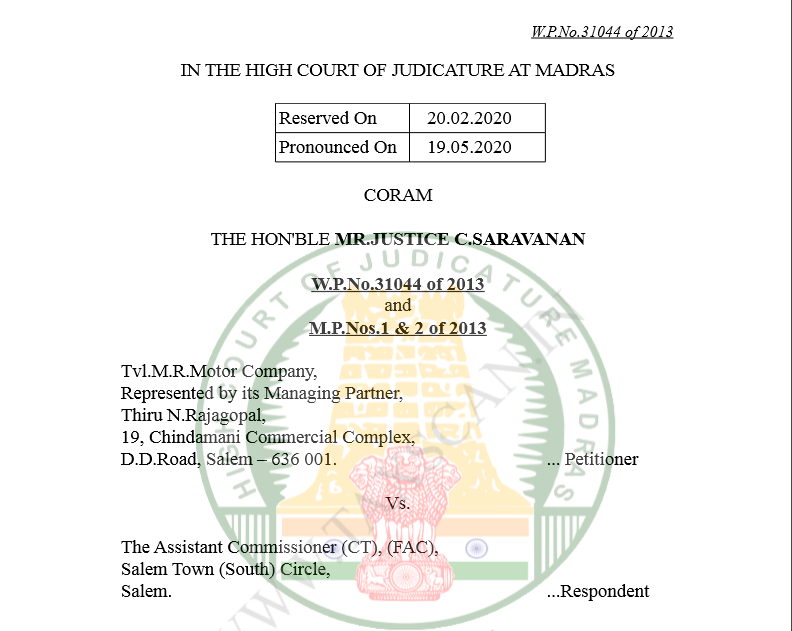

Madras HC in the case of Tvl.M.R.Motor Company Versus The Assistant Commissioner (CT)

Case Covered:

Tvl.M.R.Motor Company

Versus

The Assistant Commissioner (CT)

Facts of the case:

Writ Petition filed under Article 226 of the Constitution of India praying to issue a Writ of Certiorari, to call for the records on the files of the respondent in Rc.No.366/2013/A1 dated 12.09.2013 and quash the same as being without jurisdiction and authority of law and contrary to the principle of natural justice.

The question that arises for consideration is whether the petitioner was entitled to refund of Input Tax Credit in terms of Section 19(17) and 19(18) of the TNVAT Act, 2006 and whether the Department was justified in disallowing the refund of claim on the ground that the petitioner was still in business and was adjusting the amount regularly.

The second issue that arises for consideration is whether in the light of changed scenario after the implementation of the TNGST Act, 2017, the petitioner is entitled to refund.

Observations of the court:

I have considered the arguments advanced by the learned counsel for the petitioner and learned Government Advocate appearing for the respondent. The provisions relating to adjustment and refund of Input Tax Credit is specified in Sections 19(17) and 19(18) of the TNVAT Act, 2006.

As per the Sub-Clause (17) to Section 19, if the Input Tax Credit determined by the Assessing Authority for a year exceeds the tax liability for that year, the excess may be adjusted against any outstanding tax due from the dealer.

As per Sub-Clause (18) to Section 19, the excess Input Tax Credit, if any, after adjustment under Sub-Section (17), shall be carried forward to the next year or refunded, in the manner as may be prescribed.

Therefore, merely because the petitioner was a going concern by itself did not mean that the petitioner was not entitled to such a refund of the excess of Input Tax Credit which the petitioner accumulated over a period of time.

Judgement of the court:

Therefore, I am of the view that the impugned order passed by the respondent cannot be sustained and the same is liable to be quashed with consequential direction to refund the amount lying unutilized after adjustment at the beginning of each financial year.

This Writ Petition is allowed with the above observations. No cost. Consequently, connected Miscellaneous Petitions are closed.

Read & Download the full decision in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.