Purchases were made in November 2018 (GST registration was active), however, GST registration of the supplier was canceled retrospectively from October 2018!

Buyer must verify registration and supporting […]

Budget 2021 – GST Things You Must Know!

Section 7. Scope of supply (To be amended w.e.f. 1.07.2017)

For the purposes of this Act, the expression “supply” includes —

Direct Tax Vivad Se Vishwas Scheme! Policy and Challenges!

1. Direct Tax Vivad Se Vishwas Scheme (VSV)

1.1 Whether VSV is notified?

The Vivad Se Vishwas Bill, 2020 (now VSV Act) has been passed by the Lok Sabha […]

GST on Real Estate Sector Deserves immediate attention

1.1 Why RE sector deserves immediate attention?

RE sector and the Indian economy

• The real-estate sector is 2nd highest employment generator in India a […]

Synergies between GST and Income Tax

Constitution of India

Article 265 – Taxes not to be imposed save by authority of law

246. Subject-matter of laws made by Parliament and by the Legislatures of States

• S […]

GST – Key Changes Analysis

Amendment in Section 31 [Tax invoice]

Services – the Time limit to issue an invoice

CGST Act

• Sec. 31 (2) – A registered person supplying taxable services shall, before or after the […]

Pritam Mahure

@pritam-mahure

Not recently activePritam Mahure

OOPS!

No Packages Added by Pritam Mahure. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewPritam Mahure wrote a new post, HIGH COURT ON ITC – GARGO TRADERS 5 THINGS YOU MUST KNOW 10 months, 2 weeks ago

Purchases were made in November 2018 (GST registration was active), however, GST registration of the supplier was canceled retrospectively from October 2018!

Buyer must verify registration and supporting […]

Pritam Mahure wrote a new post, 43rd GST Council Meeting Things You Must Know! 2 years, 11 months ago

Overview

No. of GSTC Meetings

18 Meetings→ Pre–GST(Before 01.07.17)

8 Meetings→ 2018–2019

3 Meetings → 2020–2021

2017–2018→ 8 Meetings

2019–2020→ 5 Meetings

Reducing Frequency?

40th […]

Pritam Mahure wrote a new post, Budget 2021 – GST Things You Must Know! 3 years, 2 months ago

Budget 2021 – GST Things You Must Know!

Section 7. Scope of supply (To be amended w.e.f. 1.07.2017)

For the purposes of this Act, the expression “supply” includes —

(a) all forms of supply of goods or service […]

Pritam Mahure wrote a new post, Major Changes in GST Rules! 3 years, 4 months ago

Major Changes in GST Rules!

How many times the Rules amended?

2017 → 14 times

2018 → 14 times

2019 → 9 times

2020 → 14 times

Total → 51 times!

What’s new – Changes made through Not. No. 94/2020-CT! […]

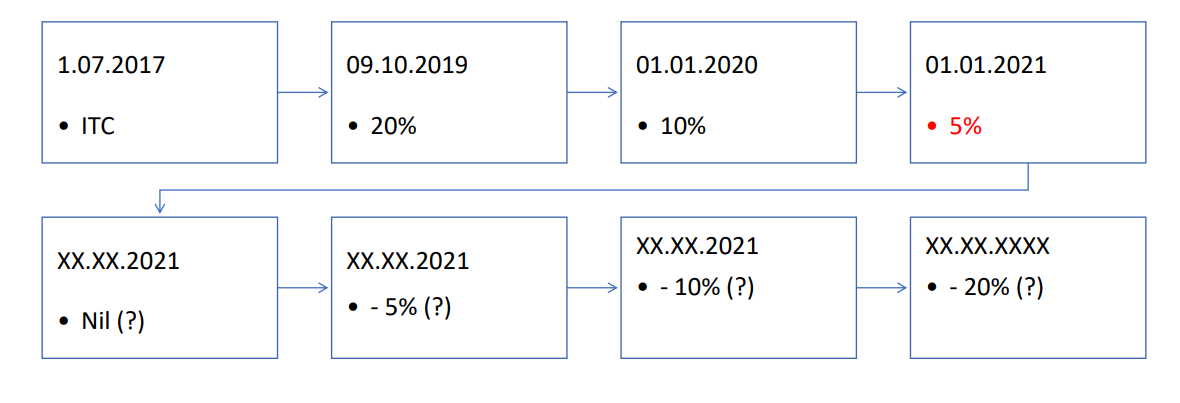

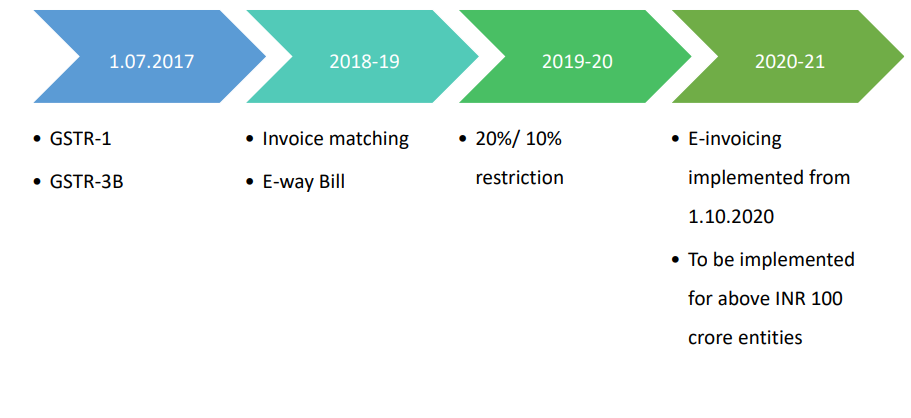

Pritam Mahure wrote a new post, E-invoicing 3 years, 4 months ago

What is E-invoicing?

Electronic invoicing / e-invoicing is a form of electronic billing!

Why E-invoicing?

E-invoicing is increasingly mandated by Governments across the world, particularly due to GST/VAT […]

Pritam Mahure wrote a new post, E-invoicing in India! 3 years, 5 months ago

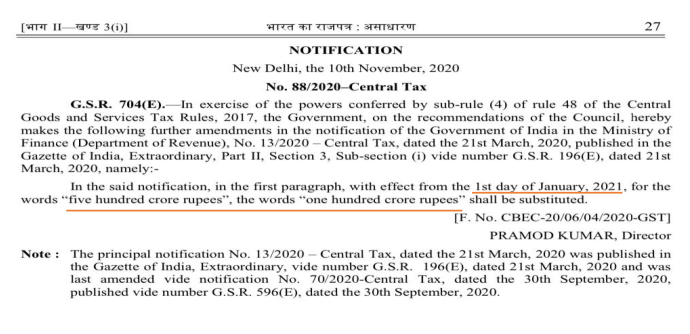

E-invoicing in India!

Concept and Challenges!

E-invoicing – Status update!

Already implemented – 1.10.2020 → • Aggregate turnover above INR 500 crore!

From – 1.01.2021 → • Aggregate turnover between INR 1 […]

Pritam Mahure wrote a new post, E-invoicing in India! Concept and Challenges! 3 years, 5 months ago

E-invoicing in India! Concept and Challenges!

E-invoicing – Status update!

Already implemented – 1.10.2020 → • Aggregate turnover above INR 500 crore!

Likely from – 1.01.2021 → • Aggregate turnover bet […]

Pritam Mahure wrote a new post, GST ‘Intermediary’ Services 3 years, 9 months ago

GST ‘Intermediary’ Services

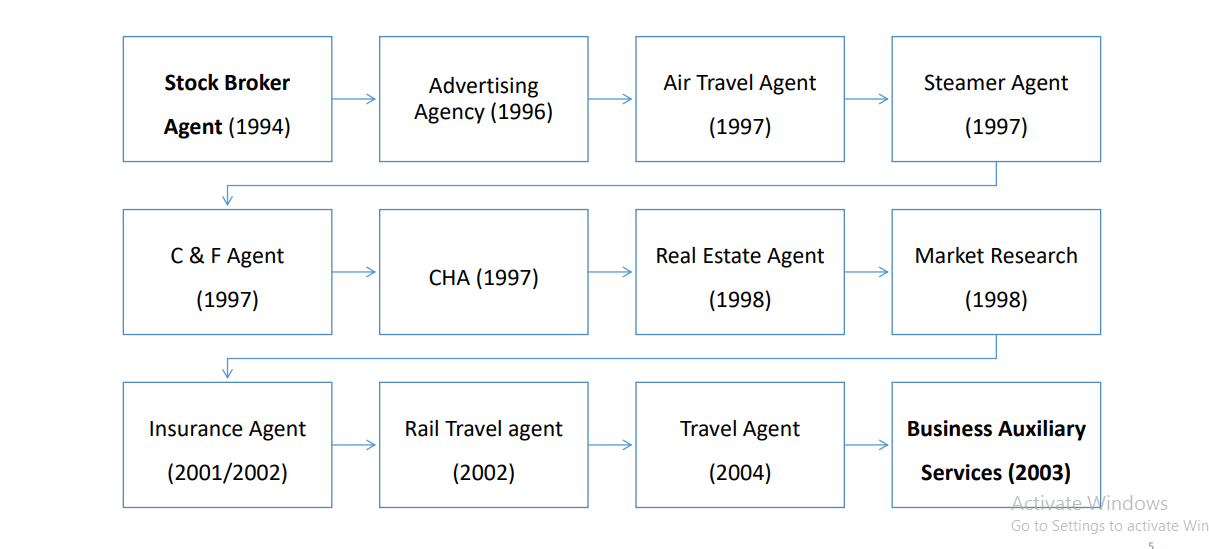

Agent – Positive List regime

Agent – Evolution!

“Commission Agent”

• Not. No. 13/2003 dated 20.06.2003 to exempt ‘Commission Agent’ services

• Explanation.- For the purposes […]

Pritam Mahure wrote a new post, Direct Tax Vivad Se Vishwas Scheme! Policy and Challenges! 3 years, 12 months ago

Direct Tax Vivad Se Vishwas Scheme! Policy and Challenges!

1. Direct Tax Vivad Se Vishwas Scheme (VSV)

1.1 Whether VSV is notified?

The Vivad Se Vishwas Bill, 2020 (now VSV Act) has been passed by the Lok Sabha […]

Pritam Mahure wrote a new post, GST Refunds Technical glitches need immediate attention 4 years ago

GST Refunds Technical glitches need immediate attention

1.1 Why GST refunds issues need attention?

Export sales are already heavily impacted and will continue to be impacted in coming months

Even receivable […]

Pritam Mahure wrote a new post, GST on Hospitals Immediate attention needed! 4 years ago

GST on Hospitals Immediate attention needed!

1. Why hospitals deserve immediate attention?

1.1 COVID-19 and Hospitals

The Entire world is engulfed by COVID-19 and hospitals are relentlessly fighting against […]

Pritam Mahure wrote a new post, GST on Real Estate Sector Deserves immediate attention 4 years ago

GST on Real Estate Sector Deserves immediate attention

1.1 Why RE sector deserves immediate attention?

RE sector and the Indian economy

• The real-estate sector is 2nd highest employment generator in India a […]

Pritam Mahure wrote a new post, Synergies between GST and Income Tax 4 years ago

Synergies between GST and Income Tax

Constitution of India

Article 265 – Taxes not to be imposed save by authority of law

246. Subject-matter of laws made by Parliament and by the Legislatures of States

• S […]

Pritam Mahure wrote a new post, GST – Key Burning Issues 4 years ago

GST – Key Burning Issues

Relief expected

Key GST issues needing attention!

Interest

• Notices already issued – Declare void-ab-initio

ITC

• Blocked by Rule 86A

• Nonpayment of GST by the supplier? […]

Pritam Mahure wrote a new post, Five Things Businesses Must Learn From Corona Scare! 4 years, 1 month ago

Five Things Businesses Must Learn From Corona Scare!

1. Be ever-ready for surprises!

1.1 Why to be ever-ready for surprises?

The world is well-connected than ever it was in the entire human history!

This […]

Pritam Mahure wrote a new post, GST and Corona Impact and Way forward 4 years, 1 month ago

GST and Corona Impact and Way forward

How Corona affected business?

1. Global slowdown

GST / VAT has a direct correlation to consumption trends

Global inward and outward travel, transport and trade is […]

Pritam Mahure wrote a new post, GST Supply, Levy and Advance RulingsGST – Budget 2020! 4 years, 2 months ago

GST – Key Changes Analysis

Amendment in Section 31 [Tax invoice]

Services – the Time limit to issue an invoice

CGST Act

• Sec. 31 (2) – A registered person supplying taxable services shall, before or after the […]

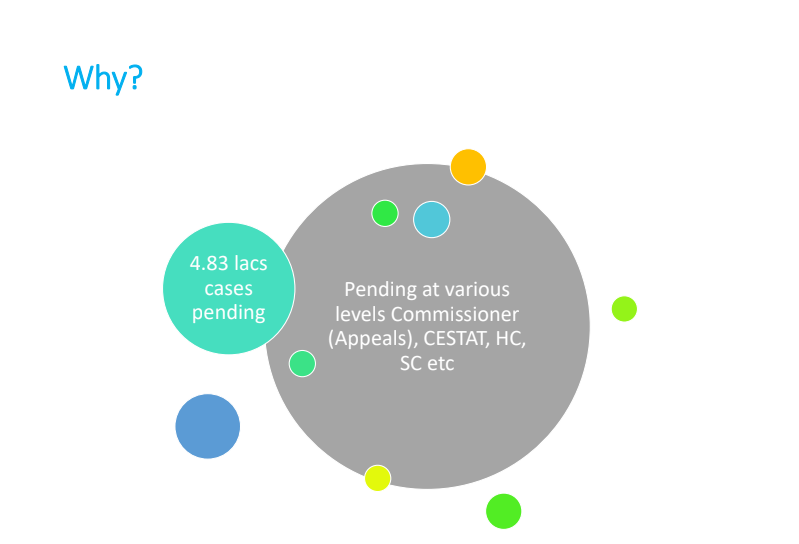

Pritam Mahure wrote a new post, Union Budget 2020 Vivad Se Vishwas Scheme (VVS) for Direct Taxes 4 years, 2 months ago

Union Budget 2020

Vivad Se Vishwas Scheme (VVS) for Direct Taxes

Features and Challenges!

VVS for Direct Tax!

Why introduced?

VVS

In the lines of Sabka Vishwas Scheme!

Vivad se Vishwas S […]

Pritam Mahure wrote a new post, CGST and IGST Act – Impact of Finance Bill, 2020! 4 years, 2 months ago

CGST and IGST Act – Impact of Finance Bill, 2020!

1. Act – Key Amendments

1.1. GST – Ten amendments you must know!

To iron out certain creases and amend provisions relating to fake/b […]

Pritam Mahure wrote a new post, Union Budget 2020 GST – Key Amendments You Must Know! 4 years, 2 months ago

GST – Background

GST – Key changes – An overview

GST – Key Changes

Analysis

Amendment in Section 16

[Eligibility and conditions for taking input tax credit]

The time limit for debit note rati […]