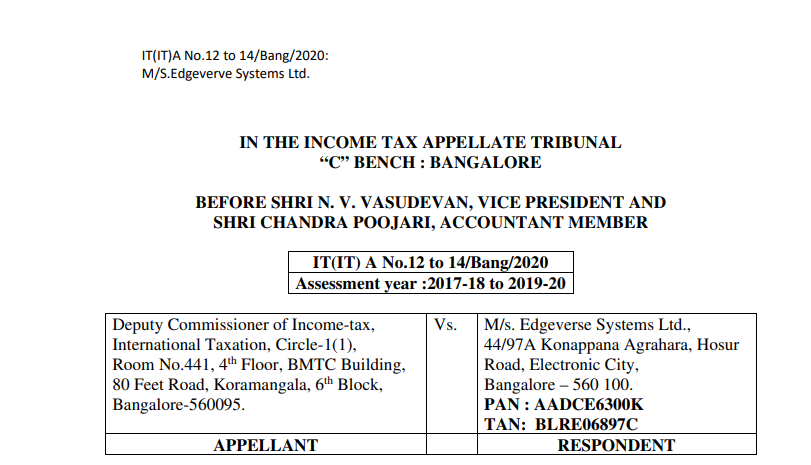

ITAT in the case of DCIT Versus M/s. Edgeverse Systems Ltd.

Case Covered:

Deputy Commissioner of Income-tax

Versus

M/s. Edgeverse Systems Ltd.

Facts of the Case:

The Assessee is a company and is engaged in the business of Products, Platforms, and services. During the previous year relevant to AY 2017-18 to 2019- 20, the Assessee made in all about 34 payments which are listed out in the impugned order of the CIT(A) to non-residents after grossing up the invoice amount and deducting tax at source thereon at the rates in force as per Sec.195 of the Income Tax Act, 1961 (Act). It was the plea of the Assessee that the payments made to non-resident were not chargeable to tax and therefore the Assessee was not under any obligation to deduct tax at source on the aforesaid payments. This plea was rejected by the revenue authorities in the application filed by the Assessee u/s.248 of the Act pleading that the Assessee was not under any obligation to deduct tax at source on the aforesaid payments made to non-residents. The Assessee also made a claim in the alternative and without prejudice to the main ground that the Assessee was not under any obligation to deduct tax at source on the aforesaid payments to non-residents, that the rate at which tax has to be deducted is not at a higher rate as prescribed by Sec.206AA of the Act but at the rate applicable as per the Treaty for Double Taxation Avoidance (DTAA) between India and the country of which the payees were tax residents. Section 206AA was introduced from FY 2010-11. Section 206AA requires every taxpayer who receives taxable income to furnish their PAN to the payer of such income. This applies to both the resident as well as non-resident recipients. The payments in case of residents would include salary, rent, professional receipts, contractual receipts, and so on. In the case of a non-resident, these would include all receipts that are taxable in India. A recipient of taxable income should furnish PAN to comply with the provisions of TDS under the Income Tax Act. Upon furnishing of the PAN, payments made to the recipient would be taxed at the rate of TDS specified under the various TDS provisions of the Income Tax Act. A recipient who does not furnish PAN would suffer TDS at the higher rates specified in Section 206AA. The recipient is also required to furnish his PAN to the payer and both of them are required to indicate the same in all correspondence, bills, vouchers, and other documents that are sent to each other. A recipient who fails to furnish PAN to the person making a payment would suffer TDS at the higher of the rates mentioned below:

- At the rate specified in the relevant provision of the Act;

- At the rate or rates in force, i.e., the rate prescribed in the Finance Act.;

- At the rate of 20%

Related Topic:

ITAT: Validity of a Notice issued to an amalgamating company which is no more existent.

Observations:

At the time of hearing it was not disputed that the issue raised by the revenue in its appeals are already decided by a Special Bench of ITAT, Hyderabad. The issue regarding the applicability of provisions of section 206AA of the Act, in cases of tax to be deducted at source, when the income is exigible to tax under DTAA and the payees are unable to provide valid Permanent Account Numbers, came up for consideration before the Special Bench, ITAT in the case of Nagarjuna Fertilizers & Chemicals Ltd. Vs. AC IT (2017) 78 taxmann.com 264 (Hyderabad-Tribunal) (SB). The question before the special bench was whether the provisions of section 206AA had an overriding effect for all other provisions of the Act, whether the assessee has to deduct tax at source at the rates prescribed in section 206AA in case the payees are unable to furnish their PANs, even in cases where tax liability arises out of the treaty. The DTAA provides for a rate of 10% whereas as per the provisions of Sec.206AA of the Act, the rate of tax deduction at source is 20%.

Decision:

The Special Bench held that DTAA overrides the Act, even if it is inconsistent with the Act. DTAAs are entered into between two nations in good faith and are supposed to be interpreted in good faith. Otherwise, it would amount to the breach of Article 253 of the constitution.

The Hon’ble Delhi High Court in the case of Danisco India Private Limited Vs. Union Of India & Ors. (Delhi High Court) in W.P.(C) 5908/2015 Judgement/Order dated 05/02/2018 held that where reciprocating states mutually agree upon acceptable principles for tax treatment, the provision in Section 206AA (as it existed) has to be read down to mean that where the deductee i.e the overseas resident business concern conducts its operation from a territory, whose Government has entered into a Double Taxation Avoidance Agreement with India, the rate of taxation would be as dictated by the provisions of the treaty.

In view of the aforesaid decisions on the issue, we are of the view that there is no merit in the appeals of the Revenue.

As the result, the appeals are dismissed.

Order pronounced in the open court on this 10th day of September 2020.

Read the Copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.