E-units out of the scope of GST: AAR

E-units out of the scope of GST: AAR

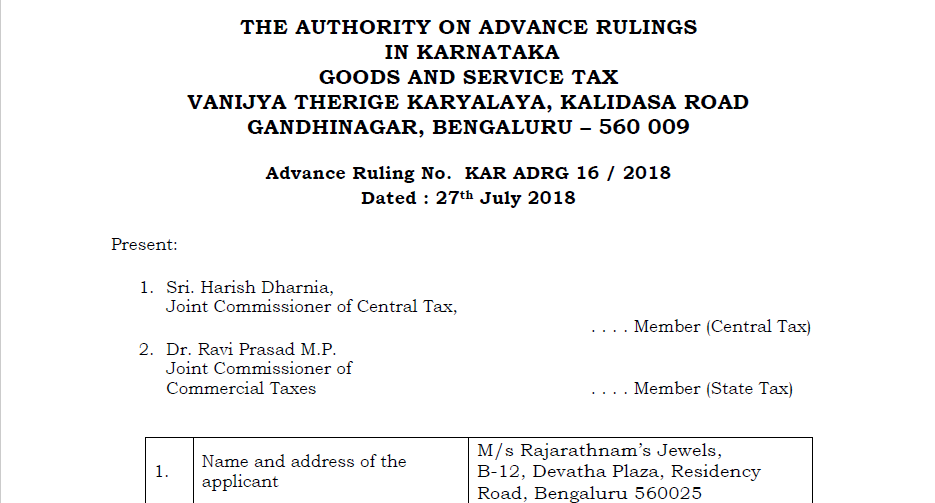

An advance ruling is given by the Authority of the Advance Ruling(AAR) of Karnataka. Regarding the transfer of E-units to the other party. This ruling was submitted by the M/s Rajarathnam‟s Jewels. The applicant will provide EVR to the other party and the other party can claim the Diamonds. There is no direct involvement of the diamonds. Following is the issue/question raised by the applicant and ruling given by the AAR:

Issue/Question Raised by the Applicant

- Whether mere deposit of diamond with safe vaults acknowledged by Electronic Vault Receipts (EVR) would be treated as the supply for the purpose of levy of GST?

- Whether conversion of EVR (representing receipt for diamonds deposited) into E-units (securities) would be treated as supply liable to GST?

- Whether E-units would be treated as securities and thereby transaction in E-units would remain out of the scope of the levy under GST?

- Whether the derivative contracts in E-unit and settlement thereof would be treated as the transaction in securities and thereby would remain out of the scope of the levy under GST?

- Whether conversion of E-units into diamonds would be treated as supply liable to GST?

Download the full explanation and reasoning provided by the both by clicking the below image:

Ruling

- The mere deposit of diamond with safe vaults acknowledged by Electronic Vault Receipts (EVR) does not constitute of supply of diamonds for the purpose of levy of GST.

- The conversion of Electronic Vault Receipts representing the diamonds held in the Vaults to E Units would constitute a supply of diamonds liable to tax under the Goods and Service Tax Act.

- The E Units are securities under the clause (101) of section 2 of the Central Goods and Services Tax Act and hence transactions in E Units would remain out of the scope of levy of tax under Goods and Services Tax Act.

- The derivative contracts in E Units and settlement thereof would be treated as transactions in securities in case it involves only E-Units without any involvement of physical diamonds and thereby would remain out of the scope of levy under GST.

- The conversion of E Units into diamonds would constitute a supply of diamonds liable to tax under the Goods and Services Tax Act.

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.