Postponement of Clause 30C and Clause 44

Postponement of Clause 30C and Clause 44 in Form 3CD(Tax Audit)

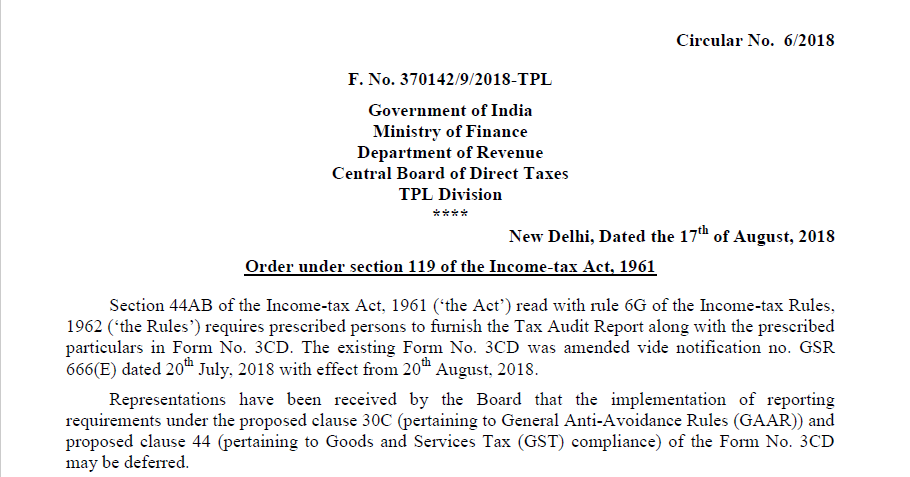

A circular was issued on the 17th of August 2018 regarding the postponement of the Clause 30C and Clause 44 in Form 3CD of Income Tax. Form 3CD is the form for the tax audit of the taxpayers. The Clause 30C and Clause 44 in Form 3CD were introduced by the Notification No. 33/2018 of the CBDT.

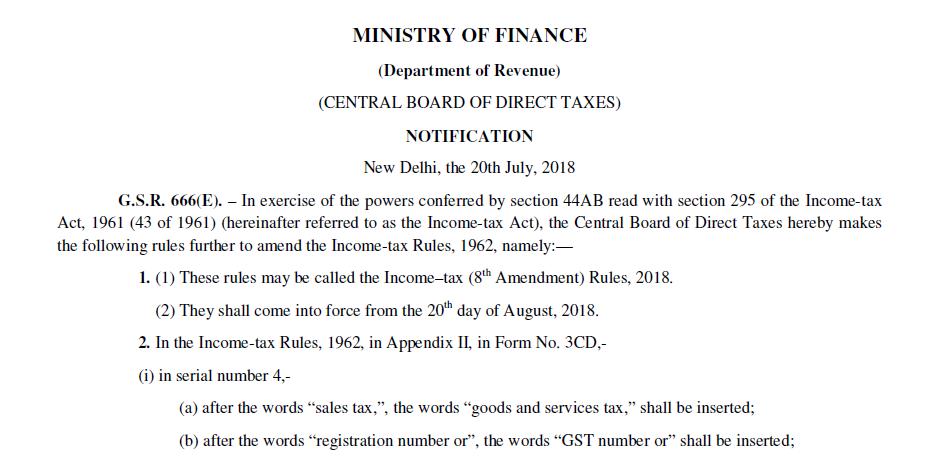

This notification has amended the income tax rules and introduced the Income Tax (Amendment) Rules, 2018. There are various changes but the Clause 30C and Clause 44 in Form 3CD is related to the information regarding the GST. When the sudden changes were applied in the middle of the Assessing Year(AY) and the filing time is too close. It will create the problems for the tax auditors and taxpayers various kind of troubles. So, the Institute of the Chartered Accountant of India(ICAI) Suggested that these change should be applicable from the next Financial year(2018-19).

CBDT also took a step to understand the problems faced by the Auditors and the taxpayers. CBDT Issued the Circular no.6/2018 regarding the postponement of Clause 30C and 44 in Form 3CD. But the rest of the amendments issued under the Notification No.33/2018 will be applicable. Only the Clause 30C and Clause 44 in Form 3CD will be postponed till 31st March 2019.

Download the Circular no. 6/2018 of Postponement of Clause 30C and Clause 44 in Form 3CD by clicking the below Image:

Download the Notification No. 33/2018 of Income Tax (Amendment) Rules, 2018 by clicking the below Image:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.