Services provided by the corporate office is supply

Services provided by the corporate office is supply: AAR

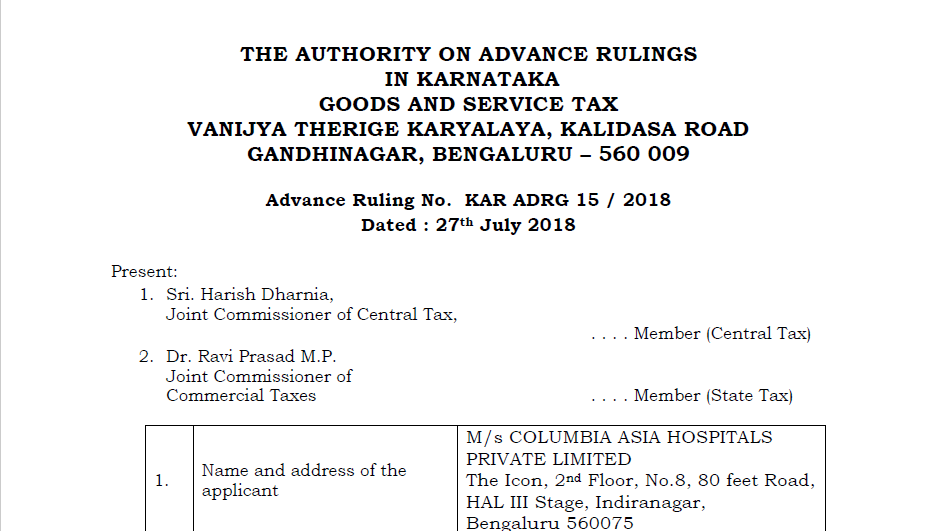

An advance ruling is given by the Authority of the Advance Ruling(AAR) o0f Karnataka. Regarding the services provided by the corporate office to the other branches which are the distinct person under GST Regime. The Services provided by the corporate office will be treated as supply. Even if provided to the other branches of the same entity. This ruling was submitted by the M/s COLUMBIA ASIA HOSPITALS PRIVATE LIMITED.

Issue/Question raised in Advance ruling

Whether the activities performed by the employees at the corporate office in the course of or in relation to employment such as accounting, other administrative and IT system maintenance for the units located in the other states as well i.e. distinct persons as per Section 25(4) of the Central Goods and Services Tax Act, 2017 (CGST Act) shall be treated as supply as per Entry 2 of Schedule I of the CGST Act or it shall not be treated as supply of services as per Entry 1 of Schedule III of the CGST Act?”.

Download the full explanation and reasoning provided by the both by clicking the below image:

Ruling

The activities performed by the employees at the corporate office. In the course of or in relation to employment such as accounting, other administrative and IT system maintenance for the units located in the other states as well i.e. distinct persons. As per Section 25(4) of the Central Goods and Services Tax Act, 2017 (CGST Act) shall be treated as supply as per Entry 2 of Schedule I of the CGST Act.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.