Relaxation to Claim Exempt Allowances Under New Tax Regime of the Income Tax Act, 1961

The Central Board of Direct Taxes vide Notification No 38/2020 dated 26th June 2020 has empowered the employees who opt for new Concessional Tax Regime under Section 115BAC(5), to claim following allowances under Section 10(14) read with Rule 2BB of the Income Tax Rules, 1962 (“the Rules”) w.e.f. A.Y. 2021-22:

- Allowance granted to meet the cost of Travel on Tour/Transfer.

- Daily Allowance when on Travel to meet the ordinary daily charges incurred on account of absence from his normal place of duty.

- Conveyance Allowance in performance of duties of an office or employment of profit.

- Transport Allowance for blind, deaf, dumb, or orthopedically handicapped between the place of his residence and the place of his duty maximum up to INR 3,200 per month.

Further, while determining perquisites, above mentioned employees shall not be eligible to avail exemption for free food and non-alcoholic beverages under Rule 3(7)(iii) of the Rules if paid vouchers are provided by the employer.

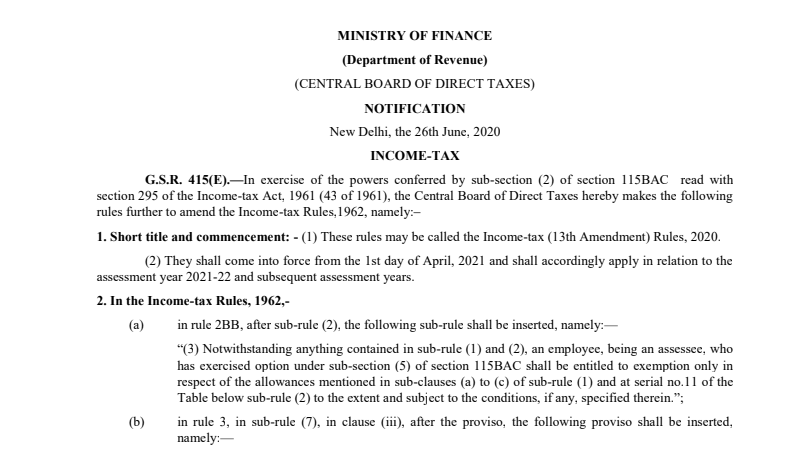

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 26th June 2020

INCOME-TAX

G.S.R. 415(E).—In exercise of the powers conferred by sub-section (2) of section 115BAC read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules,1962, namely:‒

1. Short title and commencement: –

(1) These rules may be called the Income-tax (13th Amendment) Rules, 2020.

(2) They shall come into force from the 1st day of April 2021 and shall accordingly apply in relation to the assessment year 2021-22 and subsequent assessment years.

2. In the Income-tax Rules, 1962,-

(a) in rule 2BB, after sub-rule (2), the following sub-rule shall be inserted, namely:—

“(3) Notwithstanding anything contained in sub-rule (1) and (2), an employee, being an assessee, who has exercised an option under sub-section (5) of section 115BAC shall be entitled to exemption only in respect of the allowances mentioned in sub-clauses (a) to (c) of sub-rule (1) and at serial no.11 of the Table below sub-rule (2) to the extent and subject to the conditions, if any, specified therein.”;

(b) in rule 3, in sub-rule (7), in clause (iii), after the proviso, the following proviso shall be inserted, namely:—

“Provided further that the exemption provided in the first proviso in respect of free food and non- alcoholic beverage provided by such employer through paid voucher shall not apply to an employee, being an assessee, who has exercised an option under sub-section (5) of section 115BAC.”.

[Notification No. 38/2020/F. No.370142/15/2020-TPL]

GUDRUN NEHAR, Director (Tax Policy and Legislation)

Note:

The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section-3, Sub-section (ii) vide number S.O. 969 (E), dated the 26th March 1962 and last amended by the Income-tax (12th Amendment) Rules, 2020, vide notification number G.S.R. 338 (E) dated 29.5.2020

Read the Notification:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.