Faceless Assessment and Appeal

Budget Speech For Introducing Faceless Proceedings

• Budget 2018-19 – “We had introduced e-assessment in 2016 on a pilot basis and in 2017, extended it to 102 cities with the objective of reducing the interface between the department and the taxpayers. With the experience gained so far, we are now ready to roll out the E-assessment across the country, which will transform the age-old assessment procedure of the income tax department and the manner in which they interact with taxpayers and other stakeholders. Accordingly, I propose to amend the Income-tax Act to notify a new scheme for assessment where the assessment will be done in electronic mode which will almost eliminate person to person contact leading to greater efficiency and transparency”

• Budget 2019 – 20 (I) – Within the next two years, almost all verification and assessment of returns selected for scrutiny will be done electronically through the anonymized back office, manned by tax experts and officials, without any personal interface between taxpayers and tax officers

Budget 2019-20 (II) – “The existing system of scrutiny assessments in the Income-tax Department involves a high level of personal interaction between the taxpayer and the Department, which leads to certain undesirable practices on the part of tax officials. To eliminate such instances, and to give shape to the vision of the Hon’ble Prime Minister, a scheme of faceless assessment in electronic mode involving no human interface is being launched this year in a phased manner. To start with, such e-assessments shall be carried out in cases requiring verification of certain specified transactions or discrepancies. 125. Cases selected for scrutiny shall be allocated to assessment units in a random manner and notices shall be issued electronically by a Central Cell, without disclosing the name, designation, or location of the Assessing Officer. The Central Cell shall be the single point of contact between the taxpayer and the Department. This new scheme of assessment will represent a paradigm shift in the functioning of the Income Tax Department.

Related Topic:

Improvements in Faceless Assessment – Turant Faceless Scheme

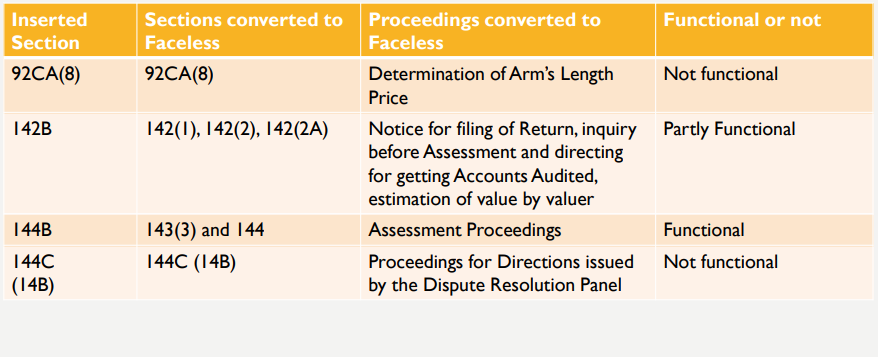

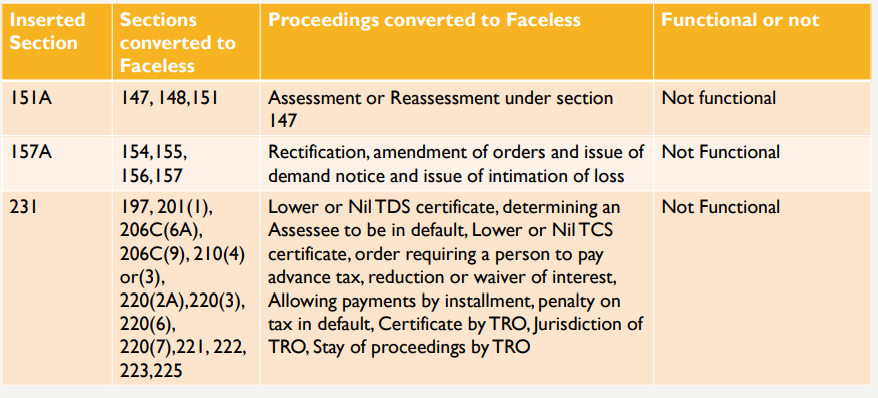

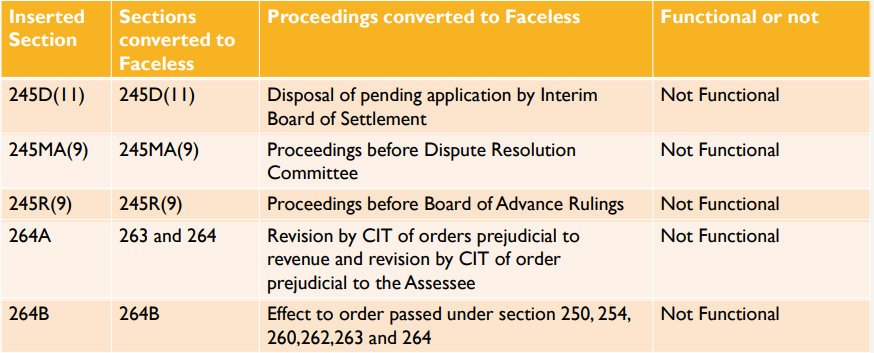

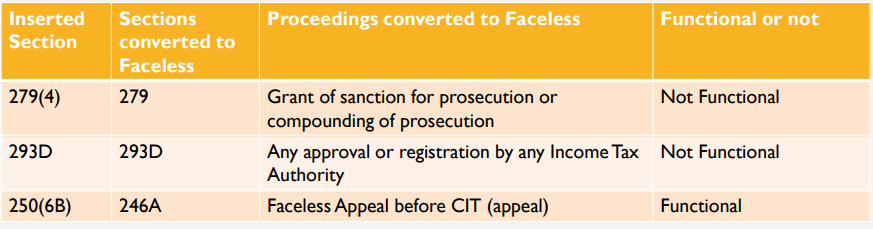

Proceedings That Are Transformed To Faceless Proceedings

By March 2022 or By March 2023 as the case may be the above proceedings shall be converted to Faceless.

For All the Proceedings which are proposed to be made Faceless and are not functional following is the amendment in their respective section

• The Central Government may make a scheme, by notification in the Official Gazette, for the purpose of _____________ under this chapter/section/subsection, so as to impart greater efficiency, transparency and accountability by-

– Eliminating the interface between the _________ and the Assessee in the course of _______ to the extent Technologically feasible

– Optimising utilization of the resources through economies of scale and functional specialization

– Introducing a ________ with dynamic jurisdiction

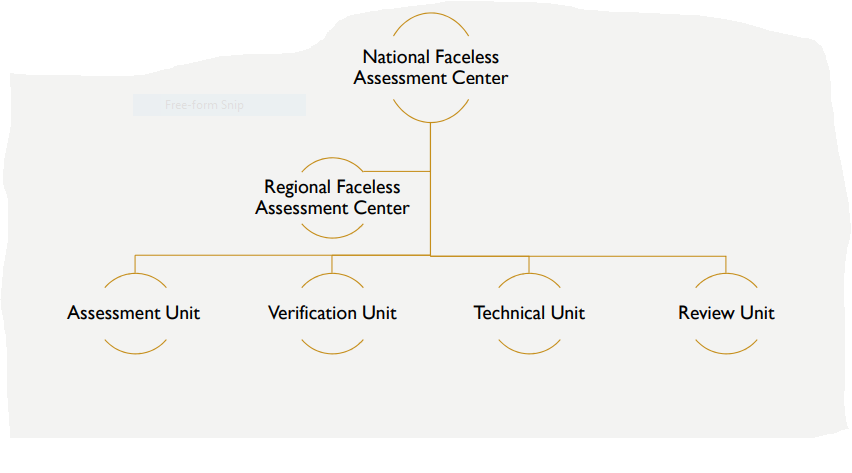

Structure Of Department Conducting Assessment Proceedings

Read & Download the full Copy in pdf:

If you already have a premium membership, Sign In.

CA Pratham Bhatia

CA Pratham Bhatia

Pratham is a keen learner of tax laws and possesses wide knowledge of the same at a very young age. He is known for solving complex factual and legal problems in a simple manner. He has worked in various dimensions of professional expertise which includes audits; Domestic tax compliance and litigation; International Tax compliance and litigation; and complex search and seizure cases of income tax. Pratham is an avid researcher and consistently fills up his treasure with knowledge which can be used for the advancement of his clients. Pratham gives his best advice to his clients when they need solutions to critical business problems and helps them in growing their businesses with complete professional support.