Circular No. 20/2020: CBDT

Circular No. 20/2020

Subject: Income-Tax Deduction from Salaries during the Financial Year 2020-21 under Section 192 of the Income Tax Acr, 1961.

Reference is invited to Circular No. 4/2020 dated 16.01.2020 whereby the rates of deduction of income tax from the payment of income under the head “Salaries” under Section 192 of the Income-tax Act, 1961 (hereinafter “the Act”), during the financial year 2019-20, were intimated. The present Circular contains the rates of deduction of income-tax from the payment of income chargeable under the head “Salaries” during the financial year 2020-21 and explains certain provisions of the Act and Income Tax Rules, 1962 (hereinafter the Rules). All the sections and rules referred are of Income Tax Act, 1961 and Income Tax Rules, 1962 respectively unless otherwise specified. The relevant Acts, Rules, Forms, and Notifications are available at the website of the Income-tax department.

Related Topic:

Exception to monetary limits for filing appeals: Circular No. 23 of 2019 (CBDT)

2. Rates of Income Tax as Per Finance Act, 2020:

As per Finance Act, 2020, income -tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2020-21 ( i.e. Assessment Year 2021-22) at the following rates:

2.1 Rate of tax

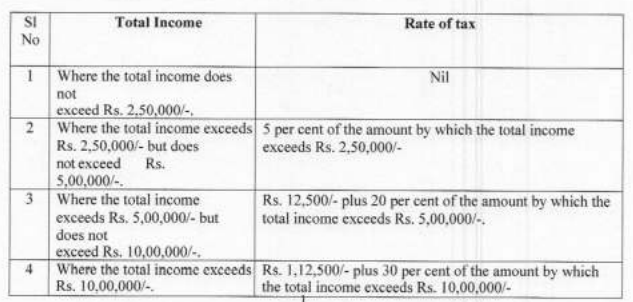

A. Normal rates of tax

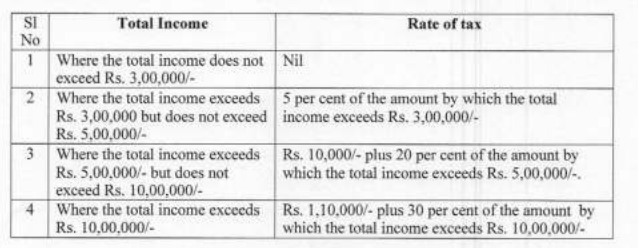

B. Rates of tax for every individual, being a resident in India, who is of the age of sixty years or more but less than eighty years at any time during the financial year:

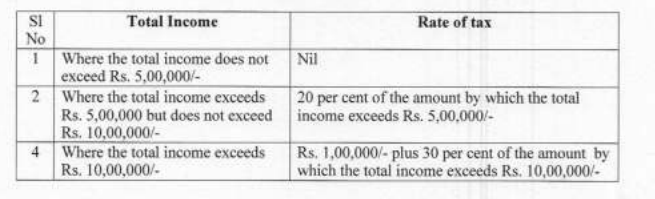

C. In case of every individual, being a resident in India, who is of the age of eighty years or more at any time during the financial year:

Related Topic:

Rule 36(4) and Circular No. 123/42/2019-GST, Ultra Vires and Impossible Mathematics!

2.2 Concessional Rates of Tax u/s 115BAC

Section 115BAC of the Income Tax Act, 1961, inserted by the Finance Act, 2020 w.e.f. Assessment Year 2021-22, inter-alia, provides that a person, being an individual or a HUF may exercise the option in respect of a previous year to be taxed under the said section 115BAC. In case of a person having income from business or profession, such a person is required to exercise the option in a prescribed manner on or before the due date specified under sub-section (1) of Section 139 of the Act for any previous year relevant to the assessment year commencing on or after 01.04.2021 and such option once exercised shall apply to subsequent assessment years.

Related Topic:

Circular No. 15/2021: CBDT

Read & Download the Full Circular in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.