Odomos is not medicine, it is mosquito repellent: Allahabad High Court, No judicial review required

Case covered:

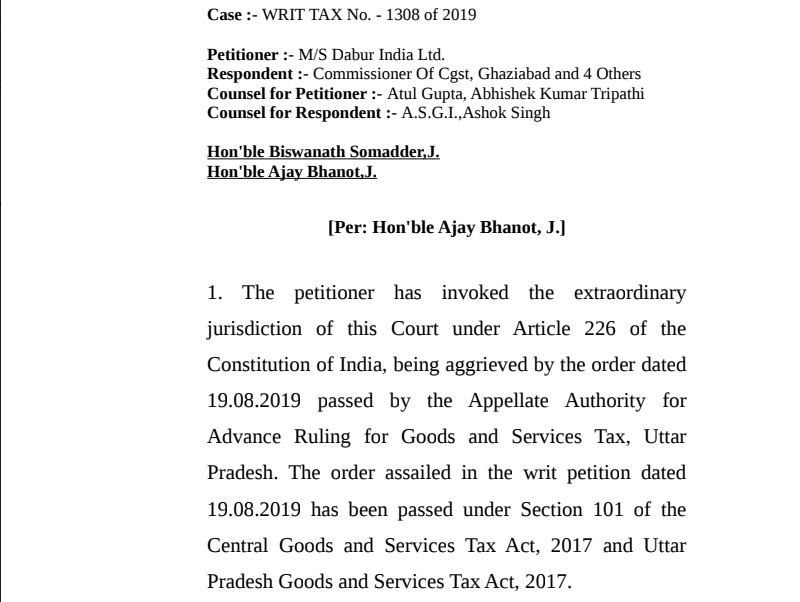

Petitioner:- M/S Dabur India Ltd.

Respondent:- Commissioner Of CGST, Ghaziabad and 4 Others

Counsel for Petitioner:- Atul Gupta, Abhishek Kumar Tripathi

Counsel for Respondent:- A.S.G.I., Ashok Singh

Facts of the case:

The petitioner has invoked the extraordinary jurisdiction of this Court under Article 226 of the Constitution of India, being aggrieved by the order dated 19.08.2019 passed by the Appellate Authority for Advance Ruling for Goods and Services Tax, Uttar Pradesh. The order assailed in the writ petition dated 19.08.2019 has been passed under Section 101 of the Central Goods and Services Tax Act, 2017 and Uttar Pradesh Goods and Services Tax Act, 2017.

The impugned order dated 19.08.2019, in the instant writ petition, the Appellate Authority has upheld the ruling of the Authority for Advance Ruling classifying odomos (product in issue), under HSN 38089191 of Chapter 38 of the Customs Tariff Act, 1975. The petitioner has also prayed that a writ in the nature of mandamus to be issued for classification of the product odomos as medicine under heading no. 3004 of the Customs Tariff Act, 1975.

Download the judgment:

Pronouncement of Court:

52. The reliance placed by the petitioner / asseessee on the judgment of this Court rendered in the case of M/s Balsara Hygiene Products Limited reported at 1986 UPTC 367 (All.) is misplaced. The entry which was under consideration before this Court in M/s Balsara Hygiene Products Limited (supra) issued under Section 3 of the Uttar Pradesh Sales Tax, 1948 and read as “Medicines and pharmaceutical preparations including insecticides and pesticides”. The said entry included insecticides and pesticides within the broader category of medicines and pharmaceutical preparations. This is in complete contradistinction to the entry under the tariff heading no.3808 which is in issue in this writ petition. The rival classifications of medicament vs mosquito repellent were not examined by this Court in the case of M/s Balsara Hygiene Products Limited (supra) while the same are directly in issue in the instant writ petition.

53. Before proceeding to the last part of the discussion, the scope and limitation of judicial review, which guide the exercise of discretionary jurisdiction under Article 226 of the Constitution of India may be stated. Judicial review is confined to the decision making process and is not directed against the decision itself. The court of judicial review examines the manner in which the decision was made. In judicial review the Court scrutinizes the correctness of the decision making process and not the decision itself. The concern of the Court exercising powers of judicial review is procedural propriety in the decision making process. While exercising powers of judicial review the Court has to find whether the decision making authority acted within its jurisdictional limits, committed errors of law, adhered to the principles of natural justice or acted in breach thereof, and whether the decision is perverse or not. The powers of judicial review are thus distinct from powers of an appellate court. The order of Appellate Authority can be judicially reviewed and not appealed against.

54. The courts exercising judicial review do not ordinarily substitute the decision of the authority by their judgment. Merely because two views are possible, a court sitting in judicial review shall not exercise its discretion in favour of an alternative view to that of the authority.

55. From the records pleadings and the arguments of the learned counsel for both the parties, this Court finds that the petitioners were given full opportunity of hearing before the authorities below. The Appellate Authority as well as Original Authority have adhered to the principles of natural justice while deciding the controversy. The order of the Appellate Authority assailed in the instant writ petition reflects due application of mind to the relevant facts and material in the record. The order is supported with cogent reasons. No arbitrariness or perversity in the findings of the Appellate Authority could be pointed out during the course of arguments. In fact two views are not even possible in the facts of this case. The Appellate Authority as well as the Original Authority have observed full procedural propriety.

56. This is not a fit case to judicially review the impugned order. Consequently, we decline to exercise our discretionary jurisdiction under Article 226 of the Constitution of India in favour of the petitioner.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.