Interim protection granted to the petitioner withdrawan: GST Fake invoice scam

Introduction:

In this case of GST fake invoice scam, the petitioner was awarded the protection. Plea for vacating this protection was moved through Counsel Harpreet Singh who put a stellar performance.

Credit goes to Ms. Mayusha Goyal, JC and Y Kumar, AC for strategizing and working diligently to build up a case to argue that this protection was being abused by the accused.

Case Covered:

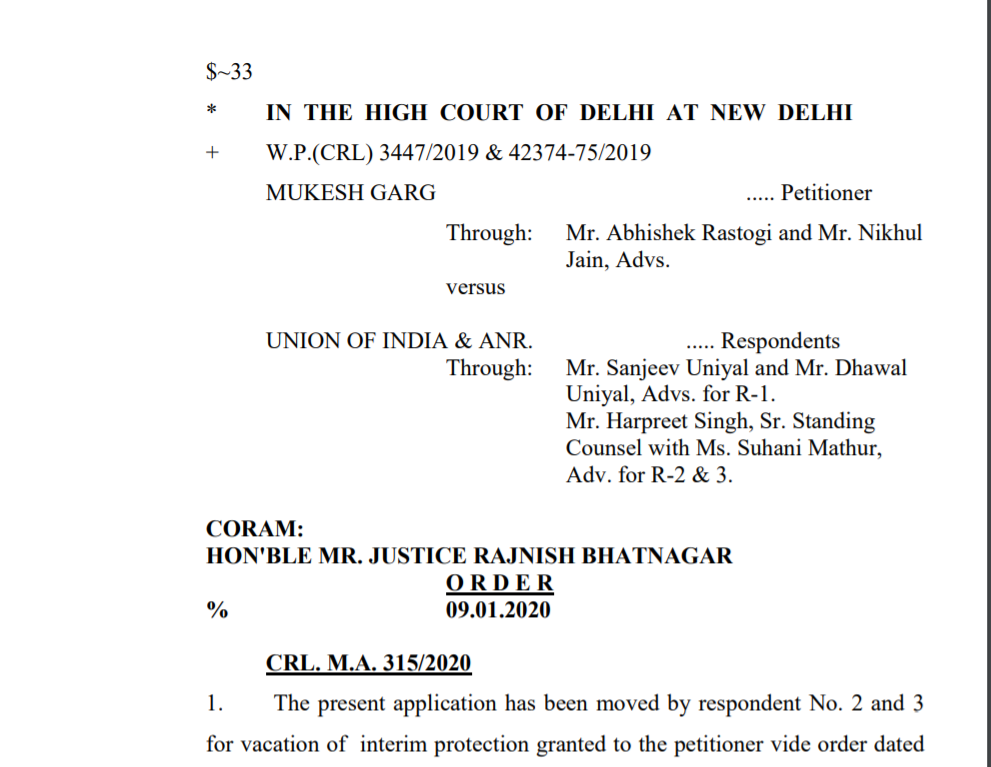

MUKESH GARG ….. Petitioner Through: Mr. Abhishek Rastogi and Mr. Nikhul Jain, Advs.

versus

UNION OF INDIA & ANR. ….. Respondents Through: Mr. Sanjeev Uniyal and Mr. Dhawal Uniyal, Advs. for R-1. Mr. Harpreet Singh, Sr. Standing Counsel with Ms. Suhani Mathur, Adv. for R-2 & 3.

Full text of the order with highlights wherein interim protection granted to the petitioner withdrawan in GST Fake invoice scam

1. The present application has been moved by respondent No. 2 and 3 for vacation of interim protection granted to the petitioner vide order dated 10.12.2019.

2. It is averred in the application that during the investigation of one M/s Royal Sales India, Delhi which was related to a firm namely M/s Oblique Enterprises was required to be verified. Data from A.I.O. and Eway bill(s) were retrieved and it was found that Input and Output of goods were not in correlation and it appeared that the party was availing input tax credit (I.T.C.) and passing on such credit without actual receipt of goods and without actual supply of goods. M/s Royal Sales India availed I.T.C. mainly on invoices qua soft drinks, almonds, MS scrap etc., whereas it has issued invoices for sale of plastic dana, news print, paper board etc. It was further seen that an excess in put tax credit amounting to Rs. 1.37 Crores has been passed on. In view of the same, 13 premises of main suppliers and main recipients engaged with input tax credit of M/s Royale Sales India were searched on 09/08/2019. On the statement of one supplier M/s Luv Kush Beverages Pvt. Ltd., it emerged that Anuj Garg alongwith the petitioner is handling the firm M/s Royal Sales India and accordingly a search was conducted at the house of Anuj Garg where a total cash of Rs. 34 lakhs was seized. Further searches at 5 premises of suppliers and recipients of such Input Tax Credit was also conducted on 16.08.2019 and, voluntary statements of Bank Managers of Bandhan Bank, Union Bank of India, IndusInd Bank were tendered. From the same, more such firms reportedly controlled/handled by the petitioner came to light. Based on this, search warrant dated 07.09.2019 were executed at 8 premises in co-ordination with GST Delhi North and GST Delhi East Commissionerate and Panchnama/voluntary statements were subsequently availed. From such statements, it became evident that there are many firms controlled/handled by the petitioner and again search warrant dated 25.09.2019 were executed at 12 premises/residence and search were conducted in co-ordination with CGST Delhi North Commissionerate & CGST Delhi East Commissionerate.

3. It is averred that during the search of premises F-204, 2nd Floor, Aditya Complex 2, D-Block, Central market, Prashant Vihar, Delhi-85, documents in respect of multiple firms relating to Anuj Garg and petitioner containing entries of cash and bank transactions were also seized. In accordance with sham transactions various summons were issued to the petitioner but he has failed to join and co-operate in the investigation.

4. All these firms have resorted to sale or cause effect of sale of goods, by issuing goods-less invoices and on collection of the payment by RTGS/NEFT/Cheque, return the cash back to same person as per agreed terms of facilitation/commission etc. and this was done in order to avail input tax credit for offsetting any likely tax liability etc.

5. It is further averred that the petitioner was summoned repeatedly by the department but he has not appeared even once on one pretext or the other. It is averred that the petitioner is involved in huge tax evasion and illegal utilization of input tax credit under the GST laws. It is further averred that the investigation is at a nascent stage and the petitioner is trying to scuttle the same and is threatening the crucial witnesses, the fact which has been revealed during the investigation.

6. The counsel for the respondent No. 2 and 3 has argued on the lines of his application and his main thrust for vacation of the interim protection is mainly on the ground that the petitioner and his son who is petitioner in WP(Crl.) 3446/2019 are threatening the witnesses.

7. On the other hand, it is urged by the counsel for the petitioner that no threats have been given by the petitioner or his son and they have been joining the investigation as and when directed.

8. In order to support his contention the counsel for the respondent No. 2 and 3 has shown the statement of the witnesses during the course of the arguments. It is also contended by the counsel for the respondent No. 2 and 3 that the names of the witnesses have deliberately not been disclosed in the application. The relevant portion of the application which shows about the threats being extended reads as follows : “It has come on record at Ques no. 6 of the voluntary statement dated 14/11/2019 tendered by Sh.*****[employee of Anuj Garg] that the petitioner has threatened him by saying that “tujhemeindekhloonga” and scolded him for stating true facts to GST department. Further, at Ques no. 9 of the voluntary statement dated 14/11/2019 tendered by Sh. *****, it was stated that he got a whatsapp audio call from petitioner on or around 25/09/2019 asking him to favour his son Sh. Anuj Garg in the statements to the department and help his son Sh. Anuj Garg always or otherwise he will frame ***** into the case. Again at Ques no. 6 of his voluntary statement dated 15/11/2019, Sh. **** further elaborated that he was not threatened in person but a whatsapp call was made by petitioner threatening him regarding helping his son Sh. Anuj Garg to get out of the case or he would frame in the case by falsifying evidences/creating false evidence/and / or making other employees of Anuj Garg to depose falsely against him. Likewise, at Ques no. 29 of the statement dated 14/11/2019 tendered voluntarily by Sh. ***, it was stated by him that Anuj Garg demanded his explanation as to why he had given a statement to the department against him and what was the necessity etc.”

9. I have also gone through the statements of the witnesses produced in the Court and the same shows about the threats being extended to the witnesses. Therefore, in view of the fact that the petitioner is not joining the investigation, rather misusing the interim protection granted to him and threatening the witnesses and also keeping in view the fact that as per the respondent No. 2 and 3 many other witnesses are yet to be examined, the interim protection granted to the petitioner is hereby withdrawn. The application is disposed of accordingly. 10. List on the date already fixed i.e. 27.03.2020

Download original order in case of MUKESH GARG Vs. Union of India:

9717_2020

#GST Fake invoice

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.