Materials used for Rakhi should be interpreted as per Rule 3(c) of the Customs Tariff Act

Materials used for Rakhi should be interpreted as per Rule 3(c) of the Customs Tariff Act, 1975: AAR

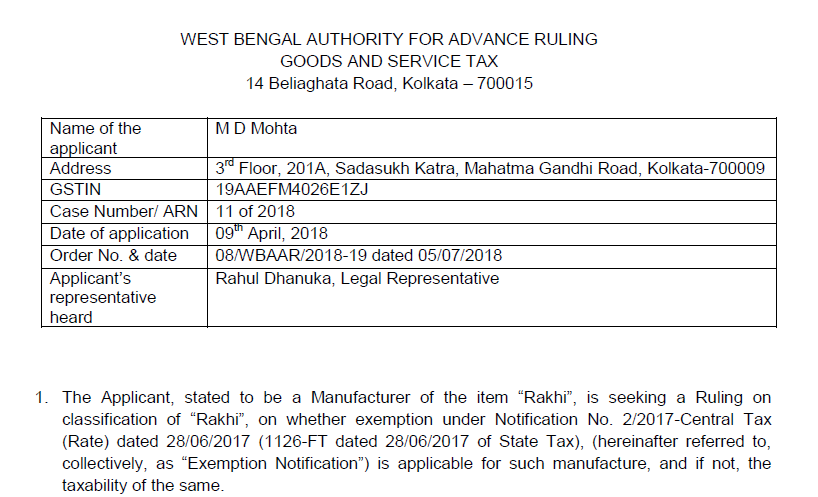

An advance ruling is given by the Authority of the advance ruling of West Bengal. The festival “Rakshabandan” is near and to the most of the manufacturers of the industries who manufacture the “Rakhi” should be pretty confused regarding the applicability of GST. The MD Mohta(Applicant) has raised the issue of the advance ruling in front of the Authority. The rakhi is made of the various products depending on the design and structure. So, the applicant filed an application for the clarification for interpretation of the materials used for manufacturing. Also, the Applicability of the GST. Rakhi does not only is for the show or an accessory but it is the symbol of the protection.

Issue/Question raised in the Advance Ruling:

Ruling on the classification of “Rakhi”, on whether the exemption under Notification No. 2/2017-Central Tax (Rate) dated 28/06/2017 (1126-FT dated 28/06/2017 of State Tax), (hereinafter referred to, collectively, as “Exemption Notification”) is applicable for such manufacture, and if not, the taxability of the same.

Download the full facts and reasoning for the advance ruling regarding the Materials used for Rakhi should be interpreted as per Rule 3(c) of the Customs Tariff Act, 1975:

Ruling:

The Applicant has to classify the goods “Rakhi” as per its constituent materials. In accordance with Rule 3(c) of the Rules for Interpretation of the Customs Tariff Act, 1975. As laid down in Explanatory Notes (iv) of Notification No 1/2017-CT(Rate). Dated 28.06.2017 (Note (v) of 1125 – FT dated 28/06/2017 of State Tax).

Rakhi will attract GST in accordance with its classification as stated above.

The exemption under Notification No. 2/2017-Central Tax (Rate) dated 28/06/2017 (1126-FT dated 28/06/2017 of State Tax) is not applicable for “Rakhi”.

This Ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.