Polypropylene Leno Bags Should be classified under HSN 6305 33 00: AAR

Polypropylene Leno Bags Should be classified under HSN 6305 33 00: AAR

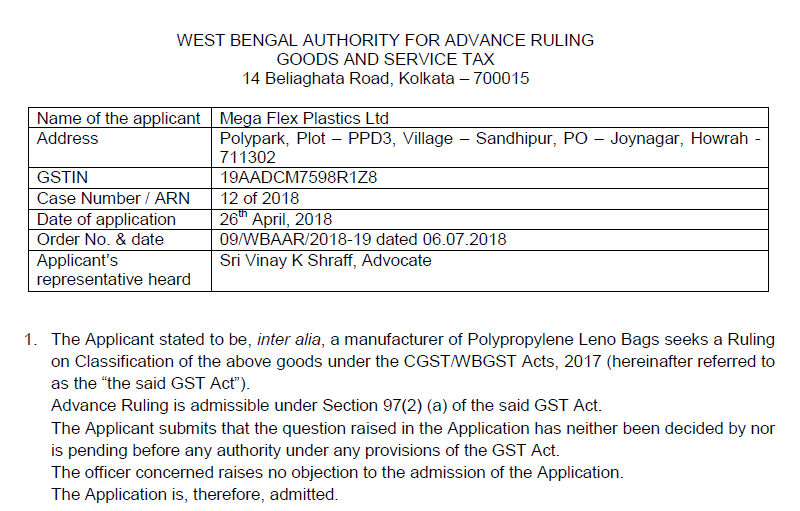

An advance ruling is given by the Authority of the advance ruling of West Bengal. The Applicant(Mega Flex Plastics Ltd) stated to be, inter alia, a manufacturer of Polypropylene Leno Bags. These bags are mainly used for packing of potato, onion, raw mango and other vegetables and citrus fruit in bulk. The Applicant is of the opinion that the PP Leno Bags manufactured is classifiable under Tariff Head 6305 33 00 of the GST Tariff. Which is aligned to the First Schedule of the Customs Tariff Act, 1975 (hereinafter referred to as the “the said Tariff Act”).

Issue/Question raised for Advance Ruling:

Classification of the Polypropylene Leno Bags under the CGST/WBGST Acts, 2017.

Download the full facts and reasoning for the advance ruling. Regarding the classification of the Polypropylene Leno Bags by clicking the below image:

Ruling:

‘Polypropylene Leno Bags’, if specifically made from woven Polypropylene fabric using strips or the like of width not exceeding 5 mm. Without any impregnation, coating, covering, or lamination with plastics, are to be classified under Tariff Sub Heading 6305 33 00.

This Ruling is valid subject to the provisions under Section 103 until. Unless declared void under Section 104(1) of the GST Act.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.