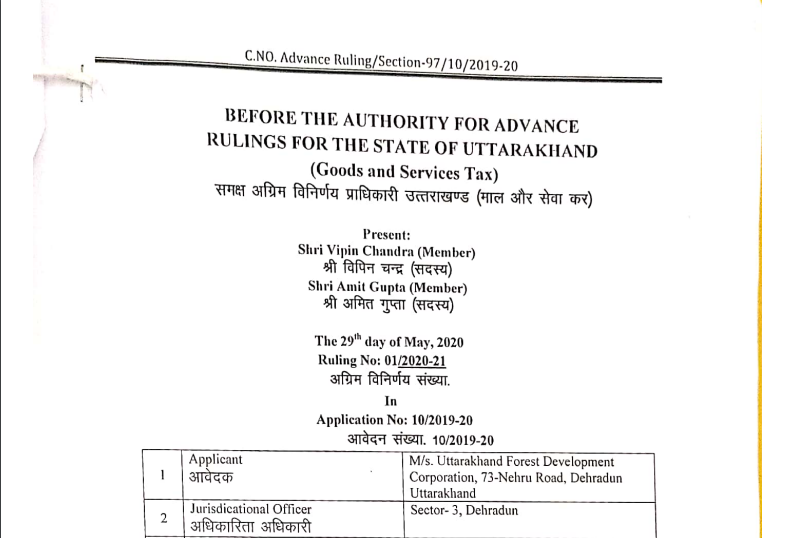

Uttarakhand AAR in the case of M/s. Uttarakhand Forest Development Corporation

Case Covered:

M/s. Uttarakhand Forest Development Corporation

Facts of the case:

This is an application under sub-section (1) of Section 97 of the CGST/SGST Act, 2017 (hereinafter referred to as Act) and rules made thereunder filed by M/s. Uttarakhand Forest Development Corporation, 73-Nehru Road, Dehradun, Uttarakhand (hereinafter referred to as ‘The applicant’) is registered with the GSTN having registration No. 05AAALU0009M0ZG and seeking advance ruling on the following question:

a. What will be the applicable rate for GST on royalty payable to Govt of Uttarakhand under RCM in respect of Reta, Bazri & Boulders extracted as per the permission of Govt authorities?

Advance Ruling under GST means a decision provided by the Authority or the appellate authority to an applicant on matters or on questions specified in sub-section (2) of section 97 or sub-section (1) of section 100 in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant.

Observations:

On perusal of record, we find that the applicant is a Govt. body constituted under Act of State Assembly of Uttarakhand State. The applicant is a sole agency for the removal & sale of forest produce from the entire forest area in Uttarakhand. The applicant has various forest-related activities, one of the activity is allowed to extract minor minerals (Reta, Bazri & Boulders) from river bed in the forest area of Uttarakhand and make sale of it to the buyers in an open market. The applicant pays a royalty for the extraction of minor minerals on the rates fixed by the Govt. of Uttarakhand to State Govt. of Uttarakhand. The applicant is depositing GST under RCM on royalty by 18% and collecting 5% on sale price from buyers.

Order:

In view of the above discussion & findings we hold as under:

The services rendered by the applicant during the period 01.07.2017 to 31.12.2018 attract GST at the same rate of Central Tax as on supply of like goods involving the transfer of title in goods i.e. 5% and w.e.f. 01.01.2019 the said service attracts GST @ 18%.

Read & Download full order in pdf:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.