NIL GSTR 1 via SMS facility is now available

NIL GSTR 1 via SMS facility

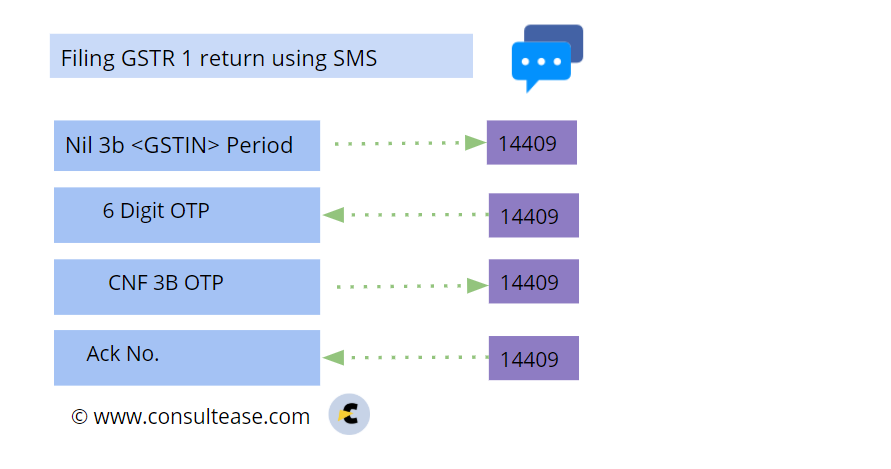

NIL GSTR 1 via SMS facility is available from 1st July 2020. It is going to benefit the lacs of taxpayers. You can simply send the text on a specified number to file the return. Read the detailed process here. You need to send SMS at the specified number. The number specified for this purpose is 14409. The following chart can explain the process in a simple flow.

GSTR 1 is a regular return of GST. It is required to be filed monthly by the taxpayers having a turnover of more than Rs. 5 crores. In other cases, it can be file Quarterly. It contains the details of the outward supply. Sales can be categorized into various forms. Like domestic sales, export sales, B2C sales, and B2B sales.

Its due date is the 10th of next month in case of monthly filing. Quarterly return can be filed by the last day of the month next to a quarter. But in 2020 dates were extended due to lockdown. See the extended due dates of GSTR 1 here. It is updated till 30th June 2020.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.