RECOVERY PROCEEDINGS, STAY AND PAYMENT OF TAX

- RECOVERY PROCEEDINGS, STAY AND PAYMENT OF TAX

- Time Limit for Initiating Recovery Proceedings- Section 78

- Legal Provision

- Judicial Pronouncement

- Applicability of Time Limit for Initiating Recovery Proceedings- Section 78

- Modes of Recovery Proceedings- Section 79

- Immunity from Payment of Tax for Notice issued to Other Person on behalf of Taxable Person

- Stay on Recovery Proceedings- Section 79

- Recovery Proceedings- Without Adjudications

- Amount Payable shall be First Charge on Property

- Liability on Related Persons for the Tax Amount Due

- Liability on Reorganization/ Restructure of Business for the Tax Amount Due

- 3. Company in Liquidation Sec 88-

- Download the copy:

RECOVERY PROCEEDINGS, STAY AND PAYMENT OF TAX

Time Limit for Initiating Recovery Proceedings- Section 78

Legal Provision

A summary of the order issued under section 52 or section 62 or section 63 or section 64 or section 73 or section 74 or section 75 or section 76 or section 122 or section 123 or section 124 or section 125 or section 127 or section 129 or section 130 specifying therein the amount of tax, interest, and penalty is required to be uploaded electronically in Form DRC-07 read with Rule 142(5) and recovery of dues under existing laws to be made in Form DRC-07A read with Rule 142A.

Pursuant to such order passed under the CGST Act, 2017 taxable person is required to pay the amount within the period of 3 months from the date of service of the order failing which recovery proceedings will be initiated. Form in DRC-07/ 7A to be treated as Notice for Recovery.

In our opinion, the period of 3 months is statutory and must be complied before initiating any recovery proceedings.

Related Topic:

format of GST Appeal Final Commissioner (Appeal)

Judicial Pronouncement

Hon’ble High Court of Bombay in case of Tata Teleservices Maharashtra Ltd vs M.F. Department of Revenue [2014 (307) E.L.T. 90 (Bom.)]- On 27-1-2014, Petitioner was served with communication, dated 22-1-2014 and 23-1-2014 of Assistant Commissioner calling upon the petitioner to comply with the order, dated 27-12-2013 within two days failing which he threatened to take coercive action to recover the dues. Held such communications are contrary to provisions of Finance Act which provides for a period of three months to file an appeal to the Tribunal. Impugned communications is high-handed and contrary to C.B.E. & C. Circular No. 967/1/2013-CX., dated 1-1-2013. In case the Revenue is allowed to adopt coercive measures and/or if the assessee is required to pay tax determined immediately it would lead to injustice to an assessee, as his opportunity to obtain a stay from appellate authority would stand foreclosed. Moreover the inherent right of an appellate authority to stay the order being appealed against would be rendered futile – Thus impugned communications are not only in defiance of C.B.E. & C. circular but also in breach of statutory provisions – Communications set aside

Hon’ble High Court of Bombay in case of Mahindra & Mahindra Ltd vs Union of India [1992 (59) E.L.T. 505 (Bom.)]. In the said case the Adjudicating Authority encashed the Bank Guarantee before the expiry of statutory period of 3 months for filing of appeal. Tribunal’s direction to hold the realised money in deposit till disposal of appeal set aside. Department directed to pay back the entire amount recovered by encashing bank guarantee and thereafter the assessee to execute fresh bank guarantee.

Applicability of Time Limit for Initiating Recovery Proceedings- Section 78

Proper Officer may initiate the recovery proceedings with such period less than 3 months. However reasons to be recorded in writing where the Proper Officer consider shorter period of 3 months from the service of order for initiating recovery proceedings

Modes of Recovery Proceedings- Section 79

Proper Officer for the recovery of sum which remains unpaid pursuant to order even after the lapse of 3 months from the date of service of order

1. Deduct from the amount payable to such Taxable Person

2. May require any other specified officer to deduct the amount so payable to such Taxable Person

3. By detaining and selling any goods belonging to such person which are under the control of the proper officer or such other specified officer. Such goods will be sold by process of Auction as per Rule 144.

4. By notice in writing require any other person from as prescribed in Rule 145

a. From whom money is due or

b. From whom money may become due or

c. From a person who holds the money

d. From a person who may subsequently hold money

Recovery from other person cannot be made without issue of the show cause notice.

In a Writ Petition filed before High Court of Bombay by M.P Enterprises [2018 (19) G.S.T.L. 493 (Bom.)]. Notice dated 31st August, 2018 issued to the Petitioner’s customer M/s. Motherson Sumi Systems Ltd., directing it pay over any dues/amounts payable to the Petitioner into the treasury. We have today passed an order in Writ Petition No. 10085 of 2018 in M.P. Enterprises v. Union of India & Others (belonging to the same group) [2018 (19) G.S.T.L. 487 (Bom.)], on identical notices dated 30th August, 2018 issued to the Banker of the Petitioner therein. We also quash and set aside the notice dated 31st August, 2018 issued to M/s. Motherson Sumi Systems Ltd.

Hon’ble High Court of Bombay in a Writ Petition filed by Sikkim Ferroys Alloys Ltd [2016 (338) E.L.T. 220 (Bom.)]. It is stated that the respondent No. 2 has sold goods worth Rs. 5,45,97,991/ involving above Central Excise Duty and the petitioners are required to pay Rs. 2,14,74,163/ to respondent No. 2. However, there is a default in payment of Central Excise Duty to the tune of Rs. 68,24,763/ by the second respondent. Held It cannot threaten coercive measures and directly seek to recover money from petitioners without any prior adjudication. The sum has to be preascertained and prejudged…

Seizure or Attachment of Overdraft Account

S.B International vs Asst. Dir. Directorate of Revenue Intelligence [2018 (361) E.L.T. 305 (Del.)]- A credit balance in a bank account is an asset of the account holder and the said asset may be seized or attached provided the same is permissible in law. However, if the bank account is an overdraft account, the same would represent a liability owned by the accountholder and, therefore, question of seizing the same or attaching the same would not arise.

5. Detain the movable or immovable property being the under the control of such person. Further may cause the said property to be sold if the due amount is not paid within 30 days from date of such detention. Sale of Property shall take by process of Auction as prescribed in Rule 147

6. Proper Officer shall prepare the certificate in Form DRC-18 read with Rule 155 specifying the amount payable and send the same to the District Collector in which such taxable person own the property or where he resides and the same would be recovered as arrears of land revenue.

Recovery as arrears of land revenue only when the sale of excisable goods has been completed.

Union of India vs Siscom Ltd [2009 (233) E.L.T. 433 (S.C.)]- Right to recover must start with sale of excisable goods. Only when dues of Central Excise Department are not satisfied by such sale, proceedings may be initiated to recover dues as land revenue

7. Proper Officer may file an application in Form DRC-19 read with Rule 156 to the appropriate magistrate and such Magistrate shall proceed to recover from such person the amount specified thereunder as if it were a fine imposed by him

Immunity from Payment of Tax for Notice issued to Other Person on behalf of Taxable Person

The person to whom the Notice has been issued for the payment of the directly to the Proper Officer, such person if proves to the satisfaction of the officer money demanded is not due to him or such person does not hold any money.

Stay on Recovery Proceedings- Section 79

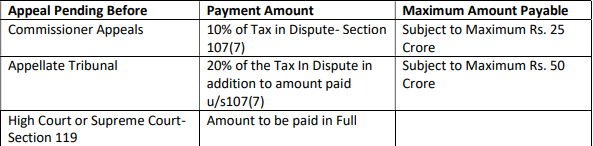

Stay from Recovery Proceedings subject to the following conditions

a. Taxable Person has filed the appeal before the Commissioner Appeal or Appellate Tribunal or High Court or Supreme Court

b. Such Taxable person has pad the admitted tax for which no appeal has been filed

c. Such Taxable person has paid specified amount of the tax as under mentioned

Once the prescribed amount has been deposited, the taxable person gets the stay on the demand of the tax, interest and penalty.

It is observed that the pre-deposit amount before filing of Appeal has been relaxed by the Court only after considering the facts, circumstances and financial difficulty in depositing the amount with certain conditions

Hon’ble High Court at Hyderabad in Writ Petition filed by Sri Dedeepriya Paints. When the petitioner concern already paid 12.5% of the disputed tax amount for the purpose of maintaining an appeal as required by law, it would be wholly unjust for the tax authorities to demand the balance of the disputed tax amount notwithstanding the pendency of the appeal – The Commercial Tax authorities shall desist from taking coercive measures for collection of the balance disputed tax amount payable by the petitioner in terms of the assessment order till disposal of its appeal by the Appellate Deputy Commissioner – The writ petition is allowed

2019 (27) G.S.T.L 530. CESTAT, West Zonal Bench, Mumbai in case of Shree Renuka Sugars Ltd vs Commr. Of CGST, Kolhapur. Appeal was not decided within the stipulated period and department seeking recovery of stayed dues. Held that such recovery is in direct contravention of statutory provisions granting stay of recovery. Impugned recovery notice set aside with cost of Rs. 5000 imposed on the department to be deposited in fund of National Legal Services Authority.

In a Writ Petition filed before High Court of Judicature at Bombay by Ramchandra A. Patankar reported in 2019 (31) G.S.T.L 58 (Bom). Petitioners bank account was attached even when the 10% of the demand was deposited and the matter was pending with Tribunal. Held Tribunal prohibited from adoption coercive proceedings where such deposits have been made and appeal is awaiting disposal.

CESTAT SOUTH ZONAL Bench, Bangalore in case of Vijaynagar Sugars Ltd vs C.C.E & S.T Belgam held that there could not be an automatic vacation of stay of recovery granted by CESTAT or Courts. The Judgement of Hon’ble Supreme Court in case of Asian Resurfacing of Road Agency Pvt Ltd vs CBI would apply to cases pending in Trial Courts only. The cases where stay has been granted, proper approach would be to file an application for vacation of stay at appropriate forum and obtain suitable directions of the Tribunal or High Court as the case may be before initiating any recovery action.

Recovery Proceedings- Without Adjudications

Recovery proceedings cannot be initiated without any Adjudications. Such recovery proceedings are in nature of violation of Principles of Natural Justice. However the adjudicating authority is well within his jurisdiction to make the provisional attachment subject to the fact that the proceedings are pending u/s 62, 63, 64, 67, 73, 74 of CGST Act, 2017.

Hon’ble High Court of Bombay in a Writ Petition filed by M.P Enterprises [2018 (19) G.S.T.L. 487 (Bom.)]. There is no amount adjudicated as payable under the Act after issuing a show cause notice under Section 73 of the Act. Petitioner’s grievance that attachment by the impugned notice dated 30th August, 2018 is contrary to and in defiance of the binding decisions of this Court

In a writ Petition filed under Article 226 of the constitution before Hon’ble High Court in case of L.C Infra Projects Pvt Ltd vs Union of India reported in 2019 (28) G.S.T.L. 3 (Karnataka). Issuance of SCN is sine qua non to proceed with recovery of interest payable u/s 50 of CGST Act, 2017. Determination of Interest without SCN and attachment of bank account for recovery is violative of principles of natural justice and hence was set aside.

Amount Payable shall be First Charge on Property

Pursuant to Section 83 of CGST Act, 2017- Notwithstanding anything to the contrary contained in any law for the time being in force any amount payable by a taxable person or any other person on account of tax, interest or penalty which he is liable to pay to the Government shall be a first charge on the property of such taxable person or such person..

However subject first charge is subject to Insolvency and Bankruptcy Code, 2016 (31 of 2016).

In our opinion such non-obstante clause of creating first charge shall mean only with respect of unsecured credits. If assets is secured by mortgage by certain statute, provision relating to such first charge will not prevail.

Statutory Dues are treated as Crown Debt. Crown debt means the debts due to the State or the king; debts which a prerogative entitles the Crown to claim priority for before all other creditors. Such creditors, however, must be held to mean unsecured creditors. Crown’s preferential right to recovery of debts over other creditors is confined to ordinary or unsecured creditors

Judicial Pronouncement- Immovable Property

Union of India vs Siscom Ltd [2009 (233) E.L.T. 433 (S.C.)]- Debt which is secured or which by reason of provisions of statute becomes first charge over property, considering Article 372 of Constitution of India, must prevail over crown debt which is an unsecured one. Assessee mortgaged its property to State Financial Corporation and also owed Central Excise duty to Revenue/State. Right of a State Financial Corporation is statutory. Statutory provision to prevail over crown debt which is an unsecured debt.

Judicial Pronouncement- Stocks

Dena Bank were reiterated recently in Bank of India v. Siriguppa Sugars & Cheimicals Ltd. [(2007) 8 SCC 353] wherein it was held : “There is no dispute that the sugar was pledged with the appellant Bank for securing a loan of the first respondent and the loan had not been repaid. The goods were forcibly taken possession of at the instance of the revenue recovery authority from the custody of the pawnee, the appellant bank. In view of the fact that the goods were validly pawned to the appellant bank, the rights of the appellant bank as pawnee cannot be affected by the orders of the Cane Commissioner or the demands made by him or the demands made on behalf of the workmen. Both the Cane Commissioner and the workmen in the absence of a liquidation, under Section 529 and 529-A of the Companies Act, 1956, stand only as unsecured creditor and their rights cannot prevail over the rights of the pawnee of the goods. Thus, the rights of the appellant bank over the pawned sugar had precedence over the claims of the Cane Commissioner and that of the workmen.

Liability on Related Persons for the Tax Amount Due

1. Liability on Agent and Principal- Sec 86:

Agent and his Principal shall be jointly/ severally liable with to pay the tax payable on the goods which has been received and supplied by Agent

2. Liability of the Directors of Private Company- Sec 89

Every person who was a director of the private company jointly and severally, be liable for the payment of such tax, interest or penalty during the period of recovery proceedings.

Immunity from the Liability to Pay Tax

The directors of such company proves that the non-recovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of the company

Patna High Court in case of Reckitt Benckiser India Pvt Ltd vs State of Bihar [2018 (10) G.S.T.L. 153 (Pat.)]- In case of offence committed by company, its officers cannot be made vicariously liable on part of company. Vicarious liability attracted only when condition precedent laid down in Section 17(1) of Prohibition of Food Adulteration Act, 1954, satisfied. In absence of specific name of any officers of company with allegation of being responsible for conduct of business of company, officer cannot be held vicariously liable for alleged offence – Continuation of criminal proceeding against accused persons to be abuse of process of Court – Entire criminal proceeding pending set aside.

Madras High Court in case of A. Venkatachalam Chettiar vs Asst. Commr. Of Commercial Taxes, Coimbatore [2018 (8) G.S.T.L. 97 (Mad.)]- Recovery of tax arrears cannot be made from personal property of Director. No record to show that winding up order was passed qua company. Company still registered entity on file of Registrar of Companies. Company owns properties. Impugned notice proposing auction of Director’s personal property wholly without jurisdiction. Section 19B of Tamil Nadu General Sales Tax Act, 1959.

Recovery from Group Company having common directors

Merely two company having the company directors, recovery proceedings cannot be initiated from the other company who has not defaulted in the payment of tax, interest or penalty. Company having common directors cannot be ground for recovery of the amount. Similarly relation of the holding-subsidiary does not entitle the adjudicating authority to recover the amount from the company who has not made any default.

K. Sera Sera Digital Cinema Ltd vs Union of India [2017 (353) E.L.T. 334 (Bom.)]- Petitioner being the subsidiary company. Holding company has defaulted in the payment of tax, interest, penalty. Revenue attached bank account of petitioner-company for dues of its holding company. Both companies separate legal entities, registered separately under Companies Act, 1956 – Merely because two Directors common in both companies, ipso facto, not to entitle Revenue to attach bank account of petitioner-company which being distinct separate entity.

3. Liability on the Partners of the Firm Sec-90

The firm and each of the partners of the firm shall, jointly and severally, be liable for the payment of the tax which is due from the firm.

No immunity to be given the partners of the firm even if the liability to pay tax arise due no breach of duty on his part in relation to the affairs of the firm

Hon’ble High Court for State of Telanagana in case of ABC Engineering Works vs C.C.E Guntur [2016 (44) S.T.R. 219 (A.P.)]- Since liabilities in a partnership firm are joint and several, partners are liable to pay debts due and other statutory liabilities to Department viz. making of predeposits – Section 35F of Central Excise Act, 1944 as applicable to Service Tax vide Section 83 of Finance Act, 1994.

Delhi High Court in case of Jaswant Sugar Mills Ltd, Meerut vs Union of Inda and others [1981 (8) E.L.T. 177 (Del.)]partnership is not a legal entity or a juristic person, yet there are occasions, both in law and practice, when a firm has been treated as having a distinct personality from those of the partners. Thus, partnership firm is a person or a entity having an independent and distinct existence liable for its acts and entitled to enforce its rights vis-a-vis its partners

4. Liability on the Guardians, Trustees Sec-91

In case where business is carried out by Guardian, Trustee or Agent of a minor or other incapacitated person on behalf of and for the benefit of such minor or other incapacitated person, the tax, interest or penalty shall be levied upon and recoverable from such guardian, trustee or agent in like manner and to the same extent as it would be determined and recoverable from any such minor or other incapacitated person, as if he were a major or capacitated person and as if he were conducting the business himself, and all the provisions of this Act or the rules made thereunder shall apply accordingly

5. Liability of Court of Ward where any Estate is under their Control- Sec 92

Where the estate or any portion of the estate of a taxable person is under the control of

a. Court of Wards

b. the Administrator General,

c. the Official Trustee or

d. any receiver or manager

and tax, interest and penalty is payable by such taxable person, then such amount shall be recoverable from be recoverable from such Court of Wards, Administrator General, Official Trustee, receiver or manager.

As per Rule 152, the proper officer shall send the order of attachment to such court or officer, requesting that such property, and any interest or dividend becoming payable thereon, may be held till the recovery of the amount payable

Liability on Reorganization/ Restructure of Business for the Tax Amount Due

1. Transfer of Business Sec 85-

Where a taxable person, liable to pay tax under this Act, transfers his business in whole or in part, by sale, gift, lease, leave and license, hire or in any other manner whatsoever, the taxable person and the person to whom the business is so transferred shall, jointly and severally, be liable wholly or to the extent of such transfer, to pay the tax, interest or any penalty due from the taxable person upto the time of such transfer

Supreme Court in case of Rana Girders Ltd vs Union of India [2013 (295) E.L.T. 12 (S.C.)] Appellant has purchased land, building plant and machinery of assessee who had committed default in payment of loan from State Financial Corporation. Purchase was not of entire unit. HELD : Only where buyer had purchased entire business, he was liable for Central Excise duty as well.

2. On Amalgamation or Merger Sec 87-

When two or more companies are amalgamated or merged in pursuance of an order of court or of Tribunal or otherwise and the order is to take effect from a date earlier to the date of the order and any two or more of such companies have supplied or received any goods or services or both to or from each other during the period commencing on the date from which the order takes effect till the date of the order, then such transactions of supply and receipt shall be included in the turnover of supply or receipt of the respective companies and they shall be liable to pay tax accordingly

3. Company in Liquidation Sec 88-

Commissioner shall notify the liquidator within three months from the date on which he receives intimation of the appointment of the liquidator, the amount which in the opinion of the Commissioner would be sufficient to provide for any tax, interest or penalty.

Till the date of the passing of order of the Court of the company in liquidation, if the sale of the property is not effected by the Department, the property shall vest with the Official Liquidator as appointed by the Court

Sri Vishnupriya Industries Ltd vs Superintendent of C. Ex. & Cus.[ 2005 (184) E.L.T. 227 (A.P.)]. Date on which winding up order passed by Court, no sale was effected – Assets of the company stand vested in the official liquidator and he alone is entailed to deal with the effects and actionable claims to which the company is or appears to be entitled to – Therefore, respondents cannot contend that the goods having been detained by them, they alone are entitled to sell and realize their dues – Any person including respondents to prove their claim before the official liquidator by placing necessary material in support of their claim

This Article has been prepared based on the Legal Provisions on the Authors understanding and purely for Educational Purpose.

Download the copy:

If you already have a premium membership, Sign In.

CA Rachit Agarwal

CA Rachit Agarwal