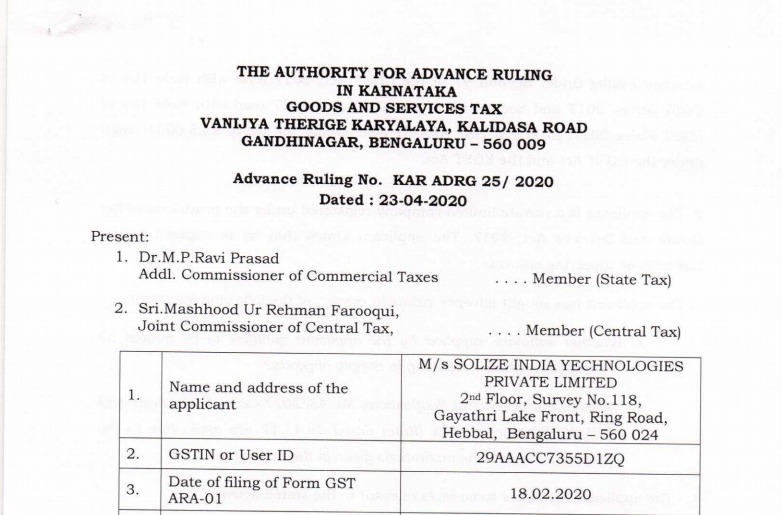

Karnataka AAR Order in the case of M/s Solize India Technologies Private Limited

Case Covered:

M/s Solize India Technologies Private Limited

Facts of the case:

M/s Solize India Technologies Private Limited, Gayathri Lake Front, Survy No. 188, Ring Road, Hebbal, Bengaluru 560024, (hereinafter referred to as “the applicant”) and having a GSTIN 29AAACC7355D1ZQ, has filed an application for Advance Ruling under Section 97 of the CGST Act, 2017 read with Rule 104 of CGST Rules, 2017 and Section 97 of the KGST Act, 2017 read with Rule 104 of KGST Rules 2017, in FORM GST ARA-01 discharging the fee of Rs. 5,000/- each under the CGST Act and the KGST Act.

The applicant is a private limited company registered under the provisions of the Goods and Services Act, 2017. The applicant states that he is engaged in the business of supplying the software.

Observations:

We have considered the submissions made by the Applicant in their application for advance ruling as well as the submissions made by him when he appeared for the personal hearing. We have also considered the issues involved, on which advance ruling is sought by the applicant, and relevant facts.

At the outset, we would like to state that the provisions of both the CGST Act and the KGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the KGST Act.

Ruling:

The supply of software supplied by the applicant which is not designed and developed specifically to any customer and sold without any customization qualifies as a “supply of goods” and “supply of computer software as goods”.

The benefit of Notification No. 45/2017- Central Tax (Rate) and Notification No. 47/2017- Integrated Tax (Rate) both dated 14.11.2017 are applicable to the supplies made if the same are made to recipients if they are covered under column (2) and if the conditions as specified in Column (4) of the said Notifications.

Question 1: Whether the software is regarded as goods or services in GST?

Answer: In terms of Schedule II of the WBGST Act, 2017, development, design, programming, customization, adaptation, up-gradation, enhancement, implementation of information technology software, and temporary transfer or permitting the use or enjoyment of any intellectual property right are treated as services.

But if a pre-developed or pre-designed software is supplied in any medium/ storage (commonly bought off-the-shelf) or made available through the use of encryption keys, the same is treated as a supply of goods classified under the heading 8523.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.