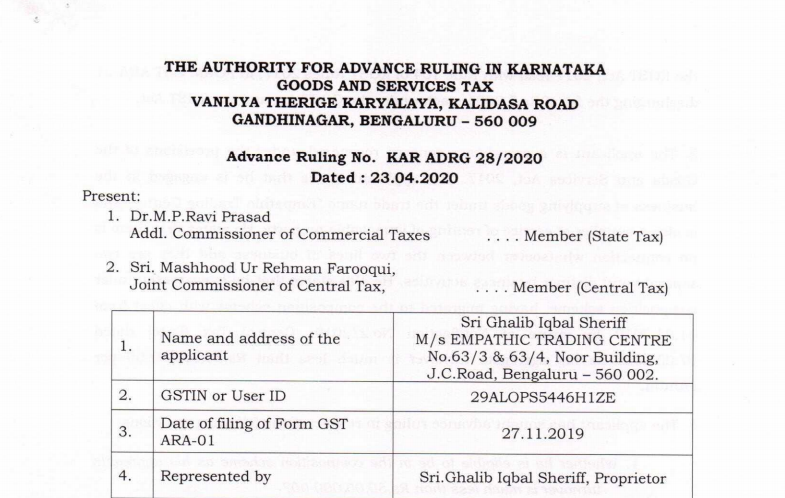

Karnataka AAR order in the case of M/s Empathic Trading Centre

Case Covered:

M/s Empathic Trading Centre

Facts of the case:

The applicant is a proprietary concern registered under the provisions of the Goods and Service Tax Act, 2017. The applicant states that he is engaged in the business of supplying goods under the trade name “Empathic Trading Centre” and is also a supplier of service of renting of immovable property. He states that there is no connection whatsoever between the two lines of business and they are two separate and distinct business activities. He also states that he is currently under a composition scheme, having migrated to the composition scheme with effect from 01.04.2019 by virtue of Notification No.2/2019- Central Tax (Rate) dated 07.03.2019 as his aggregate turnover is much less than Rs. 50,00,000-00 per annum.

Observations:

We have considered the submissions made by the Applicant in their application for advance ruling as well as the submissions made by him when he appeared for the personal hearing. We have also considered the issues involved, on which advance ruling is sought by the applicant, and relevant facts.

At the outset, we would like to state that the provisions of both the CGST Act and the KGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the KGST Act.

The applicant admittedly has two lines of business, one for the supply of goods and others for the supply of services. There is no dispute that both the activities of the applicant are taxable and also supplied by the same person. The applicant states the annual aggregate turnover of both the activities put together is not more than Rs. 50 Lakhs.

Ruling:

The applicant is eligible to be in the composition scheme under section 10 of the CGST Act, 2017 if the turnover of services of the applicant does not exceed ten percent of the turnover in a State or Union Territory in the preceding financial year or five lakh rupees, whichever is higher.

The applicant is not eligible to opt to pay tax under the Notification No. 2/2019-Central Tax (Rate) dated 07.03.2019 and under the Notification (02/2019) No. FD 48 CSL 2017 dated 07.03.2019 of the Government of Karnataka as the applicant is registered as a Composition Taxpayer.

The rate of tax applicable to the entire value is 3% CGST and 3% KGST and he cannot pay tax at 1% on supply of goods and 6% tax on the supply of service.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.