Different address in invoice and E-way bill is a clerical mistake

Case Covered:

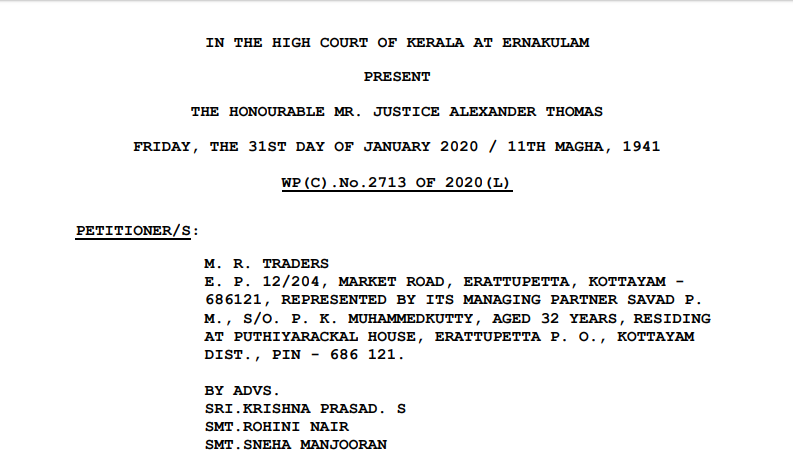

M. R. TRADERS

Versus

ASSISTANT STATE TAX OFFICER (INT) STATE GST DEPARTMENT

Facts of the case:

That the petitioner is a partnership firm, registered under the Indian Partnership Act, 1932. The petitioner has GST registration in the State of Kerala as well as Karnataka. The GST registration allotted to the petitioner’s firm in Karnataka is 29ABAFM7776Q1Z8 and the GST number allotted in Kerala State is 32ABAFM7776Q1ZL. The firm is engaged in the business of Timber and Timber products. In the course of its business, the petitioner had generated a tax invoice dated 25.1.2020 for the supply of Timber Tali Rough Square Logs from M R Traders, Karnataka to Kerala. The petitioner had calculated and paid CGST @ 9% and SGST @9% which is reflected in the tax invoice. An E Way Bill No.151196575196 was generated to transport goods through a vehicle bearing Registration No.KA 19AC 5112 for on-road transport, vehicle bearing Registration No.KA 19 AC 5112 for on-road transport, according to which the value of goods is Rs.507859.02/- including GST. The petitioner had declared the goods through online while generating E Way Bill. The petitioner had recently started a branch of the Firm at Kizhissery, Malappuram and these goods were to be transported to this branch. The petitioner Firm, had done everything their capacity to ensure that the details of the new branch are updated in the official site, however the same showed as ‘processing.’ therefore, when the E-Way bill was generated, the petitioner was under the assumption that the Kizhissery address would have automatically appeared on the E Way bill and handed the same over to the driver of the transport vehicle after taking a printout. While being so, the 1st respondent seized the vehicle when the goods were being unloaded in the firm’s premises at Kizhissery, Malappuram and the department issued Notice No.MOV 02 No/GST/93/19-20 dated 27.01.2020. The Notice was issued under Sec.129(3) of the Central Goods and Service Tax Act,2017 and the State/Union Territory Goods and Services Tax Act, 2017/under Section 20 of the Integrated Goods and Services Tax Act, 2017 seizure of the consignment that imposes extra tax and penalty for the release of the same, for the reason that the tax invoice and E-Way bill are addressed to Erattupetta, Kottayam address and there is no document seen accompanied to unload the goods at Kizhissery. The petitioner is directed to appear before the 1st respondent on 05.02.2020 at 11 a.m. The petitioner firm had sent a reply to the 1st respondent, furnishing an explanation against the Notice for the wrongful confinement of the petitioner’s consignment. In its explanation, the petitioner’s firm has clarified the reason as to why there is no document seen accompanied to unload the goods at Kizhissery. As a matter of fact, there is no evasion of tax from the part of the petitioner and for a trivial clerical error, the vehicle, as well as the goods, are detained stating that the vehicle will be released only on payment of the amount as per the demand notice. The seizure, as well as the detention of the vehicle and goods, is totally illegal. The 1st respondent does not have any authority to seize the vehicle and detain the same under the GST Act. The petitioner firm is facing inimitable losses as they have to pay demurrage and extra container charges on a per-day basis. The petitioner has valid documents to show that there is no violation of the provisions of the Central Goods and Service Tax Act, 2017 Act and Rules. As a result of which it can be seen that the petitioner had no intention to evade the Tax.

Observations of the court:

After having heard both sides and after going through the pleadings and materials on record, the following directions and orders are passed :

(1) It is ordered that the vehicle and goods detained in pursuance of the impugned Ext.P4 order shall be immediately released by the 1st respondent to the petitioner on his furnishing bank guarantee for the amounts shown in Ext.P4.

(2) Thereafter, the 1st respondent will duly take up the matter for finalization of adjudication proceedings pursuant to Ext.P4 and shall afford adequate opportunity of being heard to the petitioner through their representative/counsel, if any and then will pass orders finalizing such adjudication proceedings, without much delay, preferably within a period of 6 weeks from the date of production of the certified copy of this judgment.

While doing so, the 1st respondent shall take into consideration the vital contention urged by the petitioner that the so-called error pointed out by the respondent for issuing Ext.P4 order, that the address shown in the invoice is different from the address shown in the E Way bill, etc. is only a clerical mistake and is not a serious mistake which should justify the detention and penalty proceedings and also the contentions raised by the petitioner on the basis of Ext.P2, etc.

With these observations and directions, the above Writ Petition (C) will stand finally disposed of.

Download the copy:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.