GST format required in refund application

Refund in GST:

In GST taxpayer is not required to submit any documents upto the refund of Rs. 5lac. Only a self declaration will work. For refund of more that Rs. 5lac documents will be required. In this article we will provide you the formats for various declaration and statements.

Related Topic:

RTI revealed that Government levied Zero penalty on Infosys

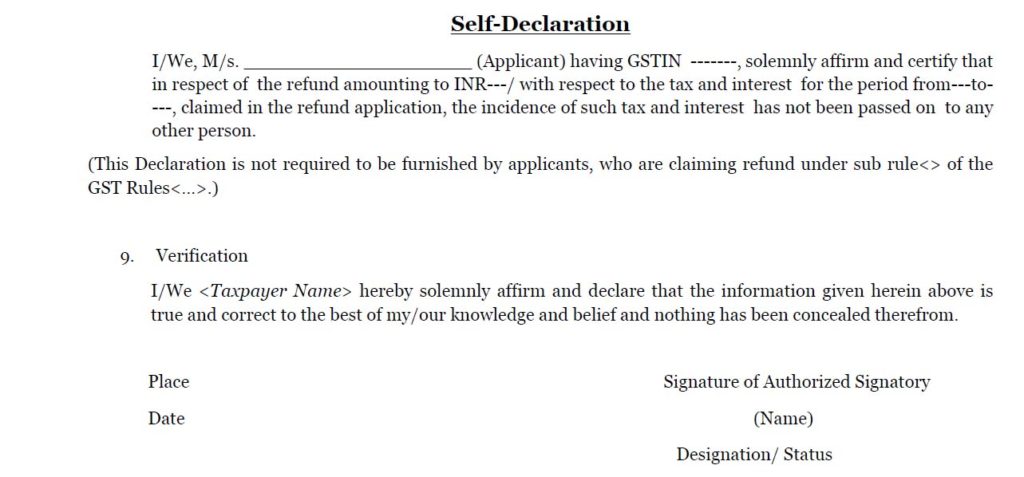

GST format for self declaration for GST refund less tha Rs. 5lac:

As we have stated earlier when the refund is for less that five lac rupees as declaration will be required. Following is the format for such declaration.

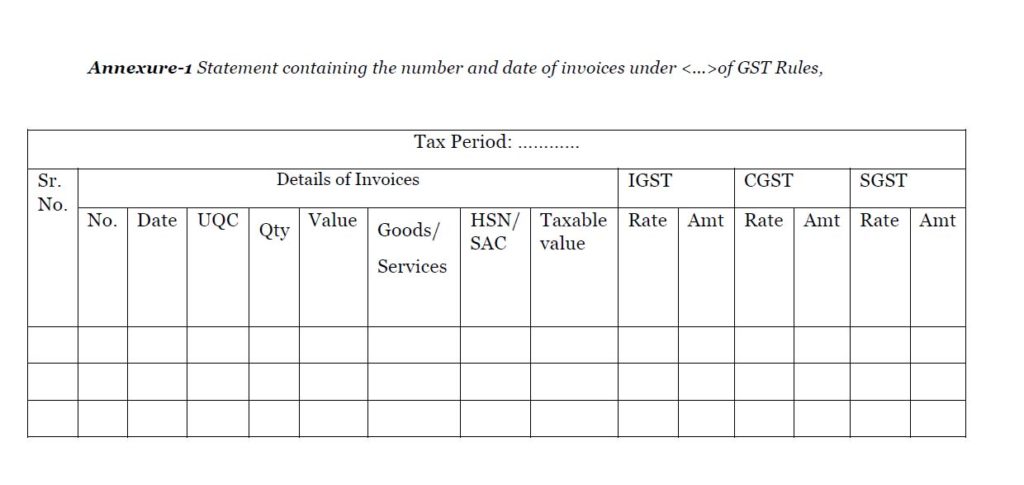

GST format for statement containing number and date of invoices:

A statement containing number and date of invoices is required when refund is for more that Rs.5 Lac. The format of such statement is follows.

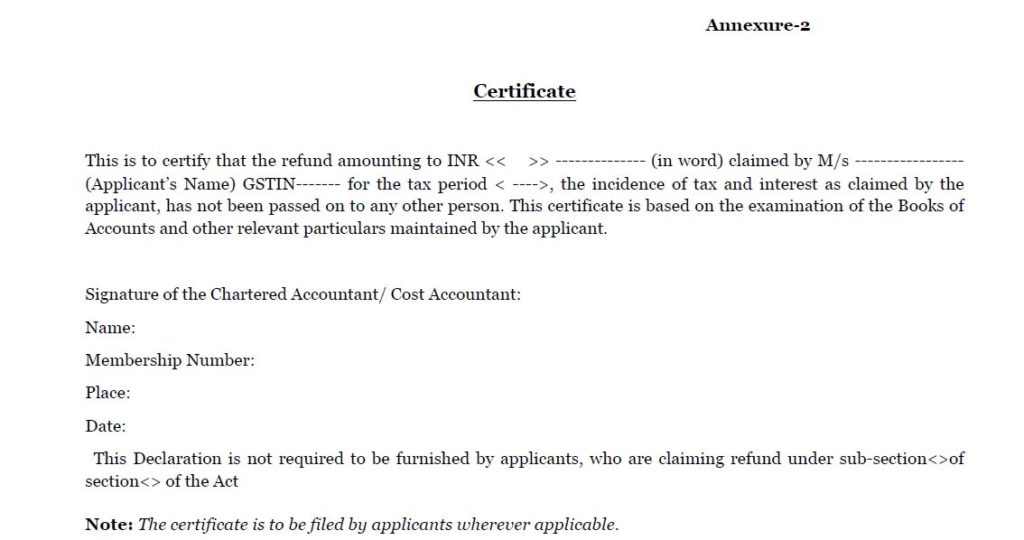

GST format for CA/CWA certificate for refund:

A certificate from a CA or CWA is required when the refund amount is more than Rs.5lac. The format of same is here.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.