RTI revealed that Government levied Zero penalty on Infosys

Introduction-

There is a lot of hue and cry on the performance of Infosys. Earlier GST portal and now income tax one. Both are spoiled by Infosys and are an example of their professional failure. But the government kept levying the penalties on the public instead of them. As we all know that there are huge penalties on compliance delays in GST. But government levied Zero penalty on Infosys in spite of their utter failure.

Text of RTI filed by CA Ram Bajaj

To,

M/s Ram Bajaj and Co Chartered Accountants

Near Gattani School

Nokha Bikaner, Rajasthan

Pin: 334803.

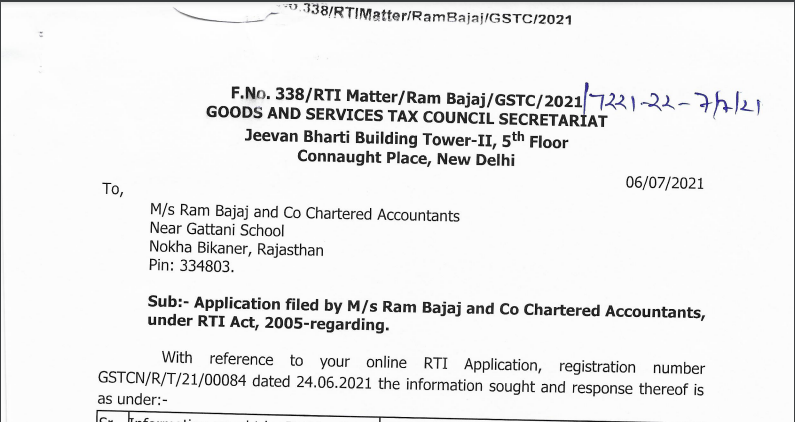

Sub: – Application filed by M/s Ram Bajaj and Co Chartered Accountants, under RTI Act, 2005-regarding.

With reference to your online RTI Application, registration number GSTCN / R / T / 21/00084 dated 24.06.2021 the information sought and response thereof is as under: –

1. Due to non-function and technical The GST Council does not collect any penalty issue due to the incompetency of GSTN from any agency. The portal which is managed by Infosys since July 2017, how much penalty received by the GST Council from Infosys from July 2017 to till date.

The GST Council does not collect any penalty from the agency.

2. Month-wise details of Penalty received by Department from July 17 to till date.

3 is there any proposal for change the vendor from Infosys to other company due to non-function/incompetence of Infosys.

The required information may be available with the CPIO, GSTN 4th Floor, world mark 1, East Wing, Asset-11 Hospitality District, Aero city New Delhi-110037, to whom a copy of this application is being transferred under Section 6 (3) of the RTI, Act, 2005 for providing information, if any, to you directly.

In case you are dissatisfied with the information, you may file an appeal to First Appellate Authority, GST Council, Jeevan Bharti Building, Tower-II, 5th Floor, Connaught Place, New Delhi-110001 within 30 days of its receipt in terms of Section 19 of the RTI Act, 2005.