Download Free Excel Utility to Calculate GSTR-3B Interest

Free Excel Utility to Calculate GSTR-3B Interest

GSTR 3b is the main return of GST. We make payment of tax while filing GSTR 3b. It is not only a return but also a mechanism for self-assessment. The late filing of GSTR 3B invites the liability to pay interest. But this interest is not calculated by the GSTN portal or even by the department. here we have compiled Free Excel Utility to Calculate GSTR-3B Interest. You can download it and use this excel utility to calculate GSTR 3b interest. It is easy to use. You only need to fill the basic details. The date of filing of return. The amount of tax payable etc. It takes care of the rest of the requirements.

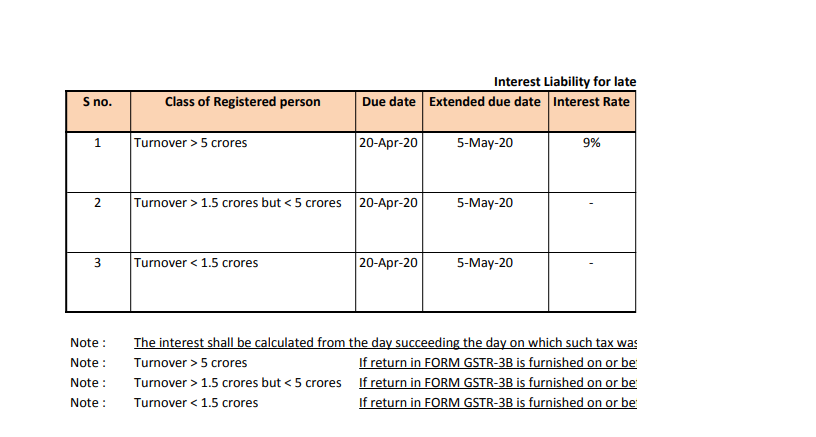

| Note : | The interest shall be calculated from the day succeeding the day on which such tax was due to be paid – section 50(2) of CGST Act. .( notification no 13/2017 – Central Tax dated 28th June 2017) | ||

| Note : | Turnover > 5 crores | If return in FORM GSTR-3B is furnished on or before the 24th day of June, 2020 (notification no.31/2020 – Cental Tax) | |

| Note : | Turnover > 1.5 crores but < 5 crores | If return in FORM GSTR-3B is furnished on or before the 29th day of June, 2020 (notification no.31/2020 – Cental Tax) | |

| Note : | Turnover < 1.5 crores | If return in FORM GSTR-3B is furnished on or before the 3rd day of July, 2020 (notification no.31/2020 – Cental Tax) | |

Read & Download the utility:

If you already have a premium membership, Sign In.

Deepak Arya

Deepak Arya

He has handled Pre-Implementation support of GST and UAE-VAT for the industries like manufacturing, infrastructure, construction, pharmaceuticals, trading, pure service industries, etc. and assisted them in identifying the issues on which immediate actions were required. He has conducted various in-house training sessions for the Finance and Accounts team of companies. He also led a team of professionals in providing End to End assistance in the GST Implementation. He was engaged in a broad range of indirect taxation matters. Experience in complying with the Service tax compliances for the companies on PAN India basis; Experience in Service tax audits conducted by the service tax authorities for MNCs in Haryana, Uttar-Pradesh and Delhi Region; Assisted to multiple clients on export requirements under GST on taxability and LUT/Bond requirements; Assistance in the modification in business processes and software with regard to GST including testing after implementation of GST; Training sessions on GST with MSME (Ministry of Small and Medium Enterprises, Govt. of India); Written various articles at different forums for knowledge sharing; Advisory to clients on cross border transactions; Legal opinions on GST and Direct Tax matters; Advised to multiple clients in UAE on Indirect tax matters;